from RoadtoRoota:

TRUTH LIVES on at https://sgtreport.tv/

from SGT Report:

In 2011 a silver bug and You Tuber with a small following who had just read the Bitcoin white paper pleaded with his audience to buy some Bitcoin at a dollar, even if it’s just ONE. Davincij was a guest on my show before he made that plea, and after. And I’ll be the first to tell you, almost no one took his advice. But it was always in the back of my mind and I finally pulled the trigger four years later at $359, and I’m very glad I did. The CEO of My Digital Money Guy Gotslak returns to SGT Report just a month after his last appearance and as I predicted then Bitcoin is almost exactly $10,000 higher now. We spit cold hard facts in this one guys, thanks for tuning in.

Get in on the action, and preserve your purchasing power!

https://www.mydigitalmoney.com/

My Digital Money: Your BITCOIN & Crypto IRA Platform For Retirement Investing

from SGT Report:

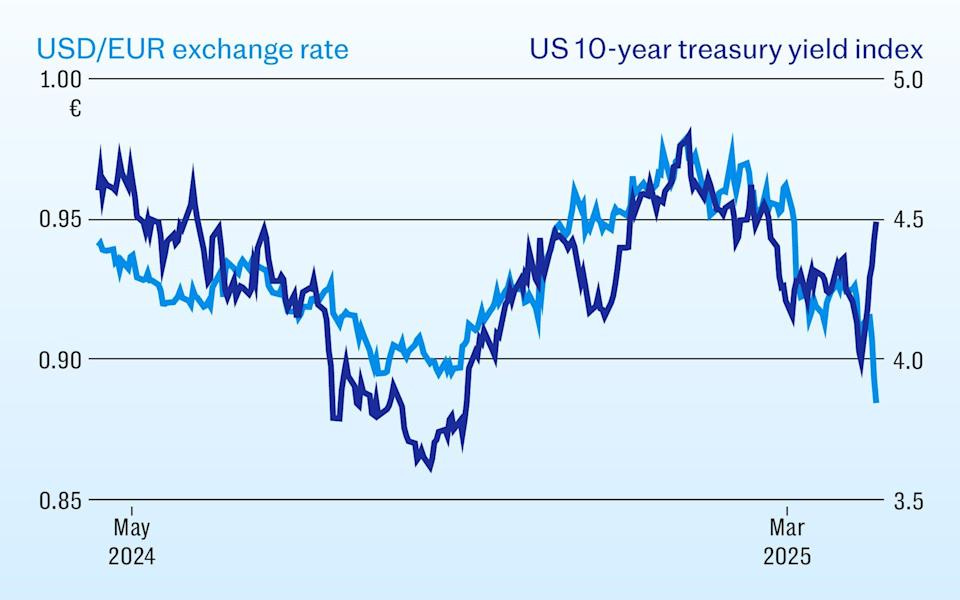

Author of Planet Ponzi Mitch Feierstein returns to SGT Report to break down the very latest regarding Trump, tariffs and the FED-Powell put against the United States of America. Thanks for tuning in.

My Digital Money:

https://www.mydigitalmoney.com/

Your BITCOIN & Crypto IRA Platform For Retirement Investing

——-

Click the link below for Dr. Josh’s turmeric “hack” and take the first step toward pain-free living today!

https://goldenrevive.com/SGT

Mitch on Substack and @planetponzi on X:

https://substack.com/@planetponzi

by David Haggith, Gold Seek:

One of my recent warnings was that the US is sliding toward more credit downgrades because the Trump Tariffs are stripping away the one thing essential to the dollar surviving as the global trade currency—TRADE. The big thing that makes the present situation far more precarious for the dollar than any previous situation is that the trade that makes dollars desirable and even needed around the world is being seriously sucked down a vortex. That greatly reduces the need for dollars in trade, which makes this the easiest time ever for any nation wanting to ditch the dollar to do so as a way to finally end US hegemony.