by Steve Kirsch, Steve Kirsh’s Newsletter:

Executive summary

I was asked to write my rationale for why the shots should be stopped in 3 paragraphs.

My 3 paragraphs.

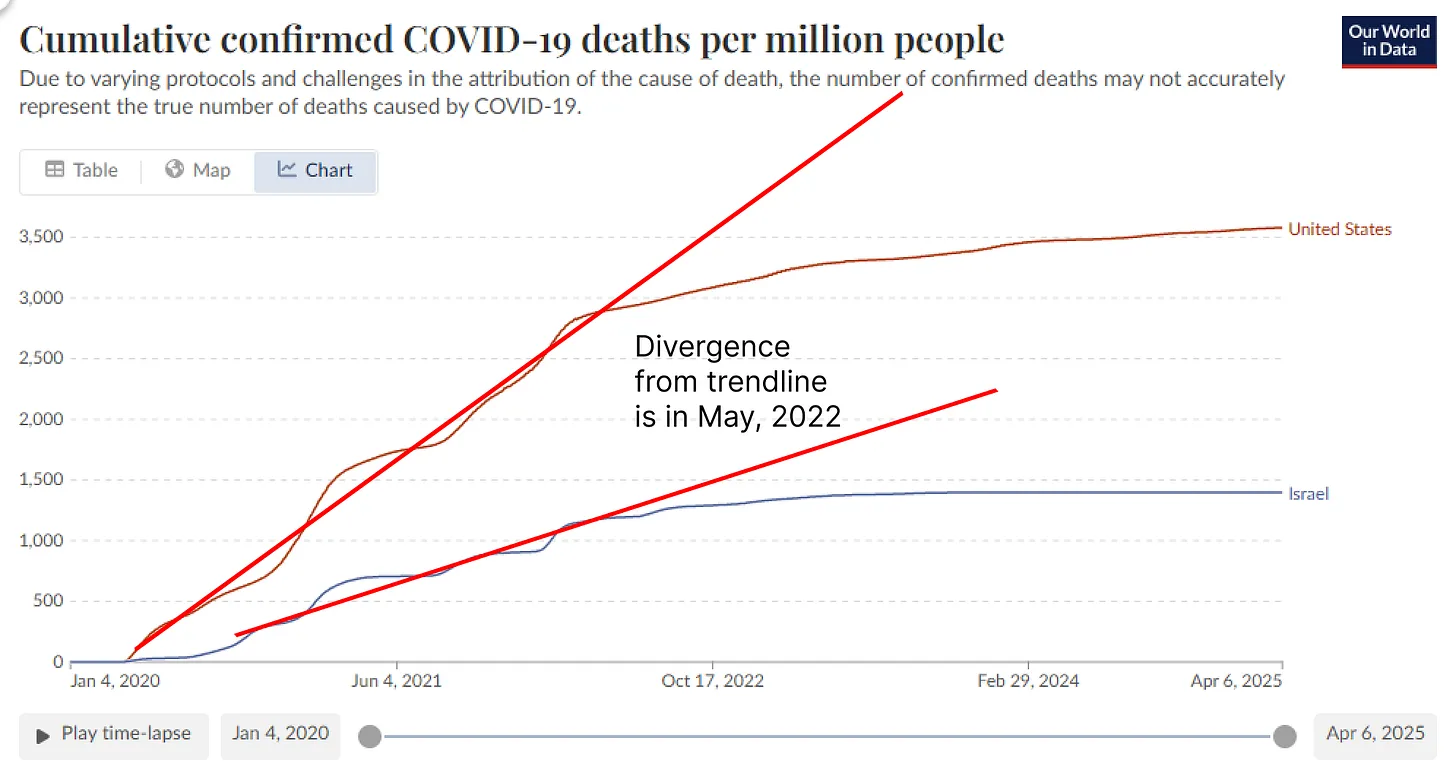

There are two primary reasons the COVID vaccines should be stopped:

- In actual use, they provide no protection against COVID infections or deaths and

- They were shown in a study by the Florida Dept of Health that they can increase risk of non COVID death by 36% or more.

Vaccines are NEVER supposed to increase all-cause mortality. They are always supposed to decrease it.

Israel on Friday launched a drone attack against a civilian ship in international waters off the coast of Malta that was trying to bring humanitarian aid to the besieged Gaza Strip, according to The Freedom Flotilla Coalition, a pro-Palestinian NGO.

Israel on Friday launched a drone attack against a civilian ship in international waters off the coast of Malta that was trying to bring humanitarian aid to the besieged Gaza Strip, according to The Freedom Flotilla Coalition, a pro-Palestinian NGO.