from GoldSeek Radio Nugget:

TRUTH LIVES on at https://sgtreport.tv/

from GoldSeek Radio Nugget:

TRUTH LIVES on at https://sgtreport.tv/

by Mac Slavo, SHTF Plan:

I want you to close your eyes and imagine (don’t really close them because you won’t be able to read what comes next) people with a very rich heritage.

These people are proud of their history because for 200 years, they were the greatest empire of the ancient world while ruling over much of Asia. Their revered king, Cyrus II of Persia, was considered a visionary and leader of epic proportions.

After 200 years of rule, they collapsed like all other empires, but the glory of the past echoes for eternity like a basketball player that tells stories of his career even when he’s 80 years old.

Great changes came after the Achaemenid Empire, the strongest Persian dynasty in the ancient world, but the Iranians, a tribe that originated in today’s India and migrated to today’s Iran, are obsessed with the past and their so-called rightful place in the league of nations where they think they ought to be considered as being in the top tier.

from SD Bullion:

TRUTH LIVES on at https://sgtreport.tv/

from Peak Prosperity:

TRUTH LIVES on at https://sgtreport.tv/

from Arcadia Economics:

TRUTH LIVES on at https://sgtreport.tv/

from ZeroHedge:

SUMMARY:

from Birch Gold Group:

This week, Your News to Know rounds up the latest top stories involving gold and the overall economy. Stories include: A World Bank insider explains central banks’ gold buying surge; yet another all-time high for gold’s price, , and just how strange is the lack of price action in silver?

The World Bank just published a very interesting report, Gold Investing Handbook for Asset Managers. The author, veteran central banker Kamol Alimukhamedov explains exactly why central banks are dedollarizing and buying record quantities of gold (for two years in a row).

by Mike Maharrey, Silver Seek:

Indians are known to have a love affair with gold. India ranks as the number two gold-consuming country in the world behind only China. But Indians are also pretty fond of silver. In fact, India is the world’s biggest silver consumer.

And Indian silver demand is surging.

Silver imports skyrocketed by 260 percent in February, hitting a record high of 2,295 tons. That was up from 637 tons in January, according to a report in the Economic Times of India.

The Times said this surge in Indian silver buying “could support global prices trading near their highest in three years.”

by Peter Schiff, Schiff Gold:

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Last month marked the 17th in a row that the People’s Bank of China (PBOC) continued stacking gold. Notably, the bank typically reports lower numbers than its actual buying volume and is now also introducing a digital yuan to facilitate cross-border gold settlements.

from ZeroHedge:

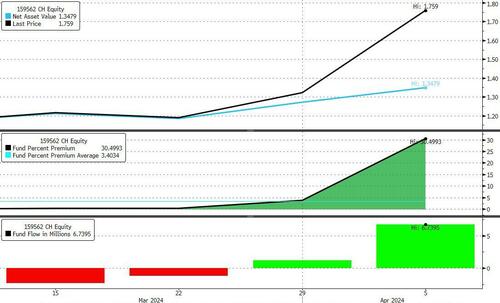

For the second time in a week, trading in an ETF that owns gold companies was halted in China overnight.

The ETF’s price had gained over 40% in the past four sessions before falling 10% after trading resumed Monday.

“The lack of alternatives, and the fact that it’s become a lot more difficult than it was a few years ago to get your money out of China and invest elsewhere – I think that’s definitely helping gold,” said Nikos Kavalis, managing director at consultancy Metals Focus Ltd.

“Demand is pretty decent, considering where the price is.”