by Clint Siegner, Silver Seek:

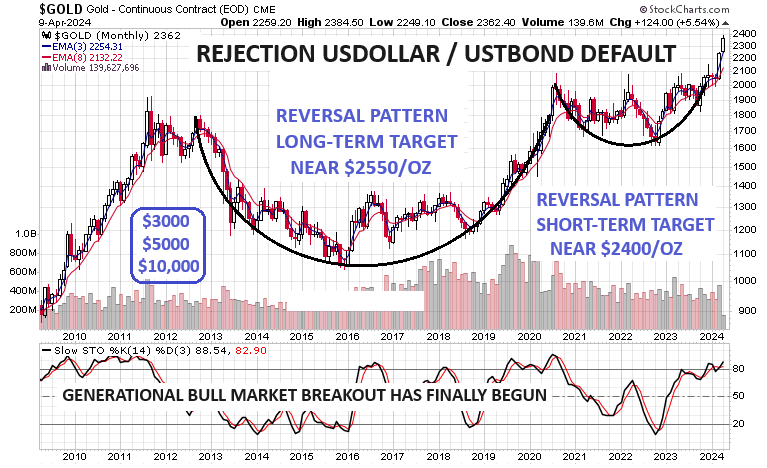

Gold’s breakout to new all-time nominal highs is making headlines. On Friday, the price settled at just under $2,200/oz, after gaining almost $100/oz for the week.

Silver actually outperformed gold on a percentage basis. The white metal gained $1.17/oz, or 5%, as compared to gold’s 4.5% gain.

The difference is that silver is stuck in the middle of the range where it has traded for the past four years. It is roughly $5/oz below its 2020 high and $25 below its all-time high.