from Birch Gold Group:

This week, Your News to Know rounds up the latest top stories involving precious metals and the overall economy. Stories include: Sky-high gold forecasts by top names, why the Middle East escalation proves gold’s run isn’t driven by military conflict and could a surprise interest rate hike push gold’s price down?

Global banks revise gold price forecasts, raising eyebrows everywhere

A recent call for $4,000 gold has been made. Which of our “usual suspects” was behind it? Frank Holmes? Alasdair MacLeod? Putin?

The leading cryptocurrency has reached a two-year high after several consecutive days of gains

The leading cryptocurrency has reached a two-year high after several consecutive days of gains After six months of blocking ceasefire resolutions at the United Nations, the US delegation submitted its own draft resolution on Friday ostensibly aimed at stopping the hostilities so humanitarian aid can reach the starving people of Gaza. Unfortunately, the American team linked the proposed ceasefire to the release of hostages and to the repudiation of Hamas which merely restates the Israeli position on a final settlement. The draft resolution also failed to explicitly demand an immediate ceasefire, but inserted deliberately-ambiguous language intended to give Israel sufficient legal flexibility to continue its aggression. In short, the US draft resolution was a cynical hoax concocted by the backers of Israel’s bloody campaign in Gaza that blew up in the US delegations face heaping more shame on the administration and the American people.

After six months of blocking ceasefire resolutions at the United Nations, the US delegation submitted its own draft resolution on Friday ostensibly aimed at stopping the hostilities so humanitarian aid can reach the starving people of Gaza. Unfortunately, the American team linked the proposed ceasefire to the release of hostages and to the repudiation of Hamas which merely restates the Israeli position on a final settlement. The draft resolution also failed to explicitly demand an immediate ceasefire, but inserted deliberately-ambiguous language intended to give Israel sufficient legal flexibility to continue its aggression. In short, the US draft resolution was a cynical hoax concocted by the backers of Israel’s bloody campaign in Gaza that blew up in the US delegations face heaping more shame on the administration and the American people. Climate investing is still booming at BlackRock, but don’t call it ESG.

Climate investing is still booming at BlackRock, but don’t call it ESG.

For obvious reasons, people have been enthralled by the enormous skies above them long before the Improved crew emergency training and enhanced satellite tracking were among the safety enhancements brought about by the widely publicized 2014 disappearance of Malaysian Airlines Flight 370.

For obvious reasons, people have been enthralled by the enormous skies above them long before the Improved crew emergency training and enhanced satellite tracking were among the safety enhancements brought about by the widely publicized 2014 disappearance of Malaysian Airlines Flight 370.

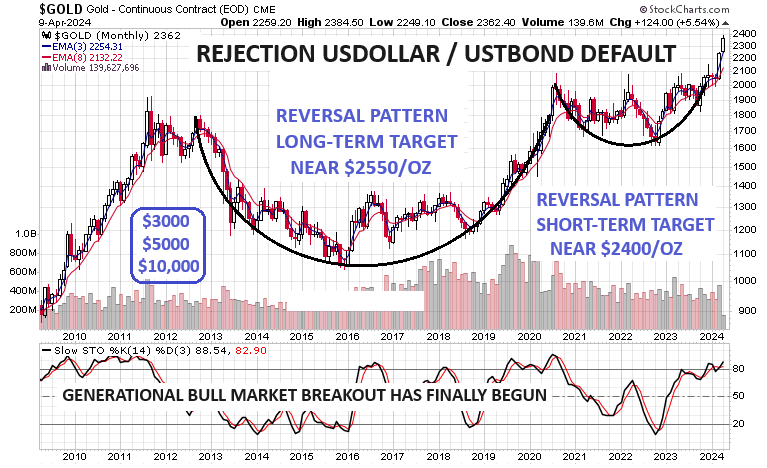

Back in February, when everyone was predicting a Fed rate cut, precious metals expert and financial writer Bill Holter said rates would be going up and not down. Since that call, the 10-Year Treasury is up more than 30 basis points. It closed today at 4.67%. Now, Holter is still calling for higher interest rates that will coincide with higher gold and silver prices. Why? It’s called inflation, and it’s not temporary. Holter explains, “Foreigners are backing away from buying Treasuries. That is the only thing that has kept the doors open, so to speak, is the fact we are able to borrow an unlimited amount of money because we are the world reserve currency. Foreigners backing away from our debt is going to lead the Federal Reserve to be the buyer of last, and then, only resort. So, you will have direct monetization between the Fed and the Treasury. What that will cause is a currency that declines in purchasing power. It will decline in a big way, and it will decline rapidly. So, what I am describing is inflation that turns into hyperinflation.”

Back in February, when everyone was predicting a Fed rate cut, precious metals expert and financial writer Bill Holter said rates would be going up and not down. Since that call, the 10-Year Treasury is up more than 30 basis points. It closed today at 4.67%. Now, Holter is still calling for higher interest rates that will coincide with higher gold and silver prices. Why? It’s called inflation, and it’s not temporary. Holter explains, “Foreigners are backing away from buying Treasuries. That is the only thing that has kept the doors open, so to speak, is the fact we are able to borrow an unlimited amount of money because we are the world reserve currency. Foreigners backing away from our debt is going to lead the Federal Reserve to be the buyer of last, and then, only resort. So, you will have direct monetization between the Fed and the Treasury. What that will cause is a currency that declines in purchasing power. It will decline in a big way, and it will decline rapidly. So, what I am describing is inflation that turns into hyperinflation.”