from BANNED.VIDEO:

TRUTH LIVES on at https://sgtreport.tv/

by Neenah Payne, Activist Post:

Klaus Schwab is the founder of the World Economic Forum. Henry Kissinger was Schwab’s mentor at Harvard and was a frequent honored guest at WEF meetings. Kissinger is known for his statement, “Control oil and you control nations; control food and you control people.”

Dutch Prime Minister Mark Rutte, a WEF “Young Global Leader”. Holland is the headquarters of the “Global Food Hub”. Rutte is the Global Coordinating Secretary to Transform Food Systems and Land Use. The Netherlands is the world’s second largest food exporter. So, as the Dutch government forces 3,000 farmers out of business, it is affecting the food supply of much of the world.

JUST IN: President Biden pushes 44.6% capital gains tax.

The highest capital gains rate ever in the USA. pic.twitter.com/AqbZoG9IfY

— Radar🚨 (@RadarHits) April 24, 2024

When professional boxers understand the economy better than Harvard economists you know this "elite" is pretty crap.

Last week UFC fighter Renato Moicano gave a hard-core victory speech defending liberty and begging people read Ludwig von Mises' "Six Lessons" to save America.… pic.twitter.com/bGLQ55s5PU

— Peter St Onge, Ph.D. (@profstonge) April 25, 2024

by Michael Snyder, The Economic Collapse Blog:

According to the absurd numbers that the government feeds us, the unemployment rate is very low and there are lots of jobs available. But if what they are telling us is true, why are so many Americans not able to find work? As you will see below, some people haven’t been hired even though they have literally applied for hundreds of jobs. There seems to be an enormous disconnect between what is actually happening in the real economy and the economic narrative that they are constantly pushing. By the time you are done reading this article, I think that you will agree with me.

by Jim Rickards, Daily Reckoning:

Does the Fed even matter that much to the real economy and investor portfolios?

That’s an important question that doesn’t get nearly enough scrutiny. It’s possible that neither the Fed nor the reporters who cover the Fed want to ask hard questions about what the Fed really does.

Could it be the case that the emperor has no clothes?

Financial journalists often refer to a Goldilocks economy (“not too hot, not too cold, just right!”) as a tribute to the Fed’s finesse in handling rates. It’s also called the “soft landing” scenario because the Fed supposedly tamed inflation without causing a recession.

from SGT Report:

Bitcoin may well prove to be the only black hole perfectly suited to mop up the tens of trillions of fiat currency sloshing around the world. And not just fiat Dollars. Yen, Rupees, Lira, Yuan and every other rapidly debasing currency around the world is ready to flee into Bitcoin. Peter Schiff has been wrong about Bitcoin for 14 years, but he continues to be unrelenting in his hatred for the asset. I discuss the supply demand metrics and why I think Schiff will continue to be wrong with the President of My Digital Money Guy Goslak. https://www.mydigitalmoney.com/

My Digital Money: The BITCOIN & Crypto IRA Platform For Retirement Investing!

https://www.mydigitalmoney.com/

——

Protect Your Retirement W/ a Gold and/or Silver IRA:

https://www.sgtreportgold.com/

or CALL( 877) 646-5347 – Noble Gold is Who I Trust

by Martin Armstrong, Armstrong Economics:

The government has successfully weaponized the banks against the people. Major banks are voluntarily sharing customers’ private transactions with the federal government “as part of a wildly overbroad financial surveillance scheme intended to identify domestic terrorists,” a group of attorneys general wrote in a letter to Bank of America in regards to discrimination against Christian organizations. The American Accountability Foundation (AAF) is now exposing how banks are cracking down on legal firearm ownership as Washington moves to nullify the Second Amendment.

by Mish Shedlock, Mish Talk:

Congratulations to Cathie Wood for losing $14.3 billion over the past decade, more than any other fund manager according to Morningstar.

Congratulations to Cathie Wood for losing $14.3 billion over the past decade, more than any other fund manager according to Morningstar.

Cathie Wood Investors Jumping Ship

The Wall Street Journal reports Cathie Wood’s Popular ARK Funds Are Sinking Fast

by Cullen Linebarger, The Gateway Pundit:

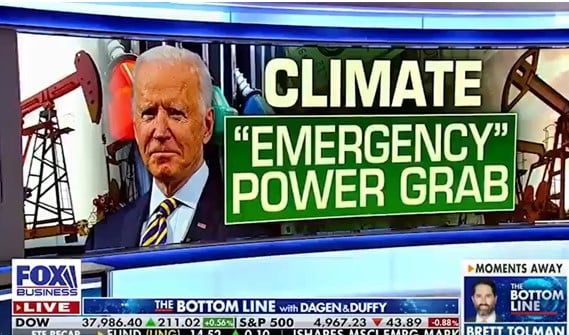

Facing dire polling numbers and a lack of left-wing enthusiasm for his “re-election” campaign, Joe Biden is considering taking an extreme measure that should send chills down the spines of any American who values liberty.

During an April 19 broadcast of the Fox Business Show The Bottom Line with Dagen and Duffy, co-host Sean Duffy revealed that the Biden White House told Fox Business that it is considering defying the Constitution and declaring a climate emergency. He then turned to his guest Marc Morano, a former Republican political aide who runs a climate change skeptic website called ClimateDepot.com, and asked him what impact it would have.

from State Of The Nation:

Who is really pulling the strings at the very top of the global power structure?

Who is really pulling the strings at the very top of the global power structure?

SOTN Editor’s Note: In the wake of the Israel’s 10/7 false flag terrorist operation conducted by both the IDF and MOSSAD using Hamas as their proxy, folks around the world are inquiring as never before about the real back story.

There are actually several conspiratorial plots afoot, all of them perpetrated by the Zionist State of Israel in order to adhere to their transparently fake prophetic timeline.

from BANNED.VIDEO:

TRUTH LIVES on at https://sgtreport.tv/