by Peter Schiff, Schiff Gold:

In 5 days, the COMEX has seen 4,190 contracts open and stand for immediate delivery. This is the strongest start to a month going back at least 2 years, which includes the start of the war in Ukraine and the February 2021 Reddit silver squeeze.

In the latest Comex update, I mentioned that:

Gold has started a bit slow. This shouldn’t be a surprise though as the game in gold continues to be net new contracts.

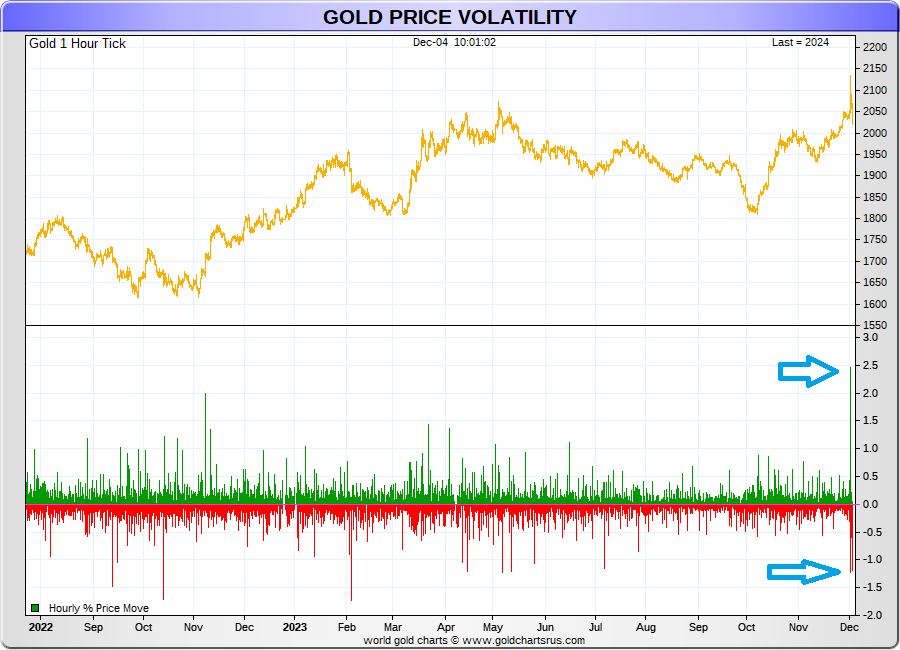

As the chart below shows, total delivery volume remains a bit below the trend. However, the delivery month just got started.