by Dave Kranzler, Investment Research Dynamics:

Anyone who does not admit that the Central Banks actively manage the price of gold is ignorant of the facts. If they are ignorant of the facts, they are too lazy to look for the truth. But GATA makes it easy. Robert Lambourne is a GATA consultant who scrutinizes everything published by BIS.

Anyone who does not admit that the Central Banks actively manage the price of gold is ignorant of the facts. If they are ignorant of the facts, they are too lazy to look for the truth. But GATA makes it easy. Robert Lambourne is a GATA consultant who scrutinizes everything published by BIS.

“As far as we can determine, only one person in the world outside central banking — GATA’s consultant Robert Lambourne — reviews the BIS monthly reports and does the calculations necessary to discover what is happening. The interventions, accomplished in large part through gold swaps and leases, are not stated plainly in the BIS monthly reports, though they easily could be. The interventions are stated plainly, if obscurely, only in the bank’s annual report. But recent BIS annual reports have confirmed the stunning accuracy of Lambourne’s monthly calculations.” – Chris Powell, GATA

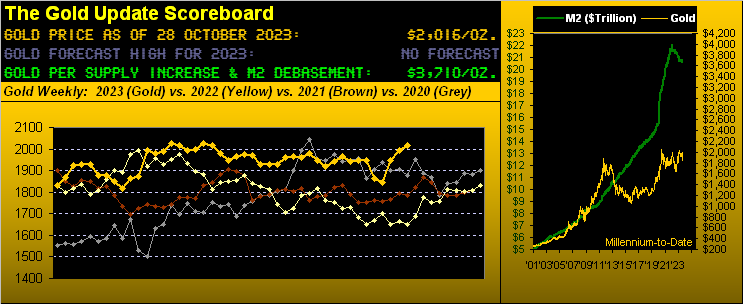

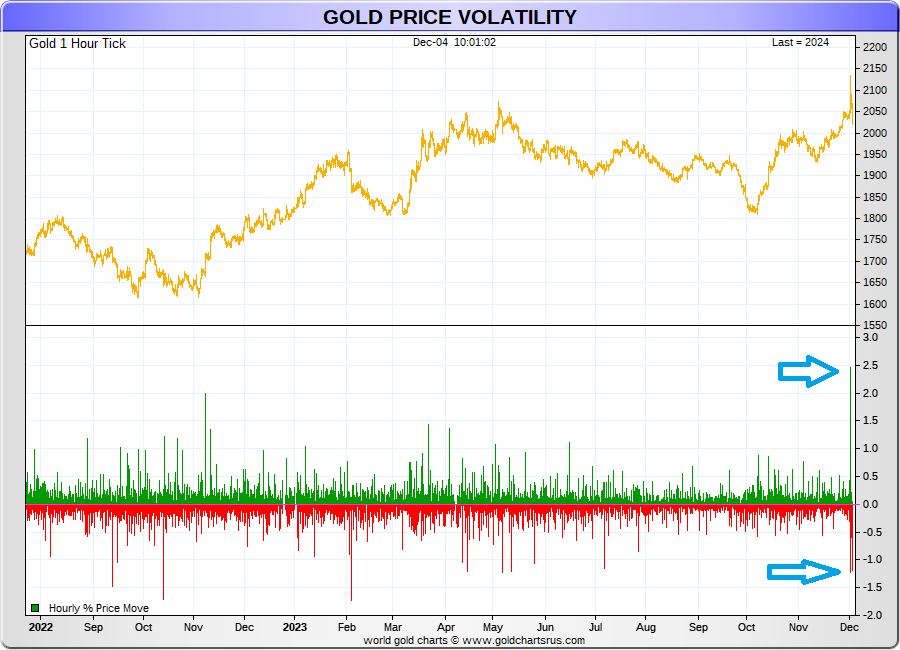

GOLD CLOSED DOWN $6.15 TO $1979.35 WHILE SILVER CLOSED DOWN 11 CENTS TO $22.73 AS THE SPECS ADD MASSIVELY TO THEIR SHORT POSITION AND CENTRAL BANKS TAKE THE BUY SIDE AND THEN TAKING DELIVERY ESPECIALLY GOLD (800 TONNES THIS QUARTER//PLATINUM CLOSED DOWN $8.90 TO $924.95 WHILE PALLADIUM CLOSED DOWN $20.35 TO $1107.65//ROBERT LAMBOURNE REPORTS ON THE BIS GOLD SWAPS WITH THE FED LOWERING ITS SHORTFALL IN SEPT DOWN TO 96 TONNES..STILL A LONG WAY TO GO//CENTRAL BANKS CONTINUE TO GORGE ON PHYSICAL GOLD ACCUMULATION//GOLD COMMENTARY TODAY FROM PETER SCHIFF/EPOCH TIMES PROVIDES AN EXCELLENT COMMENTARY ON THE DETERORIATING HEALTH OF THE CHINESE ECONOMY//PALESTINIAN THROW RATS INTO MACDONALDS//ISRAEL VS HAMAS: ISRAEL NOW CONTROLS THE NORTH SECTOR OF HAMAS WITH THEIR TANKS AS WELL AS NORTH SOUTH ROADS BUT WITH 15 CASUALTIES//STARVING YEMEN DECLARES WAR ON ISRAEL//NEW DATA RELEASED BY THE USA SUGGESTS THAT THEY ARE IN THE MIDST OF STAGFLATION//ADP REPORT AND JOLTS REPORT//SUBPRIME AUTO LOANS SKYROCKET AND IT LOOKS LIKE WE WORK WILL FINALLY SUCCUMB

GOLD CLOSED DOWN $6.15 TO $1979.35 WHILE SILVER CLOSED DOWN 11 CENTS TO $22.73 AS THE SPECS ADD MASSIVELY TO THEIR SHORT POSITION AND CENTRAL BANKS TAKE THE BUY SIDE AND THEN TAKING DELIVERY ESPECIALLY GOLD (800 TONNES THIS QUARTER//PLATINUM CLOSED DOWN $8.90 TO $924.95 WHILE PALLADIUM CLOSED DOWN $20.35 TO $1107.65//ROBERT LAMBOURNE REPORTS ON THE BIS GOLD SWAPS WITH THE FED LOWERING ITS SHORTFALL IN SEPT DOWN TO 96 TONNES..STILL A LONG WAY TO GO//CENTRAL BANKS CONTINUE TO GORGE ON PHYSICAL GOLD ACCUMULATION//GOLD COMMENTARY TODAY FROM PETER SCHIFF/EPOCH TIMES PROVIDES AN EXCELLENT COMMENTARY ON THE DETERORIATING HEALTH OF THE CHINESE ECONOMY//PALESTINIAN THROW RATS INTO MACDONALDS//ISRAEL VS HAMAS: ISRAEL NOW CONTROLS THE NORTH SECTOR OF HAMAS WITH THEIR TANKS AS WELL AS NORTH SOUTH ROADS BUT WITH 15 CASUALTIES//STARVING YEMEN DECLARES WAR ON ISRAEL//NEW DATA RELEASED BY THE USA SUGGESTS THAT THEY ARE IN THE MIDST OF STAGFLATION//ADP REPORT AND JOLTS REPORT//SUBPRIME AUTO LOANS SKYROCKET AND IT LOOKS LIKE WE WORK WILL FINALLY SUCCUMB