by Robert Lambourne, Gold Seek:

Active trading in gold swaps by the Bank for International Settlements, the central bank of the central banks, continued in September.

From information in the BIS statement of account for the month, published this week —

https://www.bis.org/banking/balsheet/statofacc230930.pdf

— it is estimated that the bank’s gold swaps fell 33 tonnes in the month, from 129 to 96 tonnes.

TRUTH LIVES on at https://sgtreport.tv/

The BIS’ gold swaps had fallen to zero as of December 31, 2022, and reached their peak for 2023 so far of 188 tonnes as of May 31.

It remains likely that the BIS has entered these swaps on behalf of the U.S. Federal Reserve. There is no evidence to suggest that any other major central bank is actively trading this much gold, and so far in 2023 many central banks have been accumulating physical gold.

The basic transaction that the BIS is believed to undertake is to swap dollars for gold transferred from a bullion bank, then to deposit this gold in a gold sight account at a central bank, presumed to be the Fed but almost certainly being the central bank that is using the BIS to execute the gold swap on its behalf.

Given the recent volatility in the levels of BIS gold swaps, it seems likely that most are of short duration. Why a central bank needs the BIS to undertake gold swaps isn’t clear, but the swaps are likely connected with short-term trading needs, which could include suppressing the gold price.

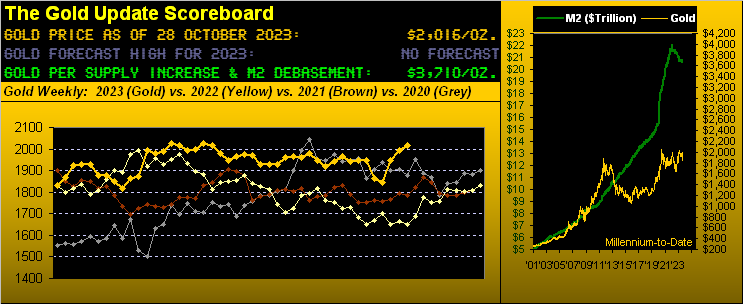

The gold price decreased from $1,940 at August 31 to $1,849 at September 29 (per USAGold.com). The volatility in the volume of swaps is clear from a review of Table B below. Volumes of swaps in 2023 are well below the average seen in the preceding four years but they remain significant.

This trading has not been officially explained by the BIS, and thus may be related to efforts to drive the gold price down in recent months. Much of GATA’s research on gold price suppression indicates that an active policy of price suppression was implemented more than 30 years ago and was meant primarily to help suppress interest rates. This article from 2005 highlights work in this area by former U.S. Treasury Secretary and Harvard University President Lawrence Summers:

https://goldensextant.com/gibsonsparadox/

It also remaining relevant are the following remarks made in a speech by Summers on September 8, 1999, as reported in the book The Wealth of Progressive Nations: The Collected Lectures of Lawrence Summers.” The remarks below are from the section of the speech titled “A New Economic Paradigm.”

“Most important of all, the Clinton-Gore administration has established a new paradigm for the management of our nation’s budget, with enormous cumulative benefits for our economy and our citizens. It has become a commonplace to remark on how exceptional today’s 4.2% unemployment rate is relative to any expectation at the beginning of the decade. It is no less remarkable that today, after 8.5 years of expansion, long-term interest rates are around 2 percentage points lower than they were at its start.”

From this it is reasonable to conclude that keeping interest rates “lower” was considered a priority and succeeding at it was “remarkable.” While this is not proof that gold price suppression was undertaken specifically to reduce interest rates, it highlights that in any case reducing interest rates was a priority.

In this context the following report issued by GATA in 2007 concerning an analysis of the gold market by Frank Veneroso is worth rereading as it confirms that GATA’s primary assertions about gold price suppression are plausible:

https://www.gata.org/node/5275

Using the September 29 gold price of $1,849, the 96 tonnes of BIS gold swaps are valued at about $5.7 billion. (The corresponding value at August 31 was around $8 billion.) So the recent trading in BIS gold swaps is of high monetary value and shows that gold remains a significant monetary asset still much traded by central banks.

As ever with the BIS, it remains unlikely that more information about why the bank undertakes these transactions will ever be provided. This secrecy implies that central bank gold policy involves much deception — that it could be currency market intervention for one or more central banks for which the BIS provides camouflage.

For example, the recently published BIS 2023 annual report does not provide any information on the gold swaps other than confirming that swaps covering 77 tonnes of gold were in place as of March 31, 2023.

The worsening finances of Western nations, especially the United States, may reduce the appeal to the BIS of undertaking gold swaps and possibly even reduce the appeal of swaps to the central bank or banks for which the BIS has been acting. So a report issued by GATA in 2012 is worth revisiting as it highlights the acknowledgment of gold price suppression by a former chairman of the BIS, Jelle Zijlstra, a Dutch politician, economist, and central banker. It seems likely that BIS management understands what the swaps are being used for and why they require camouflage:

https://www.gata.org/node/11304