by Jan Nieuwenhuijs, Gainesville Coins:

In a recent interview the Dutch central bank (DNB) shares it has equalized its gold reserves, relative to GDP, to other countries in the eurozone and outside of Europe. This has been a political decision. If there is a financial crisis the gold price will skyrocket, and official gold reserves can be used to underpin a new gold standard, according to DNB. These statements confirm what I have been writing for the past years about central banks having prepared for a new international gold standard.

TRUTH LIVES on at https://sgtreport.tv/

Wouldn’t a central bank that has one primary objective—maintaining price stability—serve its mandate best by communicating the currency it issues can be relied upon in all circumstances? By saying gold will be the safe haven of choice during a financial collapse, DNB confesses its own currency (the euro) does not weather all storms. Indirectly, DNB encourages people to own gold to be protected from financial shocks, making the transition towards a gold based monetary system more likely.

How to Prepare for a Gold Standard

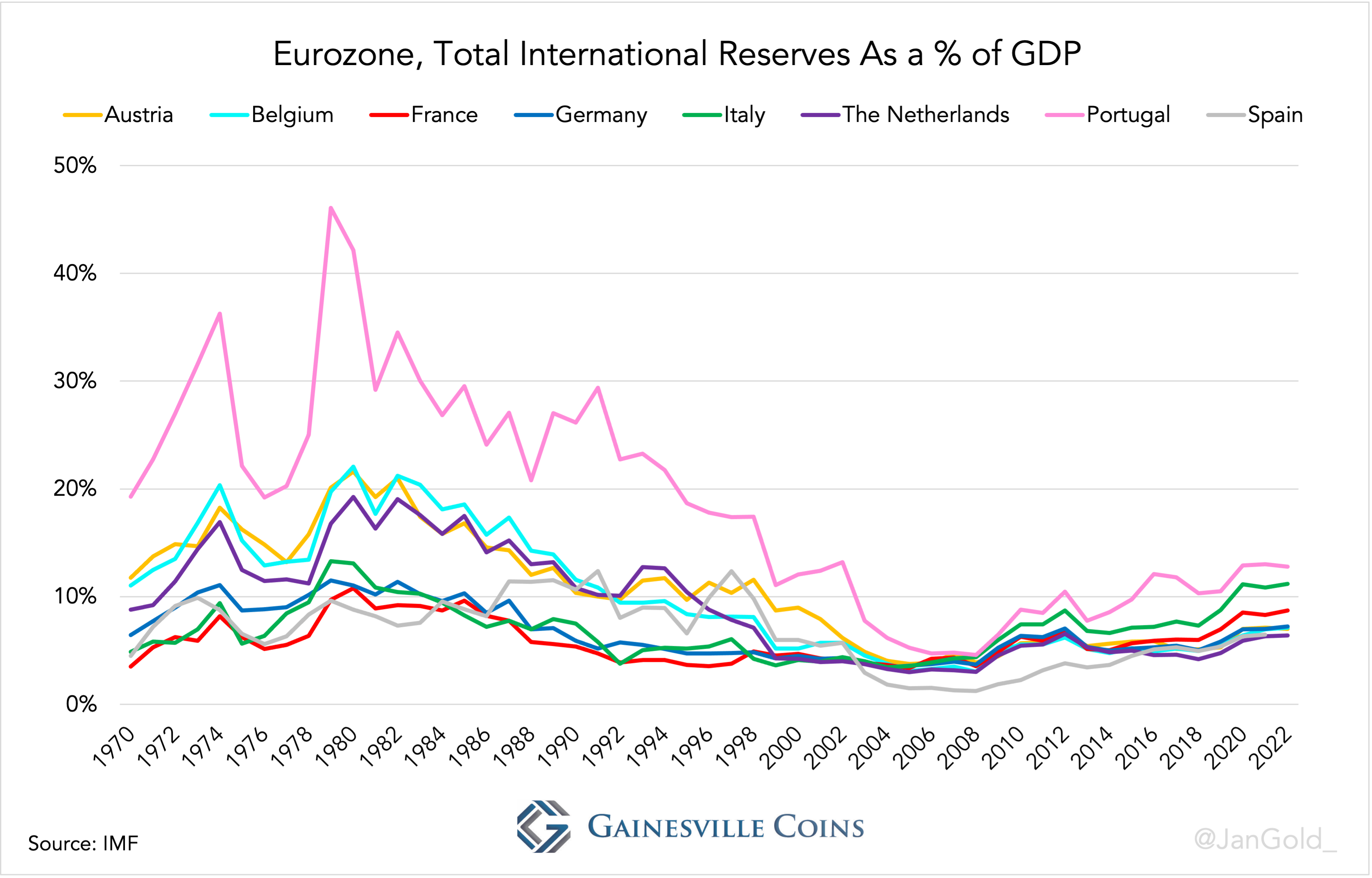

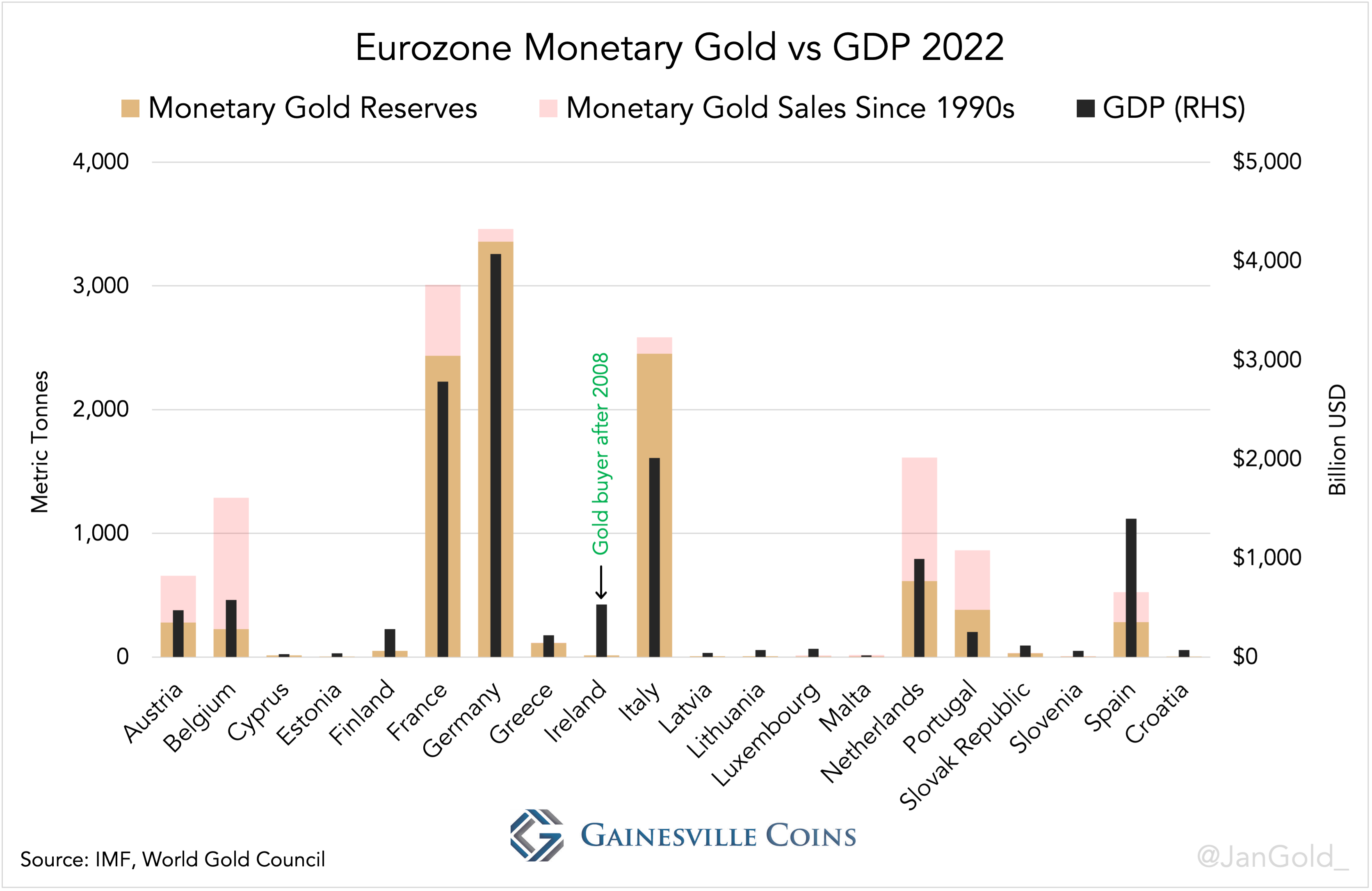

In my latest article on this subject—“Europe Has Been Preparing a Global Gold Standard Since the 1970s. Part 2”—I have demonstrated that central banks of medium and large economies in the eurozone have balanced their official gold reserves, proportionally to GDP, to prepare for a gold standard (/gold price targeting system). My analysis was pieced together by scarce quotes from central banks and data of European gold and foreign exchange holdings. My conclusion was that several medium-size economies in Europe (the Netherlands, Belgium, Austria, and Portugal) sold large amounts of gold from the early 1990s to 2008 to come on par with France, Germany, and Italy. I wrote:

Seemingly there are guidelines in the eurozone for national central banks to hold an appropriate amount of gold relative to GDP.

In another article, I revealed that in the early 1990s the People’s Bank of China (PBoC) was buying the gold DNB was selling. By selling gold Europe was allowing developing countries to buy gold and come on par with the West. China too has expressed its desire to bring its gold holdings more in line with the size of its economy, just like the Europeans, and thus to international averages. From Dutch newspaper NRC Handelsblad in 1993:

China announced that it is working to build up its [gold] reserves in order to bring it more in line with the size of Chinese GDP.

The above, and DNB’s most recent confirmation of leveling reserves, implies there are international agreements on the distribution of gold holdings.

Evenly spread gold reserves internationally are a prerequisite for a smooth transition to a gold standard. If some countries own too much and others too little, as was the case in the 1970s, a newly implemented gold standard would prove to be deflationary because the ones with too little gold would have to buy in, pushing up the real price of gold. As long as official gold reserves are evenly spread the nominal gold price can be increased to what is suited for all countries, before introducing a new system.

Another sign of Europe having prepared for a new gold arrangement are the repatriations by several countries. In the eurozone Germany, the Netherlands, France, and Austria repatriated (and redistributed) bullion for security reasons, while keeping a substantial share of their assets in liquid markets such as London. Additionally, Germany, France, and Sweden, that we know of, have upgraded gold bars that didn’t adhere to current wholesale industry standards so now all their metal can be traded instantly.

Last but not least, European central banks’ communication about gold has become unequivocally clear and candid. Stating “gold is the bedrock of stability for the international monetary system” (Germany), “gold is an excellent hedge against adversity” (Italy), “gold is … considered to be the ultimate store of value” (France), and gold “may play a stabilising role … in times of structural changes in the international financial system or deep geopolitical crises” (Hungary). Remarkable statements from entities tasked with guaranteeing financial stability.

Dutch Central Bank Comes Clean on Gold Strategy

When I asked European central banks about a legal requirement to equalize their gold reserves, two of them replied there is no such obligation. Which is strange given the obvious aligning of reserves over the past decades, illustrated in the charts below, and the new comments by DNB.

DNB provides an explanation in the aforementioned interview by revealing that their gold policy is set in consultation with its shareholder, the Ministry of Finance of the Netherlands. The idea of balancing gold reserves was first conceived in the 1970s and then executed from the early 1990s until 2008. With no legal requirements for European central banks to balance reserves, the seeds of their actions could be found at their respective governments.

Read More @ GainesvilleCoins.com