by Alasdair Macleod, Schiff Gold:

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

For now, the dollar appears to be buoyed up by rising bond yields. However, as they rise further portfolio losses for foreign investors are likely to increase, leading to dollar liquidation. It is not generally realised how many dollars and dollar securities are owned by foreigners, the bulk of them being held outside the US banking system. And the quantity of foreign currency owned by Americans to absorb this selling is very small in comparison.

TRUTH LIVES on at https://sgtreport.tv/

Higher interest rates and bond yields also threaten to destabilise the banking system, a problem equally faced by the Eurozone, the UK, and Japan. But how can the US Government protect itself from this danger?

The only answer is to admit to the end of the fiat era and put the dollar back onto a gold standard. However, the US Government does not have the mandate to take the required actions and officially at least is still in denial over the need to stabilise the currency. The legal position referring to the constitution is briefly touched upon, because laws will have to be considered to secure the dollar’s future.

Unfortunately, the US Treasury’s gold holdings are almost certainly compromised. Furthermore, since the Asian hegemons have accumulated substantial holdings of bullion in addition to their official reserves, there is bound to be a strong reluctance to hand economic power to Russia and China by endorsing a return to gold standards.

My conclusion is that the era of the fiat dollar based global currency system is rapidly ending, and for America and the dollar there can be no Plan B. It will almost certainly lead to the end of the fiat dollar, and the end of the US hegemony.

Introduction

It is dawning on increasing numbers of analysts that the era of the fiat dollar might be drawing to a close. Very few investment professionals know what to expect. Being thoroughly Keynesian in outlook, most still believe that by the Fed managing interest rates consumer price inflation can be contained and that recessions can also be avoided by expanding fiscal deficits. But the contradictions arising from a deteriorating economic outlook and CPI inflation continually rising completely scuppers these macroeconomic theories. Blaming it on Russia and OPEC+ is tempting, but not a good enough argument.

It is becoming clear that fiat currencies have become increasingly unstable. The only solution for the dollar is to fix the value of credit: but to what? It has been gold or silver throughout the history of national economies. But a denial of returning to exchanging the dollar for a fixed quantity of gold is so systemically embedded in the administration that it is difficult to see this solution even as a last resort.

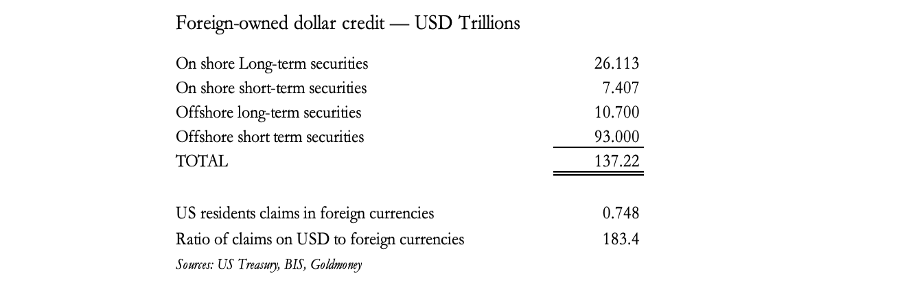

In this article I look at the background to what is sure to become a dollar crisis. The urgency of this matter has been brought forward by America’s declining global influence compared with that of the Asian hegemons, and the US Government’s profligacy. Almost certainly, exposure to the dollar will be unwound by foreign actors, and that exposure, which must include dollar credit originated outside the US banking system is colossal. The table below illustrates the approximate position.[i]

To summarise the evidence, foreigners own or are exposed to a massive $137 trillion dollars. As a cohort, if they decide to begin reducing their exposure US residents have less than a trillion equivalent in foreign currencies to sell in exchange. In the jargon of the markets, the dollar will become “offered only”.

This is the true danger from rising interest rates. As they rise, the declining value of foreign-owned long-term securities totalling $37 trillion will simply accelerate generating widespread investment and dollar liquidation. This will not be offset by US holders of foreign investments liquidating their positions for a simple reason.

US holders of foreign securities hold almost all of them in ADR form, being listed and priced in dollars. In a rising interest rate environment, they will also be declining in value and so we can expect US investors to sell them as well. The sale of an ADR does not lead to a sale of an underlying foreign currency, whereas a sale of a dollar security by a foreign holder will almost certainly do so – unless the foreign investor cohort overall is content to add to its holdings of short-term dollar securities.

Foreign liquidation of dollar investments is a largely unseen danger to the dollar by US-centric commentators who are stuck with the belief that foreigners need to accumulate them. A further rise in interest rates or bond yields, which appears to be underway, far from protecting the dollar will almost certainly lead to portfolio liquidation, dollar liquidation, and therefore its collapse, there being almost no foreign currency in US residents’ hands to absorb it.

And finally, in the run up to a presidential election year it is becoming clear that the US’s proxy war against Russia is turning into a political and military disaster. Ukraine is running out of men, and Russia is reaping the benefit of western-imposed sanctions. Disagreements between NATO members are beginning to surface.