from Redacted News:

TRUTH LIVES on at https://sgtreport.tv/

by Paul Craig Roberts, Paul Craig Roberts:

The ruling establishment’s attempt to assassinate Donald Trump has been swept under the rug. Not even conservatives and Republicans want the truth out. The reason is that the truth shatters the idealistic illusions and delusions that “USA, USA, USA Conservatives” have about America and casts discredit on the US government. To acknowledge the use of force to eliminate a presidential candidate who is regarded as a threat by the ruling establishment would upset the stock market, undermine the establishment’s wars against Russia and Iran, cause difficulties for the intended Democrat theft of the 2024 presidential election, discombobulate Washington’s allies, and create powerful propaganda against the US government.

from The Mel K Show:

TRUTH LIVES on at https://sgtreport.tv/

by Ethan Huff, Natural News:

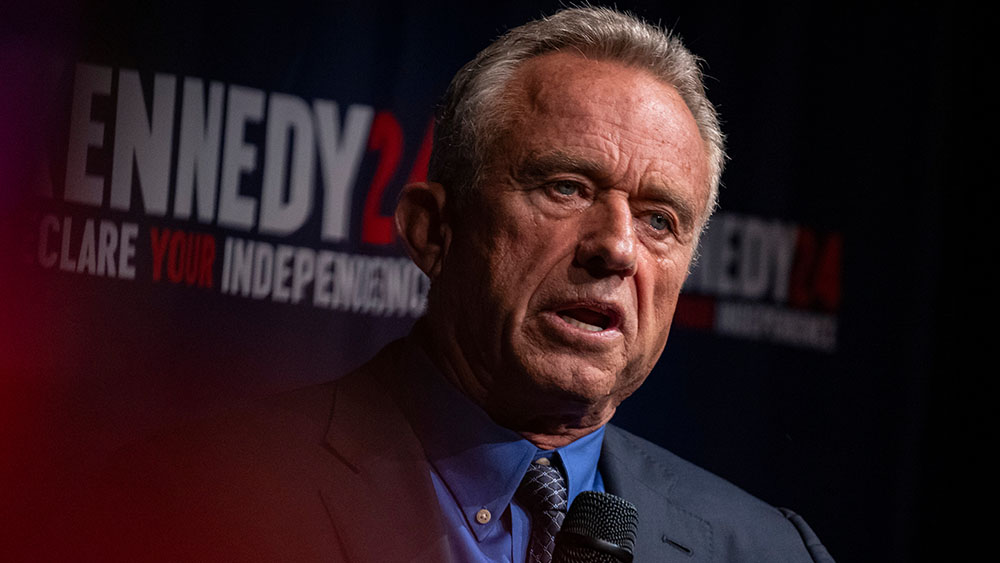

The rebellion of states has begun after Robert F. Kennedy Jr. suspended his campaign and threw his support behind Donald Trump in the 10-or-so battleground states that Trump has to win in order to achieve an election victory.

The rebellion of states has begun after Robert F. Kennedy Jr. suspended his campaign and threw his support behind Donald Trump in the 10-or-so battleground states that Trump has to win in order to achieve an election victory.

In his campaign suspension speech, Kennedy urged his supporters in the other 40 states to still vote for him, but indicated that he is voluntarily removing his name from the ballot in about 10 battleground states, some of which are refusing to cooperate because they want Trump to lose.

by Rhoda Wilson, Expose News:

A group of powerful families, through control of central banks, has manipulated the global economy, leading to immense debt and economic hardship. Financial reform is needed.

More than 10 years ago, Dean Henderson proposed a ten-step plan to address the United States’ $14 trillion debt burden and rid themselves of the debt-collector parasites known as the “financial services industry” which is using its financial clout to target and destroy America.

from Bannons War Room:

TRUTH LIVES on at https://sgtreport.tv/

by Suzanne Burdick, Ph.D., Childrens Health Defense:

U.S. Americans’ trust in vaccines — especially COVID-19 vaccines — has dropped, according to a survey conducted by the Annenberg Public Policy Center at the University of Pennsylvania. The policy center blamed the results on “greater acceptance of Covid vaccine misinformation.”

U.S. Americans’ trust in vaccines — especially COVID-19 vaccines — has dropped, according to a survey conducted by the Annenberg Public Policy Center at the University of Pennsylvania. The policy center blamed the results on “greater acceptance of Covid vaccine misinformation.”

U.S. Americans’ trust in vaccines — especially COVID-19 vaccines — has dropped, according to a survey conducted by the Annenberg Public Policy Center at the University of Pennsylvania.

from Man in America:

TRUTH LIVES on at https://sgtreport.tv/

by Nick Pope, Watts Up With That:

Only a small percentage of climate policies instituted globally have actually resulted in any significant emissions reductions, according to a study published earlier in August in Science, a respected scientific publication.

The new study, titled “Climate policies that achieved major emission reductions: Global evidence from two decades,” used artificial intelligence to assess 1,500 different climate policies pursued across 41 nations between 1998 and 2022, aiming to determine which types of policies have prompted significant emissions cuts. The study’s analysis found that only 63 of these policies constituted “successful policy interventions,” meaning that just 4% of the measures evaluated in the study’s sample effectively reduced emissions. (RELATED: Supreme Court Delivers Massive Blow To Biden’s Climate Agenda)

by Dr. Raphael Lataster, Daily Sceptic:

There have been a few papers in the medical journals on the curious problem of excess deaths persisting beyond the COVID-19 pandemic, most notably Mostert et al., which openly wondered if the COVID-19 vaccines are playing a role (and which made the mainstream media). As promised, I have gone that one little step further, showing that European excess deaths do indeed correlate significantly with COVID-19 vaccination. Appearing in Bulgarian Medicine, published by the Bulgarian Academy of Sciences and Arts (Bulgaria being more open to such research as will be made clear), my little article covers:

Absolutely insane. Outright tyranny in Brazil. They cannot allow people to access real information. https://t.co/rIaKhej3zB

— HealthRanger (@HealthRanger) August 30, 2024

by Joseph Vazquez, Newsbusters:

A leftist group financed by self-appointed Minister of Truth George Soros is partnering with a Big Tech-backed organization in an attempt to interfere in the 2024 election.

The Center for Democracy and Technology (CDT) boasted in an Aug. 21 press release how it was leading a joint effort for “Helping Election Officials Combat Misinformation in 2024” with a “course” co-led by the Google and Facebook-backed Center for Technology and Civic Life (CTCL), which was significantly involved in the whole “Zuck Bucks” scandal to influence the 2020 election. Notably, Soros pumped at least $1,496,000 into the coffers of CDT and its international affiliate between 2016 and 2023, according to grant disclosures reviewed by MRC Free Speech America.

Does the Secret Service exist at all???

Another violent Democrat tries to attack President Trump at his rally in PA.

pic.twitter.com/0SVATycP6v— Brandon Straka #WalkAway (@BrandonStraka) August 30, 2024