by Jesse Colombo, BullionStar:

You’d have to be hiding under a rock to be unaware that inflation is one of the most pressing issues of our time. After a shocking 23% increase in the cost of living since 2019, all but the wealthiest of Americans are getting squeezed and seeing their living standards plummet at an alarming rate. Grinding inflation is causing once-affluent people to become merely middle class, former middle-class people to become working class, while working class people are being forced into the ranks of the working poor and even the destitute. According to the most recent Gallup Poll, inflation was America’s number one worry with 55% of people polled saying that they worried about inflation “a great deal,” while the latest Fed survey showed that two-thirds of Americans believe that inflation has made their financial situation worse.

TRUTH LIVES on at https://sgtreport.tv/

The sad truth is that inflation is not an inevitable fact of life or an inherent flaw of capitalism; it is a direct byproduct of unbacked paper money and central banking. The United States experienced virtually no inflation for over a century until the Federal Reserve was founded in 1913 and the U.S. dollar was progressively downgraded from a gold-backed currency to a paper currency that could be — and has been — printed to oblivion.

Though the U.S. is no longer on the gold standard, savers and investors have been able to effectively protect their wealth from the ravages of inflation by creating their own personal “gold standard,” so to speak, by investing in gold and silver bullion. Unfortunately, the U.S. government taxes capital gains on gold and silver bullion at an unfairly high rate, which is particularly infuriating because those so-called “gains” are not actually gains at all as they are simply compensation for the plunging purchasing power of the dollar, which is the U.S. government’s fault in the first place! Thankfully, as I will discuss later in this piece, there is a glimmer of hope in the form of a new bill that intends to eliminate U.S. federal capital gains taxes on physical gold and silver.

What is Inflation & What Causes It?

In order to truly understand the virtues of gold and silver, it’s important to understand inflation, what causes it, and how destructive it is to society. Simply stated, inflation is an increase in the money supply that manifests in the form of pricier goods and services as well as a loss of purchasing power of the currency that is being inflated. The money supply is the number of units of currency in existence; the more units in existence, the less each unit is worth.

Contrary to popular belief, the rising money supply itself is inflation; the rising cost of goods and services is just an inevitable consequence of that inflation. General inflation is always monetary in origin and is not caused by supply shocks such as an energy crisis or a drought that pushes up food prices. As the Nobel Prize-winning economist Milton Friedman famously stated, “Inflation is always and everywhere a monetary phenomenon.”

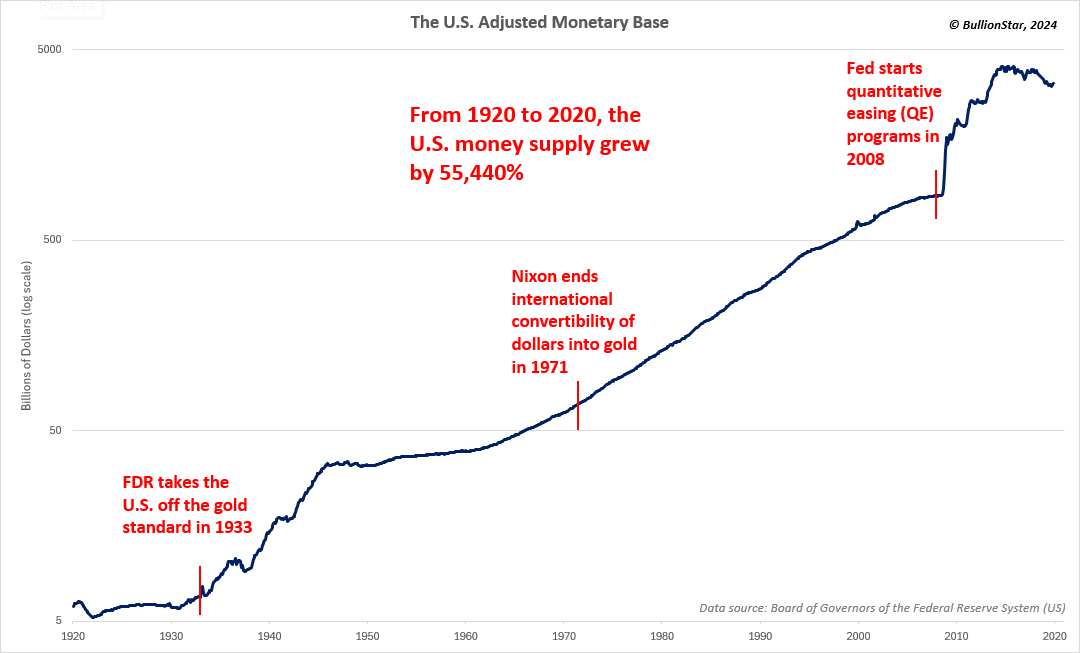

The long-term chart of the U.S. adjusted monetary base, which is one of several widely followed money supply measures, shows how the country’s money supply surged by an astounding 55,440% from 1920 to 2020. (Note that the Federal Reserve stopped publishing this data series in late-2019, which is serious reason for suspicion. Are they trying to hide how much they’ve debased the U.S. dollar? You decide.)

Though the U.S. money supply has grown as a function of time, there have been a series of pivotal events that have accelerated and further enabled that process:

-

- The U.S. Federal Reserve was founded in 1913 with the primary responsibility of issuing and managing the U.S. dollar. Unfortunately, it has proven to be a terrible steward of our nation’s currency because it has been all too willing to create new dollars to enable government spending. For example, the dollar lost half of its purchasing power within just six years of the Fed’s founding due to its funding of America’s role in World War I. Massive wartime inflation ensued, devastating the dollar’s purchasing power.

-

- President Franklin Delano Roosevelt took the U.S. off the Gold Standard in 1933. The United States was on the Gold Standard from 1834 until 1933, which meant that the dollar was backed by and redeemable in gold. For nearly a century, holders of dollars could trade $20.67 to receive an ounce of gold. The Gold Standard helped to limit the expansion of the money supply. To create inflation and counteract deflation during the Great Depression, FDR banned private American citizens from owning gold and forced them to turn in their gold to the Federal Reserve for $20.67 per ounce in 1933. Foreign governments could still redeem their dollars for gold, however. The dollar-gold exchange rate was then changed to $35 per ounce, which meant that the dollar was devalued by 59% against gold. Sure enough, the money supply and cost of living were soon increasing at a rapid rate once again.

-

- Until 1965, U.S. dimes, quarters, and half-dollars were made from an alloy that consisted of 90% silver. In response to the rising price of silver (which itself was a byproduct of inflation), Congress enacted the Coinage Act of 1965, which eliminated silver from dimes and quarters, and reduced the silver content of the half-dollar from 90% to 40%. In 1970, silver was eliminated from the half-dollar. The new coins were made from nickel and copper, which are much cheaper, non-precious metals. Because the melt value of the older silver coins exceeded their face values, the coins were quickly removed from circulation by people who were aware of their greater value — a classic example of Gresham’s Law (i.e. “bad money drives out good money”). The older silver coins are still very popular with precious metals investors today. The Coinage Act of 1965 is often overlooked but represents a significant debasement and downgrade of the U.S. dollar.

-

- From 1933 to 1971, foreign governments could still redeem their dollars for gold, which meant that the dollar was still backed by gold in some sense. On August 15th, 1971, President Richard Nixon ended all convertibility of dollars into gold, which turned the U.S. dollar into a pure fiat or paper currency that could be printed with no limitations whatsoever. Almost immediately, the money supply started growing at a breakneck pace, which led to the infamous inflation of the 1970s. The U.S. experienced an 8.21% average annual rate of inflation from 1971 to 1980, producing a cumulative price increase of 46%.

-

- To combat the 2008 Financial Crisis and Great Recession, the Federal Reserve used an unconventional and aggressive monetary stimulus tool known as quantitative easing or QE. In simple terms, QE is digital money printing in which the Fed buys assets such as U.S. Treasury bonds and mortgage bonds in order to fund government spending and pump liquidity into the economy and financial markets. From 2008 to 2014, the Fed printed approximately $3.5 trillion via its QE programs, which caused the money supply and cost of living to soar.