by Jan Nieuwenhuijs, Gold Seek:

China Is Leading the Dance in the Gold Market

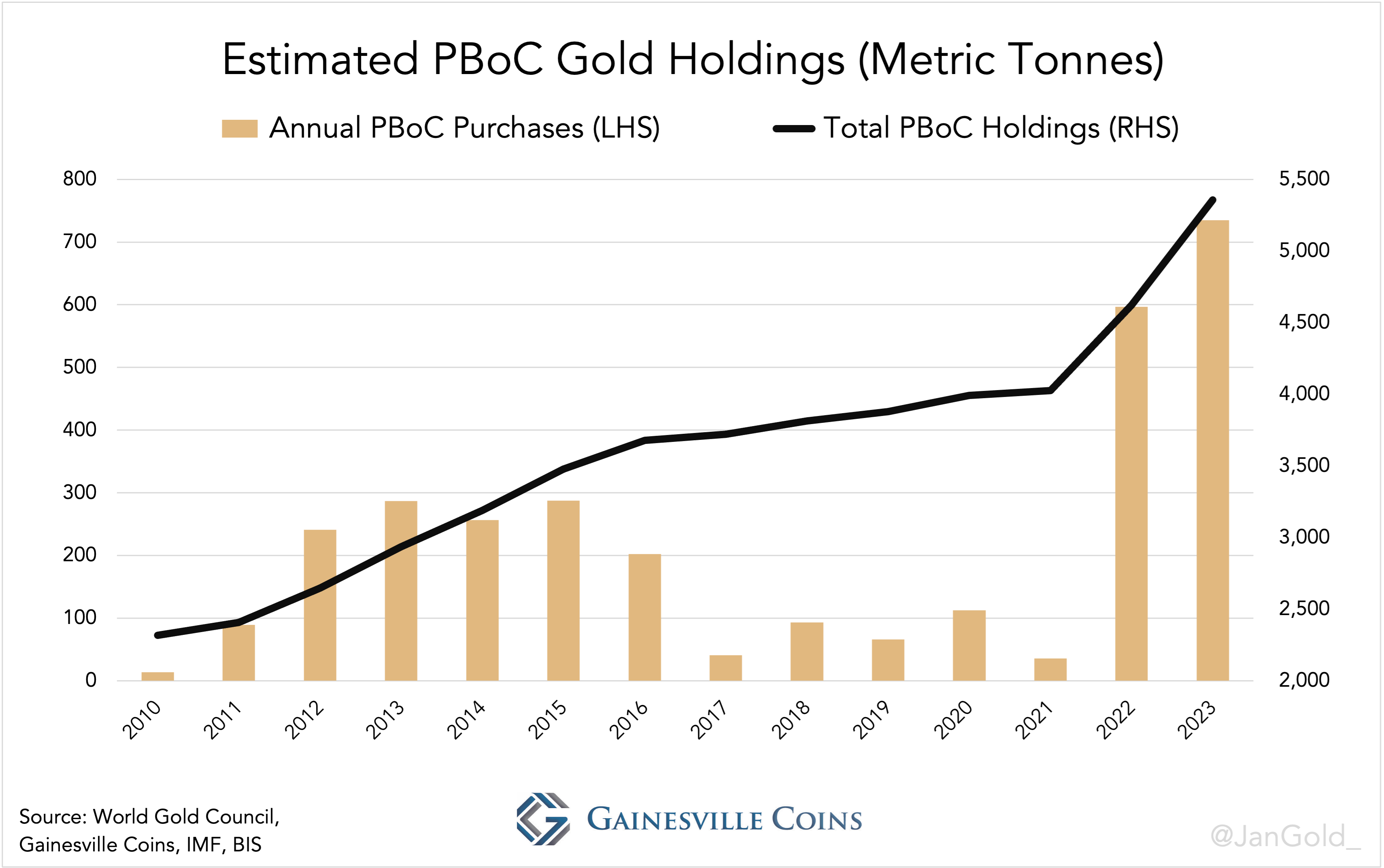

Exceptional strong gold demand from both the Chinese central bank and private sector has been driving up the gold price over the past two years, by which they have taken over control over the gold price from the West. The People’s Bank of China (PBoC) bought a record 735 tonnes of gold in 2023, of which about two thirds were purchased covertly. In addition, the private sector net imported 1,411 tonnes in 2023, and a whopping 228 tonnes just in January of 2024. If the West joins the Chinese gold buying craze, in fear of rate cuts and currency debasement, it will be a perfect storm for gold.

TRUTH LIVES on at https://sgtreport.tv/

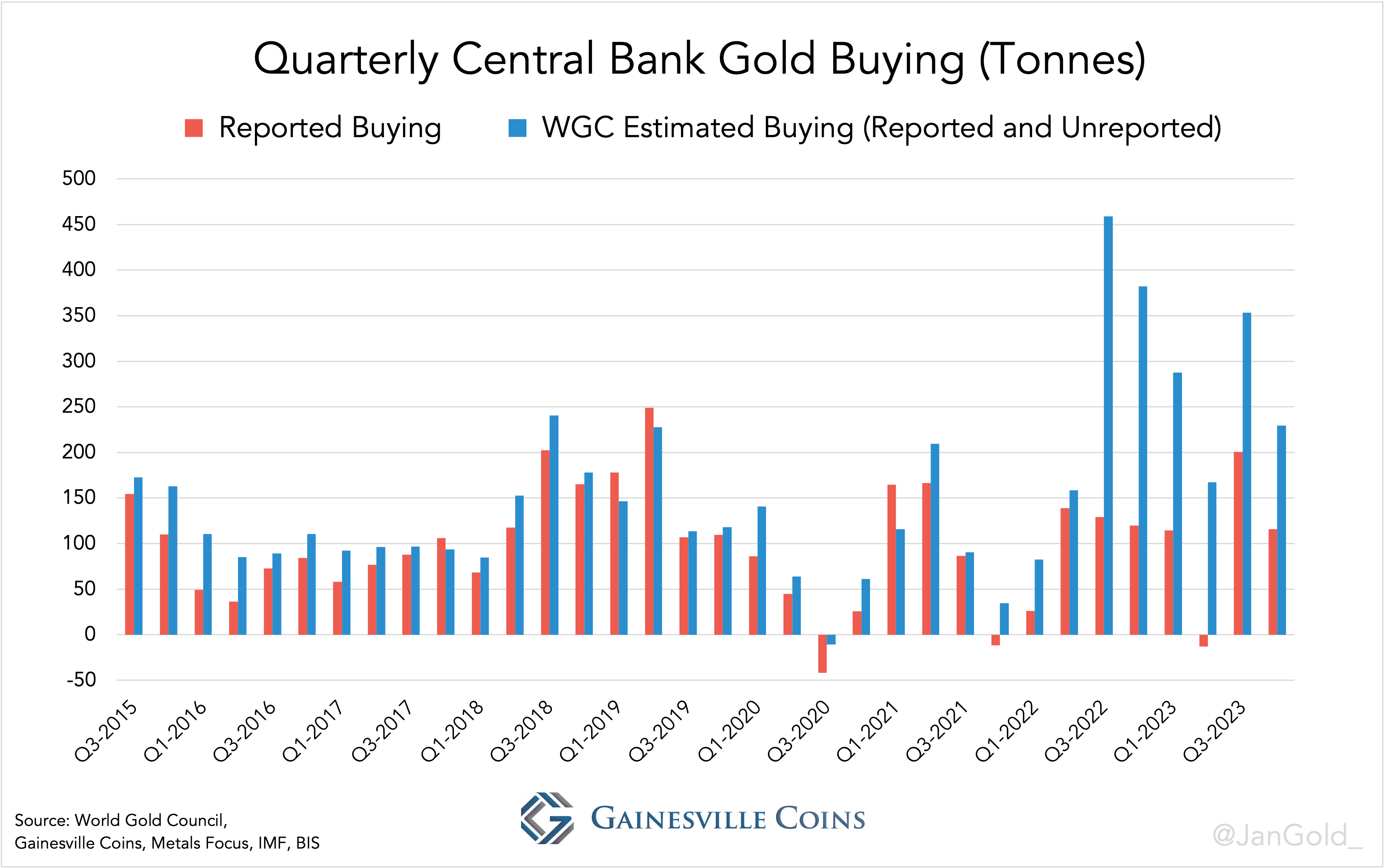

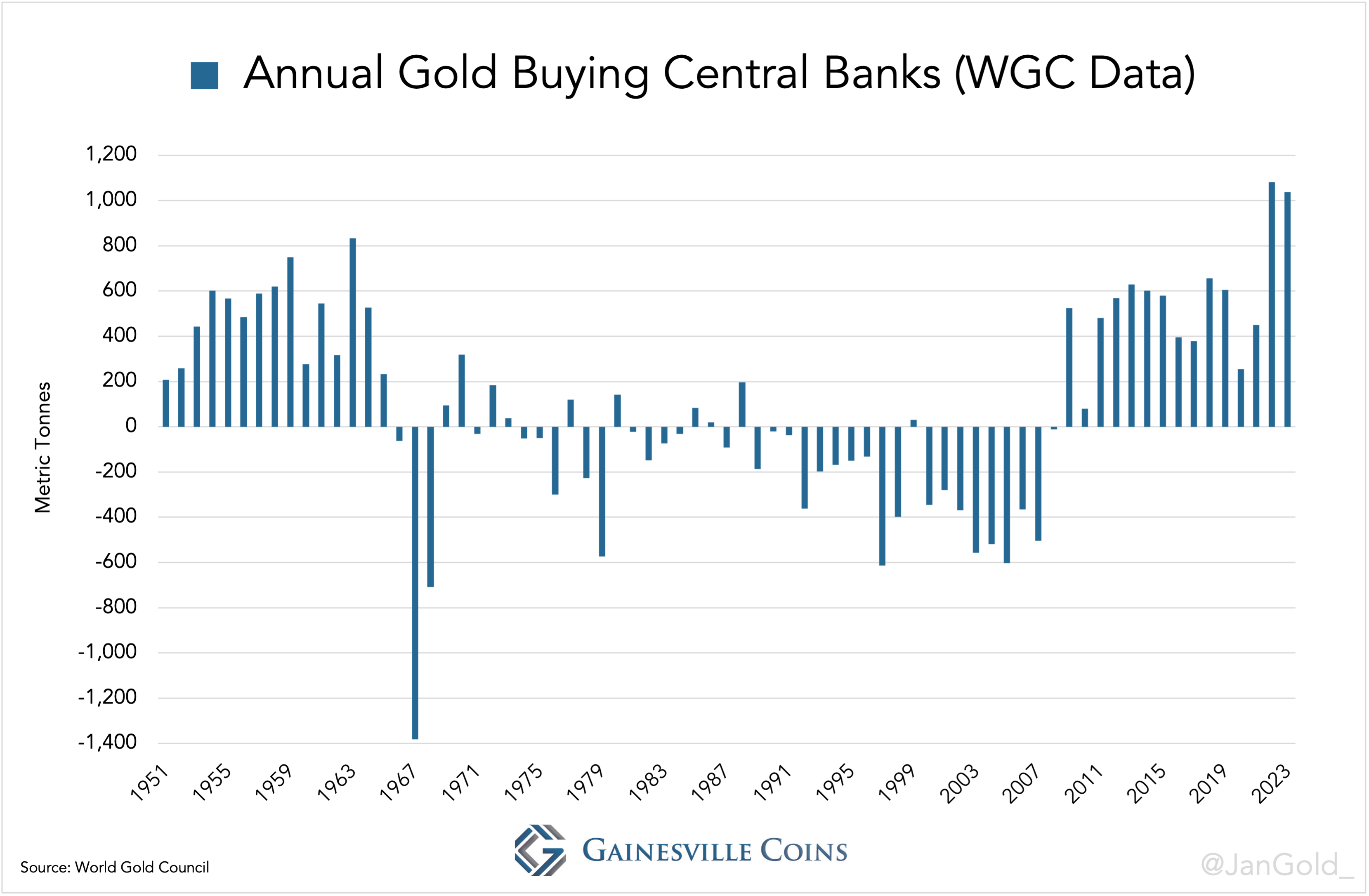

As most readers will be aware of by now, since the war in Ukraine, which led Western authorities to freeze dollar assets of the Russian central bank, estimated gold purchases by central banks as disclosed by the World Gold Council (WGC) have exploded. Covert PBoC gold purchases can be computed by comparing the WGC’s data with what is officially reported by central banks.

To compute what the PBoC secretly acquires every quarter I take eighty percent of total unreported purchases. Then, I add what the Chinese central bank reports to have bought. In total, over 2023, the PBoC bought a record 735 tonnes, up 23% from the previous record in 2022 at 597 tonnes.

My estimate is that the PBoC now holds 5,358 tonnes, which is 3,108 tonnes north of what’s officially disclosed at 2,250 tonnes (for more details click here).

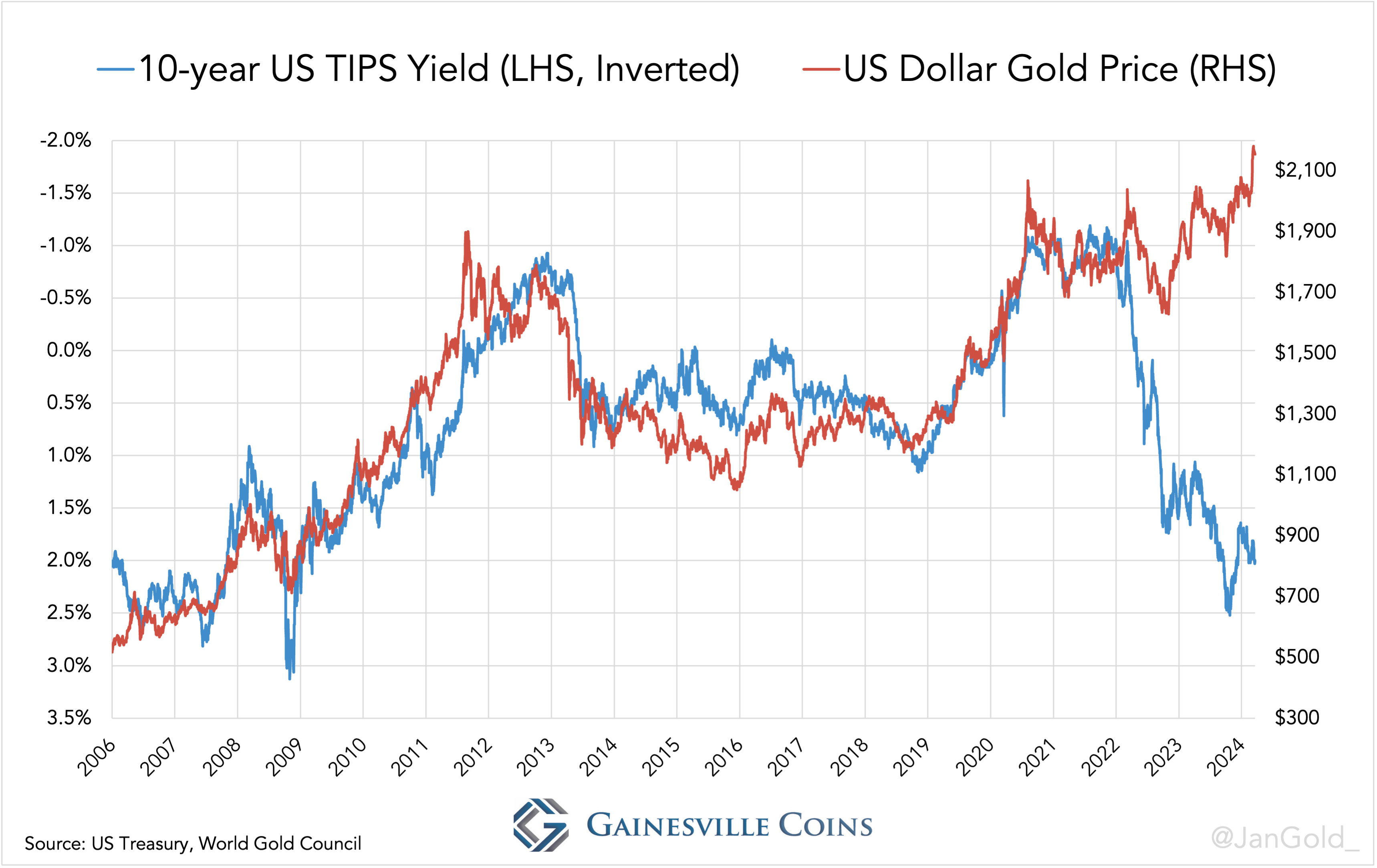

Chinese massive gold buying over the past two years have fundamentally changed the gold market. Whereas before 2022 Western institutional supply and demand was driving the price of gold and the price was more or less stuck to the “real yield” (10-year US TIPS interest rate), ever since the war gold has been less sensitive to real yields and follows its own path. This divergence, according to my analysis, has been created by China that has become one of the main driving forces of the gold price.