by Pam Martens and Russ Martens, Wall St On Parade:

At 5:13 p.m. ET on Tuesday, after the stock market closed, Fitch downgraded the U.S. credit rating from AAA to AA+. Fitch is now the second of the three major credit rating agencies to have taken the historic step of removing the triple-A rating from the U.S. S&P made its first-ever downgrade to the U.S. credit rating on August 5, 2011, also from AAA to AA+, and has kept it there ever since. Moody’s is now the only member of the Big Three credit rating agencies that has maintained a triple-A rating on the U.S.

TRUTH LIVES on at https://sgtreport.tv/

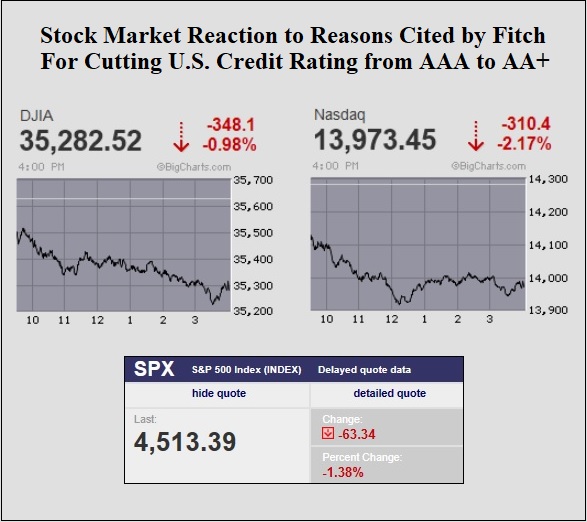

As the chart above indicates, the stock market responded negatively to this development yesterday, particularly over the fact that it came at a time when the U.S. Treasury is boosting the amount of debt it is issuing.

Yesterday, the U.S. Treasury announced its plans to increase its debt issuance, writing as follows:

“Based on projected intermediate- to long-term borrowing needs, Treasury intends to gradually increase coupon auction sizes beginning with the August to October 2023 quarter. While these changes will make substantial progress towards aligning auction sizes with intermediate- to long-term borrowing needs, further gradual increases will likely be necessary in future quarters….”

In line with that view, the Treasury boosted its auction set for next week from $96 billion to $103 billion, consisting of $42 billion in a 3-year Treasury note; $38 billion in a 10-year Treasury note; and $23 billion in a 30-year Treasury bond.

Yields on both the 10-year note and 30-yield bond saw increases in their yields yesterday, meaning their prices were declining. (Bond prices move inversely to their yields.) The yield on the 10-year was trading in the range of 4.05 percent in the early morning yesterday, then moved up to 4.12 by late afternoon. It has continued to move higher this morning, yielding 4.15 percent at 7 a.m. The yield on the 30-year bond was trading in the range of 4.10 early yesterday morning, then moved sharply up at the day progressed, reaching a yield of 4.20 by 11 a.m. This morning, at 7 a.m., the 30-year is yielding 4.25 percent.

When S&P downgraded the U.S. credit rating in 2011, it cited as one factor the growing U.S. debt as a percent of GDP. It said it anticipated U.S. debt reaching “an estimated 74% of GDP by the end of 2011 to 79% in 2015 and 85% in 2021,” while noting that these ratios were “high in relation to those of peer credits….”

Those ratios look positively Goldilocks compared to today. One of the points made by Fitch in its ratings downgrade on Tuesday was this:

“Lower deficits and high nominal GDP growth reduced the debt-to-GDP ratio over the last two years from the pandemic high of 122.3% in 2020; however, at 112.9% this year it is still well above the pre-pandemic 2019 level of 100.1%. The GG [General Government] debt-to-GDP ratio is projected to rise over the forecast period, reaching 118.4% by 2025. The debt ratio is over two-and-a-half times higher than the ‘AAA’ median of 39.3% of GDP and ‘AA’ median of 44.7% of GDP. Fitch’s longer-term projections forecast additional debt/GDP rises, increasing the vulnerability of the U.S. fiscal position to future economic shocks.”

But what is causing the most discussion behind the scenes, both domestically and abroad, are the concerns Fitch enumerated on the ability of the U.S. to govern itself. Fitch raised the following governance issues:

“In Fitch’s view, there has been a steady deterioration in standards of governance over the last 20 years, including on fiscal and debt matters, notwithstanding the June bipartisan agreement to suspend the debt limit until January 2025. The repeated debt-limit political standoffs and last-minute resolutions have eroded confidence in fiscal management. In addition, the government lacks a medium-term fiscal framework, unlike most peers, and has a complex budgeting process….”

Debt-limit standoffs are, unfortunately, not the only political standoffs. It’s difficult for ratings agencies, or the rest of the world for that matter, to forget that it was just over 2-1/2 years ago that the seat of government, the U.S. Capitol, faced a bloody insurrection — by American citizens. Photographs of that out-of-control scene made the front pages of newspapers around the world, as we chronicled here.

One comment from Fitch on U.S. governance on Tuesday seemed far too generous. It said that according to the World Bank Governance Indicators (WBGI), the “U.S. has a high WBGI ranking at 79, reflecting its well-established rights for participation in the political process, strong institutional capacity, effective rule of law and a low level of corruption.”

Read More @ WallStOnParade.com