by Pam Martens and Russ Martens, Wall St On Parade:

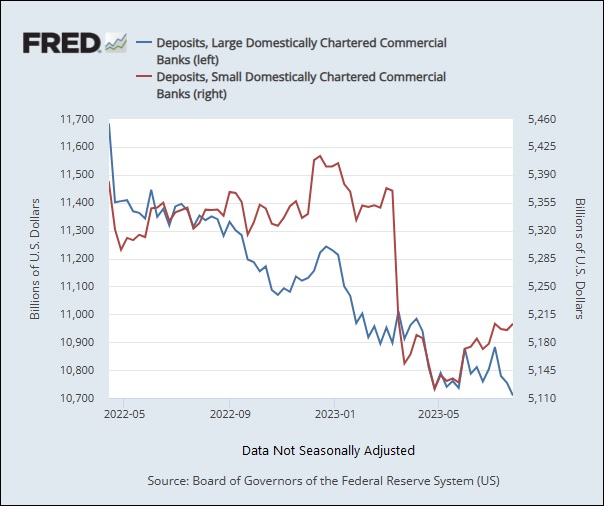

Deposits at the 25-largest domestically-chartered U.S. commercial banks peaked at $11.680 trillion on April 13, 2022, according to the updated H.8 data maintained at the Federal Reserve Economic Database (FRED). As of the most current H.8 data for the week ending on Wednesday, July 26, 2023, deposits stood at $10.709 trillion at those 25 commercial banks, a dollar decline of $970 billion and a percentage decline of 8.3 percent.

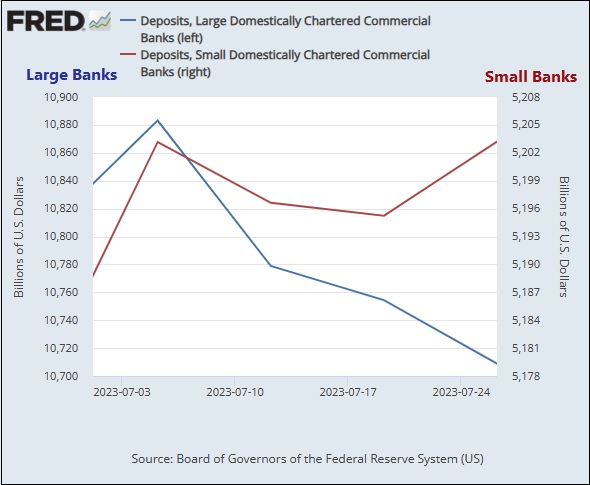

Equally noteworthy, the decline shows no signs of letting up. According to the FRED data, between July 5 and the most current reading on July 26, the 25 largest U.S. banks shed $174 billion in deposits.

TRUTH LIVES on at https://sgtreport.tv/

Despite all of the misleading news reports about depositors seeking out the perceived safety of the largest banks since the banking crisis in the spring, it’s actually been the smaller banks that have staged a comeback on growing deposits since the week of April 26. (See chart above.)

As of March 31 of this year, according to FDIC data, there were a total of 4,096 commercial banks in the U.S., meaning that if you segregate the 25 largest banks, that leaves 4,071 falling into the H.8 category of small, domestically chartered commercial banks.

This breakdown does not give the American people a quick pulse beat on the dangers lurking in the U.S. banking system – a system that imploded in 2008 and was on its way to imploding again this spring until the Fed stepped in with another bailout program. In the span of seven weeks this spring, running from March 10 to May 1, the second, third, and fourth largest bank failures in U.S. history occurred. In order of size, those were: First Republic Bank (May 1), Silicon Valley Bank (March 10) and Signature Bank (March 12). The largest bank failure in U.S. history, Washington Mutual, occurred in 2008 during the financial crisis.

Because there are only four domestically-chartered commercial banks in the U.S. with more than $1 trillion in deposits – JPMorgan Chase, Bank of America, Wells Fargo, and Citigroup’s Citibank – it behooves Americans to closely monitor what is happening at these four banks, which hold such a highly concentrated share of the banking system’s deposits and assets. That is especially true given that one of those four banks, Citigroup, blew itself up in 2008 and received the largest Fed and Treasury bailout in U.S. banking history.

Given this history, it would make far more sense for the Fed to provide this deposit data in the following breakdowns: deposits at mega banks with more than $1 trillion in deposits; deposits at large banks with $200 billion to $1 trillion in deposits; and deposits at small and medium banks with less than $200 billion in deposits.

Monitoring what is going on at these four behemoth banks should make nightly network news and the front pages of newspapers – but rarely does. This lack of media attention allows a five-count felon bank like JPMorgan Chase to continue its serial crimes while simultaneously getting bigger. JPMorgan Chase was allowed by federal regulators to gobble up the failed First Republic Bank this year, despite the fact that JPMorgan Chase is currently being credibly charged in federal court by the Attorney General of the U.S. Virgin Islands with “actively participating” in Jeffrey Epstein’s sex-trafficking of underage girls for more than a decade.

Read More @ WallStOnParade.com