by Peter Schiff, Schiff Gold:

One of the reasons Americans were able to continue spending even as price inflation raged was they saved a lot of money during the pandemic lockdowns. But those savings are nearly depleted, according to a study released by the Federal Reserve Bank of San Francisco.

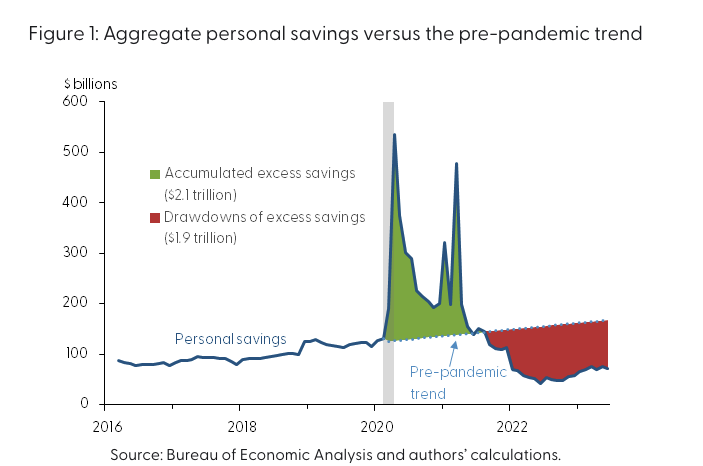

Aggregate savings peaked at $2.1 trillion in August 2021. As of June, the San Francisco Fed estimated that aggregate savings had dropped to $190 billion.

In other words, Americans have blown through $1.9 trillion in savings in just two years.

TRUTH LIVES on at https://sgtreport.tv/

American consumers pulled $100 billion per month on average from savings beginning in 2022. Unless this trend reverses, excess savings will be completely depleted sometime this quarter.

It’s not hard to understand what happened. When governments shut down the economy, people stayed home and spent far less money. They also received generous stimulus checks from the federal government. Americans dumped a lot of this excess money into savings.

Saving typically increases during a recession, but the saving rate during the pandemic was far higher than in a typical recession, according to the San Francisco Fed study.

Pandemic-related fiscal support resulted in a sizable increase in disposable income in the overall US economy at a time when health-related economic closures and social distancing led to a significant drop in household spending. As a result, aggregate personal savings rose rapidly, far beyond its pre-pandemic trend and much higher than in previous recessions.”

That raises a question: with no savings, how will Americans keep spending and continue to prop up this bubble economy?

Up until recently, the answer was credit cards.

American consumers also paid down credit cards during the lockdown year. Credit card balances were over $1 trillion when the pandemic began. They fell below that level in 2020 with an 11.2% drop. We saw small upticks in credit card balances in February and March of 2021 as the recovery began, with a sharp drop in April when another round of stimulus checks rolled out. But Americans started borrowing in earnest again in May 2021.