by Jan Nieuwenhuijs, GainesvilleCoins:

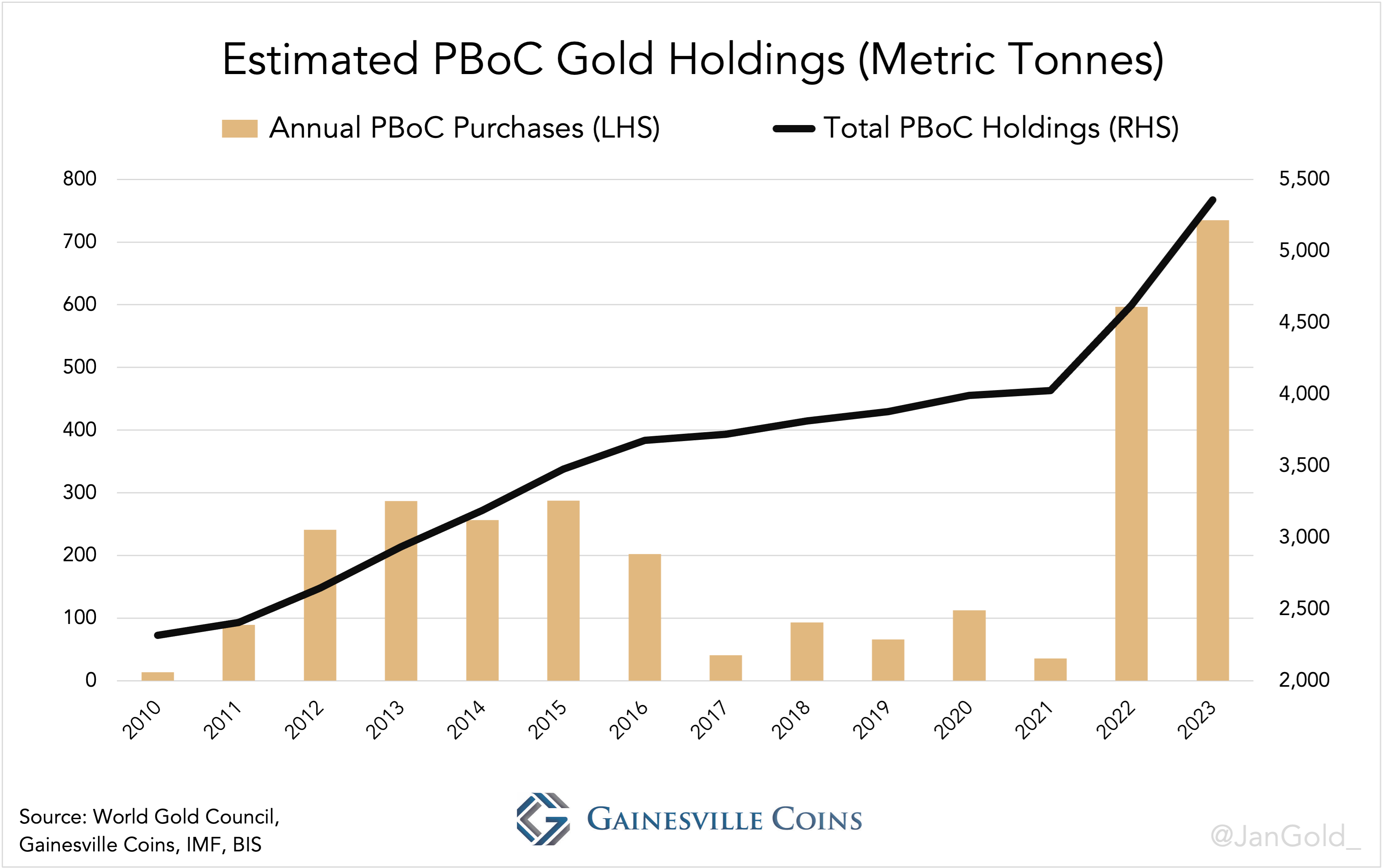

The People’s Bank of China (PBoC) bought 735 tonnes of gold in 2023, of which about two thirds were bought covertly. In this article we will examine how strong PBoC gold buying pushed up the price of gold in the past two years, how gold pricing power in general is shifting to the East, and how this new trend has set the stage for the powerful gold rally that started late February.

TRUTH LIVES on at https://sgtreport.tv/

The PBoC on an Unprecedented Gold Buying Spree

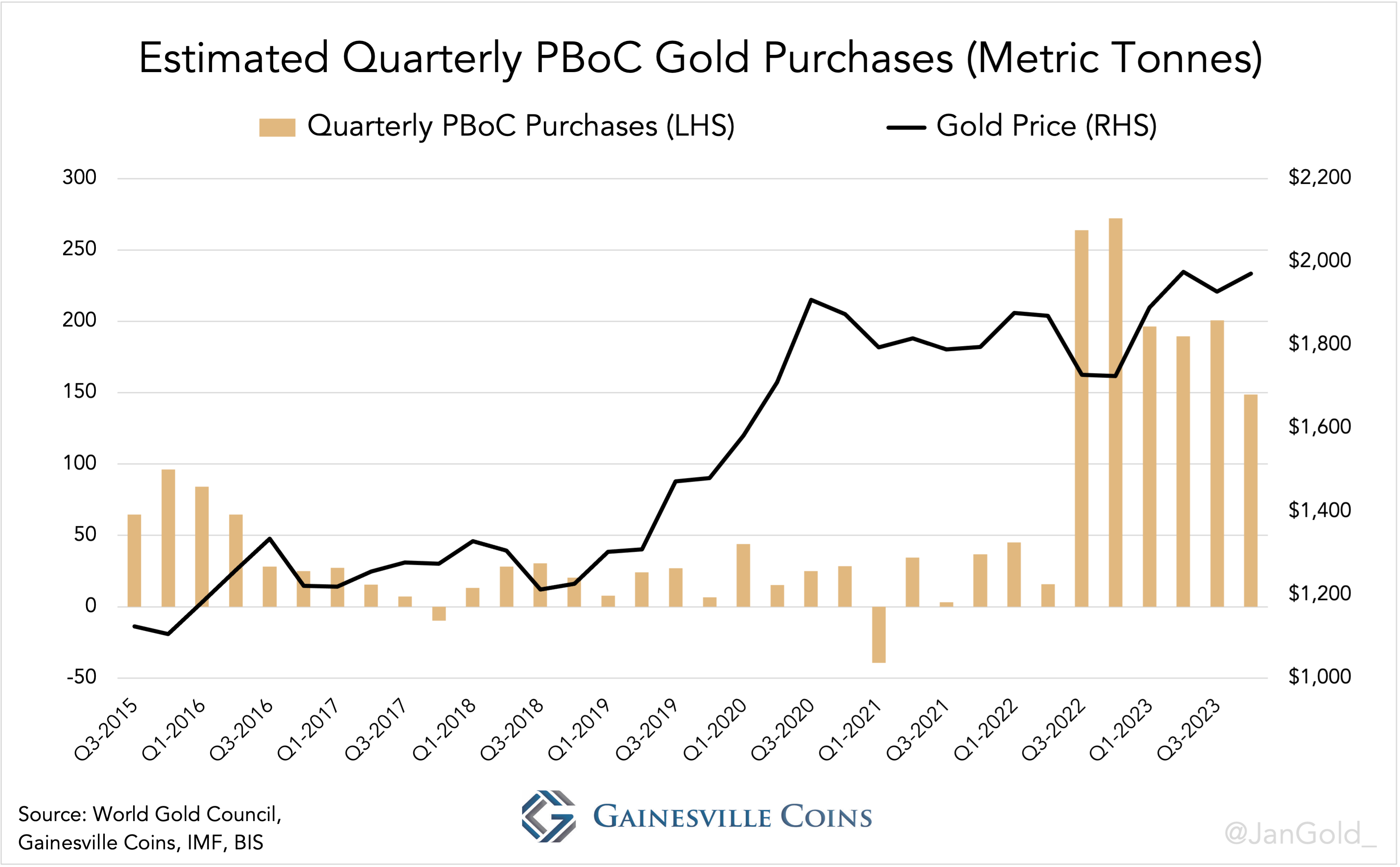

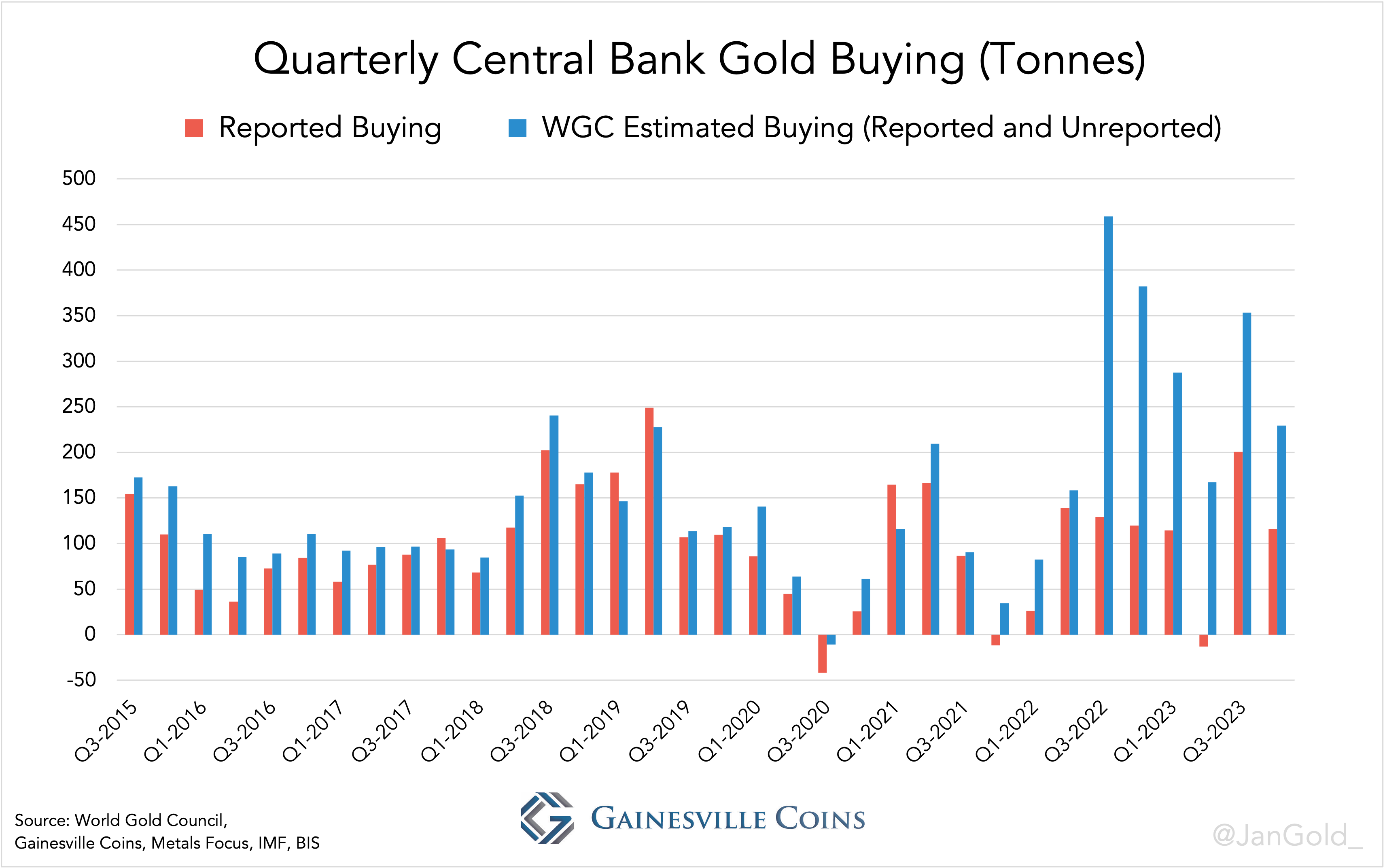

As most readers will be aware of by now, since the war in Ukraine, which led Western authorities to freeze dollar assets of the Russian central bank, estimated gold purchases by central banks as disclosed by the World Gold Council (WGC) have exploded. Covert PBoC gold purchases can be computed by comparing the WGC’s data with what is officially reported by central banks.

The difference between WGC’s estimated buying and reported buying, arising from the fact that the WGC’s numbers are based on field research, is “largely” created by the PBoC, two industry insiders shared with me.

To compute what the PBoC secretly acquires every quarter I take eighty percent of total unreported purchases. Then, I add what the Chinese central bank reports to have bought. For 2023 the PBoC bought a record 735 tonnes in total, up 23% from the previous record in 2022 at 597 tonnes. My estimate is that the PBoC now holds 5,358 tonnes, which is 3,108 tonnes north of what’s officially disclosed at 2,250 tonnes (for more details click here).

An Explosive Gold Market

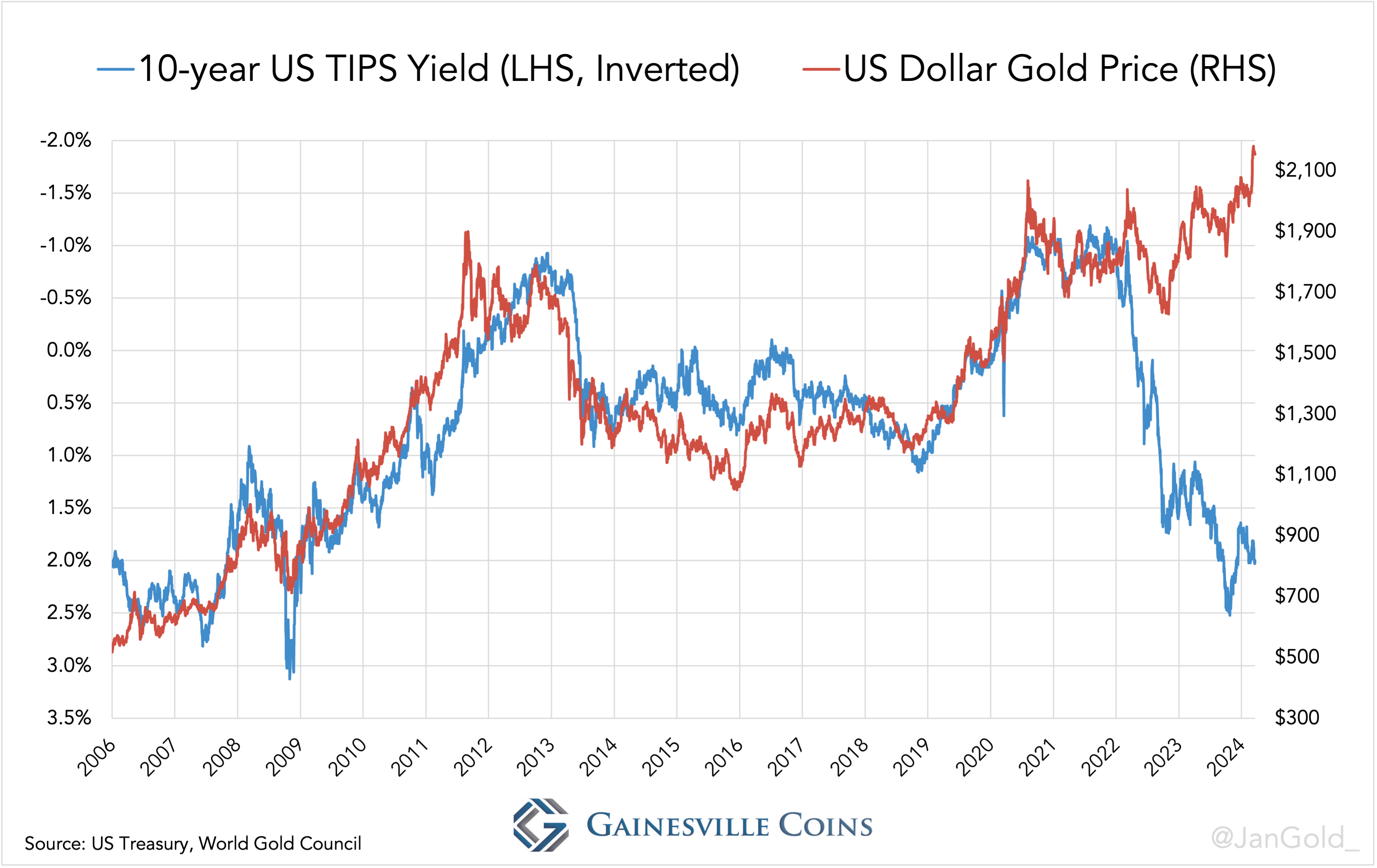

The PBoC’s massive gold investments in the past two years have fundamentally changed the gold market. Whereas before 2022 Western institutional supply and demand was driving the price of gold and the price was more or less stuck to the “real yield” (10-year US TIPS interest rate), ever since the war gold has been less sensitive to real yields and follows its own path. This divergence, according to my analysis, has been mainly created by the PBoC that has become one of the driving forces of the gold price.

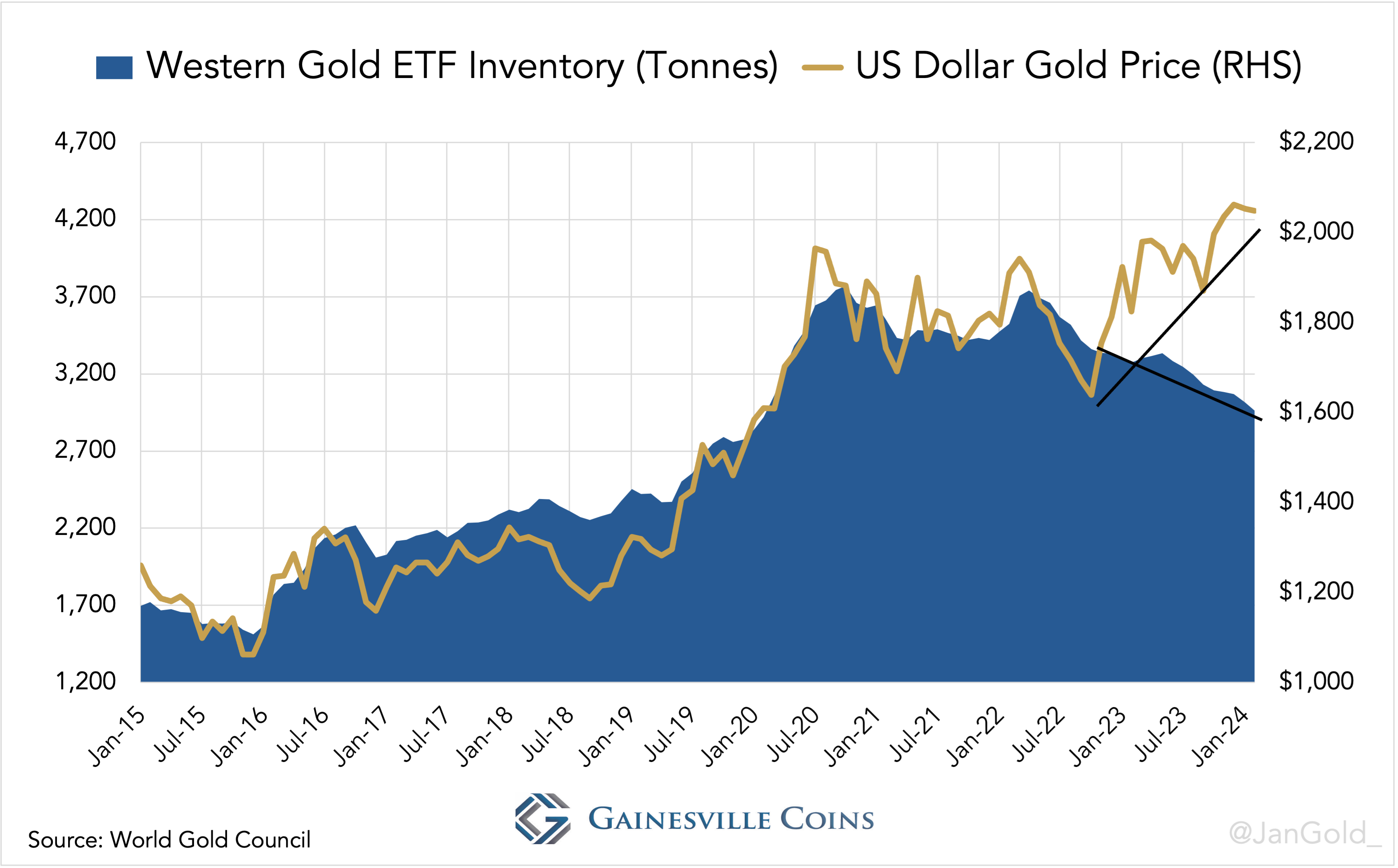

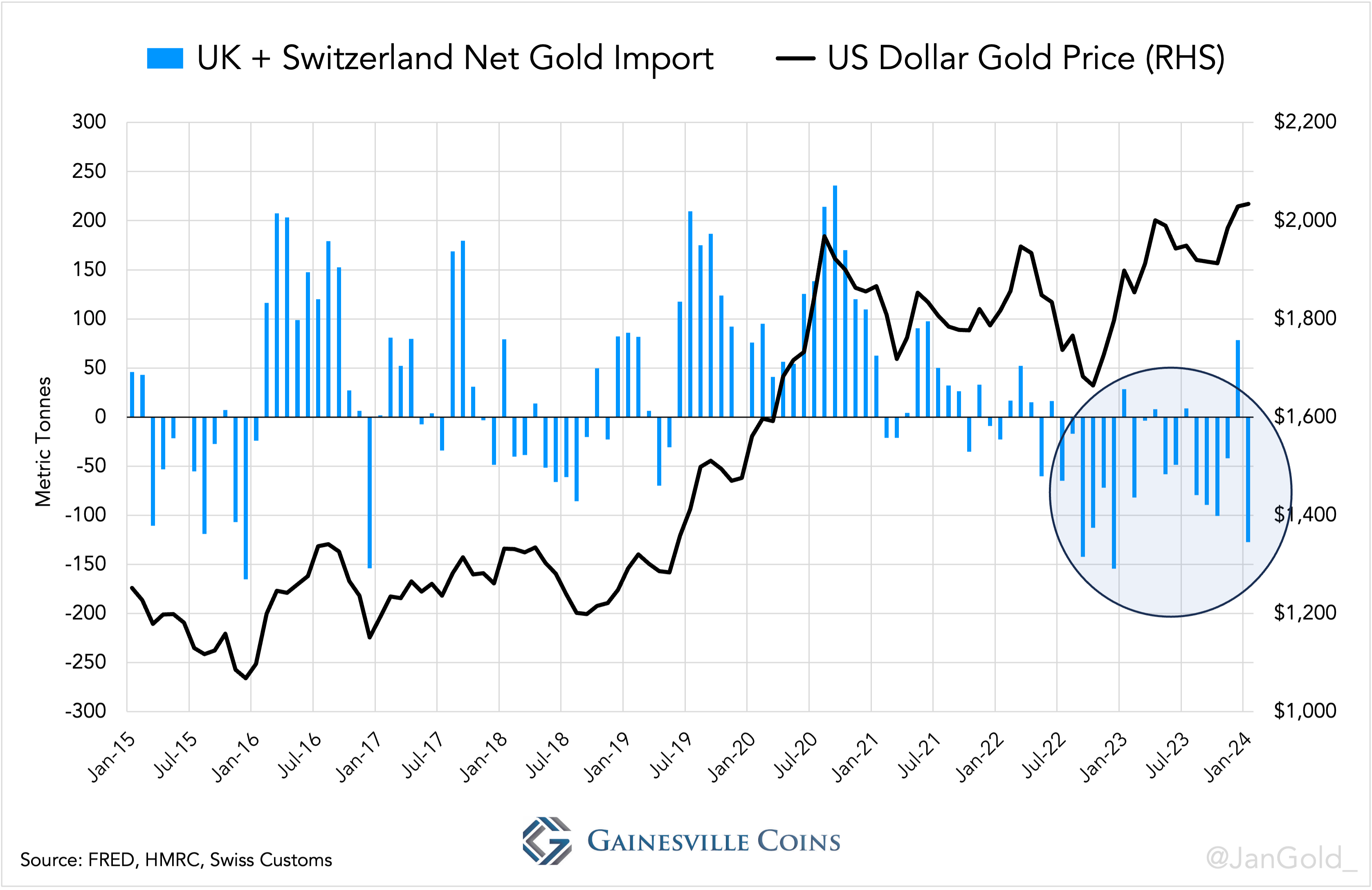

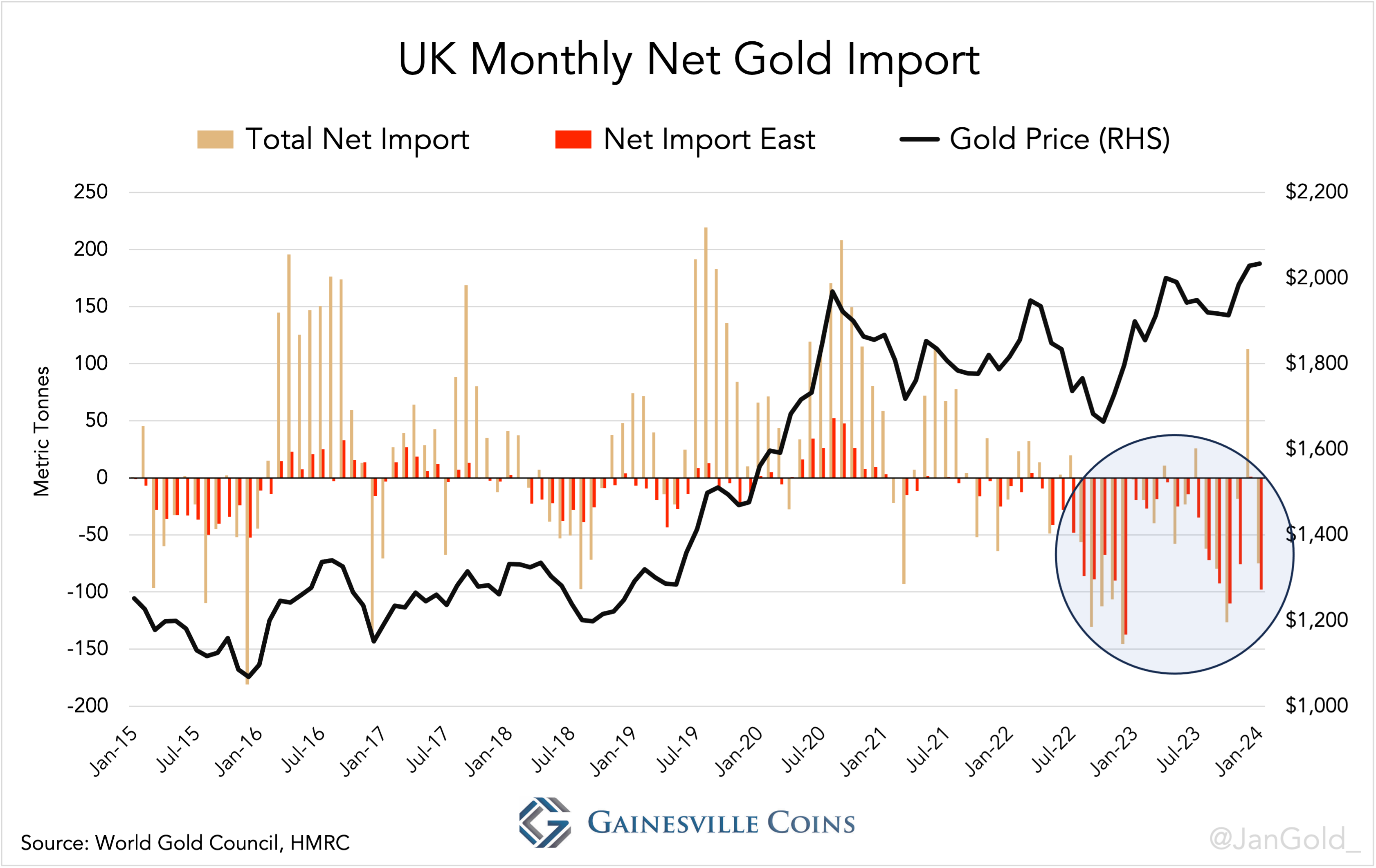

In the charts below you can see that since the PBoC started buying gold in size—in the second half of 2022—the price has been trending up, all the while the West was a net seller (previously the West would be a buyer when the gold price rose). As the gold price went up from $1,736 dollars an ounce in July 2022 to $2,034 in January 2023 the West was dishoarding, as evidenced by outflows from ETFs and net exports from wholesale markets in London and Switzerland*. Kindly note, monetary gold flows—such as the PBoC repatriating metal from abroad—do not appear in global trade statistics. All visible flows relate to non-monetary gold.

Worth noting is that since 2022 total net exports from the UK are roughly equal to the UK’s net export to the East. Increasingly, gold flowing out of London is bypassing Switzerland and is shipped directly to Asia where the 400-ounce bars from the London Bullion Market are recast into 1 Kg bars for the regional market. Global refining capacity is shifting East as well.

Read More @ GainesvilleCoins.com

.png)