from The Epoch Times:

TUCSON, Ariz.—Horses taught Christine Searle the importance of being fair. Intelligent and innately honest creatures, horses know deceit when they see it. She wishes they could teach that principle to the state of Arizona.

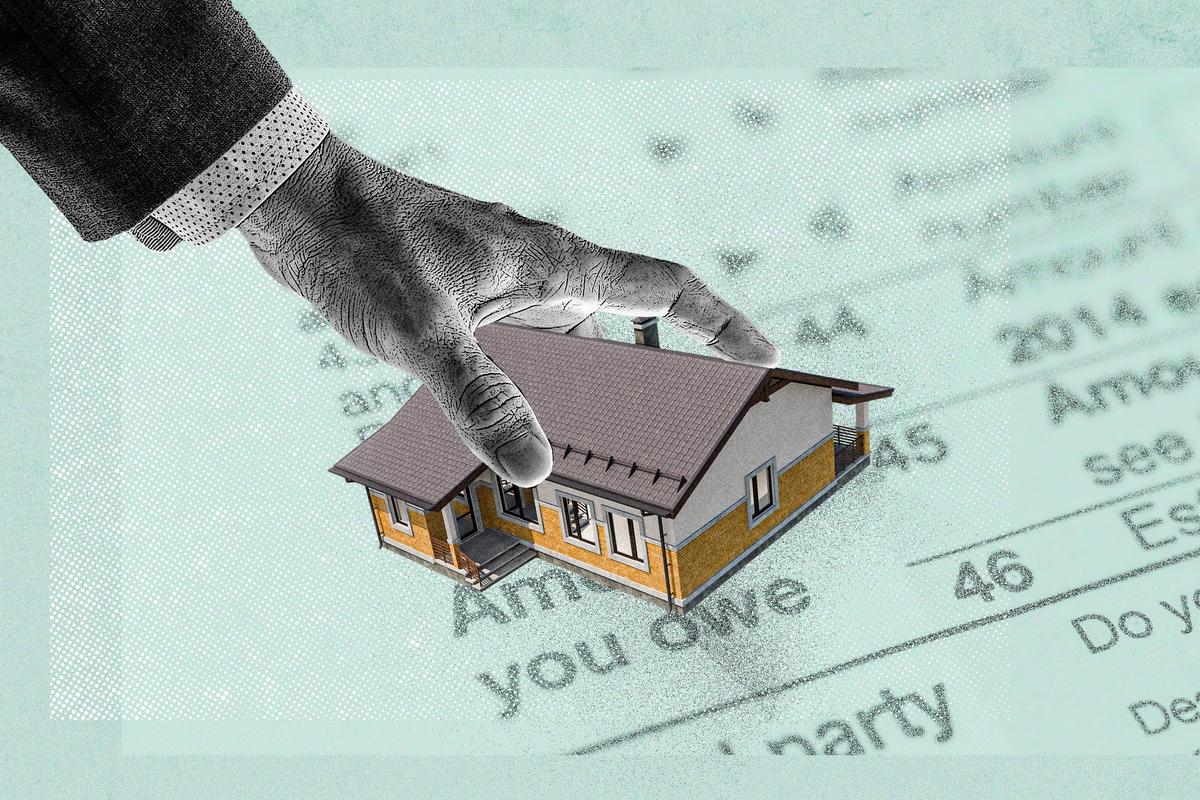

The 70-year-old horse trainer and Arizona native is on the verge of losing her life’s savings over an unpaid $1,607.68 property tax bill.

“I owed them the money. And that’s what they should get—the money I owe them,” Ms. Searle told The Epoch Times.

“I don’t think that they should have the right to take all of it.”

TRUTH LIVES on at https://sgtreport.tv/

Arizona is one of almost a dozen states that allow creditors to keep all the proceeds from sales of homes foreclosed due to unpaid taxes—known as tax lien sales, according to the Pacific Legal Foundation (PLF).

“The taxpayer must render to Caesar what is Caesar’s, but no more,” Chief Justice John Roberts wrote in the unanimous decision.

But, under their current laws, 10 states and the District of Columbia have no means of returning the excess proceeds of a home sale; what Mountain States Legal Foundation lawyers representing Ms. Searle call “home equity theft.” The states include Alabama, Arizona, Colorado, Illinois, Massachusetts, Minnesota, New Jersey, New York, Oregon, and South Dakota.

Ms. Searle hopes her case will be the one to set things right in Arizona.

In Arizona, a county treasurer can place a lien on a property for taxes owed. These financial claims are then sold at an online auction. In the auction, buyers bid the lowest interest rate they intend to charge property owners to redeem their lien. The bidding begins at 16 percent and the lowest bid wins.

Purchasing a tax lien doesn’t transfer ownership of the property. In Arizona, the property owner has three years to pay the back taxes, which includes fees and interest. If it is not redeemed within that time, the lienholder may foreclose and sell the property.

Unsold tax liens are turned over to the state. The state has the same right to foreclose, but must return any excess proceeds to the former property owner.

In 2005, Ms. Searle bought a three-bedroom, two-bath house as a rental property for $255,000. The house is in Gilbert, Arizona, 22 miles southeast of Phoenix. Its 2024 property tax appraisal came to $376,800, but she stands to lose much more than the taxable value.