by Jan Nieuwenhuijs, Gainesville Coins:

The story on the emergence of the US dollar hegemony.

After the collapse of Bretton Woods in 1971 several European central banks tried setting up a new gold pool to stabilize the price and move to a quasi gold standard. The US wanted to phase out gold from the system and enforce a dollar standard on the world.

What frightened the US was that Europe held the most gold and alluded to raising the gold price periodically to create liquidity, giving them the dominant means of creating reserves. Through its military presence in Germany, protecting it from the Soviet Union, the US was able to pressure the Germans not to cooperate with the gold pool. Without Germany the other European countries couldn’t materialize the pool and gold lost its anchor role in the monetary system. In the meantime, the US made a secret deal with Saudi Arabia to recycle oil dollars into US government bonds.

TRUTH LIVES on at https://sgtreport.tv/

The United States didn’t manage to phase out gold from the system altogether, but it did succeed in establishing a global dollar standard which yielded them unprecedented power.

For the sake of simplicity “Europe” will generally refer to Belgium, France, Germany, Italy, the Netherlands, and Switzerland, most of which also cooperated during the classic gold standard in the 19th century.

The Beginning of the End

At a conference in Bretton Woods, New Hampshire, in July 1944, no less than 730 delegates from 44 nations forged a new international monetary system. With the currency wars of the 1930s in fresh memory an agreement of fixed exchange rates and free trade was reached. Because the United States had the strongest hand at the negotiation table, only the dollar was convertible into gold at $35 per troy ounce, making it “as good as gold” and stimulating its use as a reserve currency. Other currencies were pegged to the dollar (or gold). Gold was thus the ultimate anchor of “Bretton Woods,” granted by the Federal Reserve that was obligated to convert (buy and sell) dollars into bullion for foreign central banks.

While pound sterling was still held by central banks the world over from the previous arrangement, Bretton Woods incentivized central banks to hold dollars and gold as reserves. An advantage of the dollar, relative to gold, was that it accrued interest; a disadvantage was that it could devalue against gold (or be seized). In practice, the system created demand for dollars as a trade, intervention, and reserve currency.

The “rules of the game” were enshrined in the Articles of Agreement of the newly erected International Monetary Fund (IMF) that was to administer the system and support countries with temporary balance of payments deficits through lending reserves. In consultation with the IMF countries could devalue (revalue) their currency in case of chronic balance of payments deficits (surpluses) to restore equilibrium. The system was stable as long as its members implemented similar domestic monetary policies (countries with relatively loose policies had to devalue), which didn’t happen.

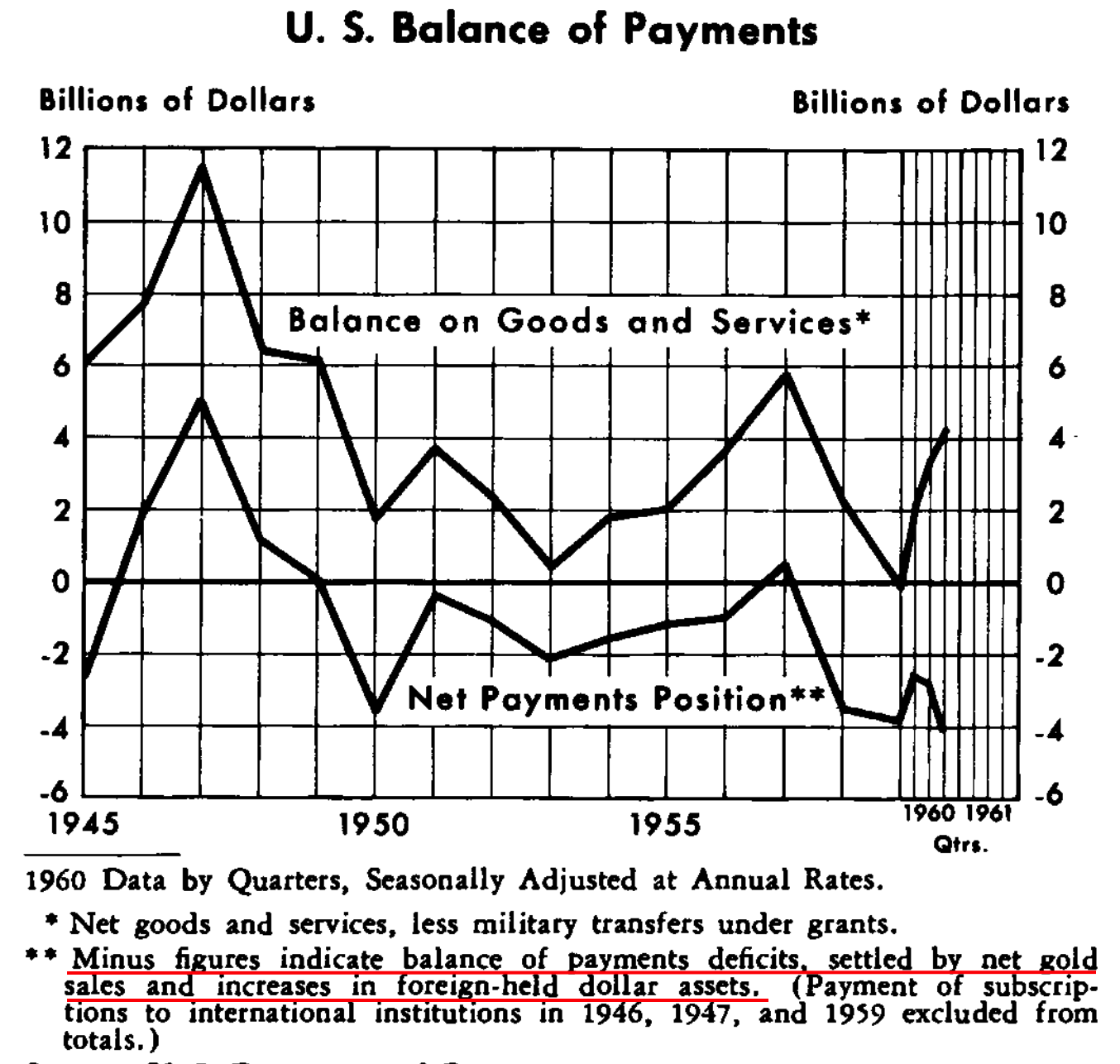

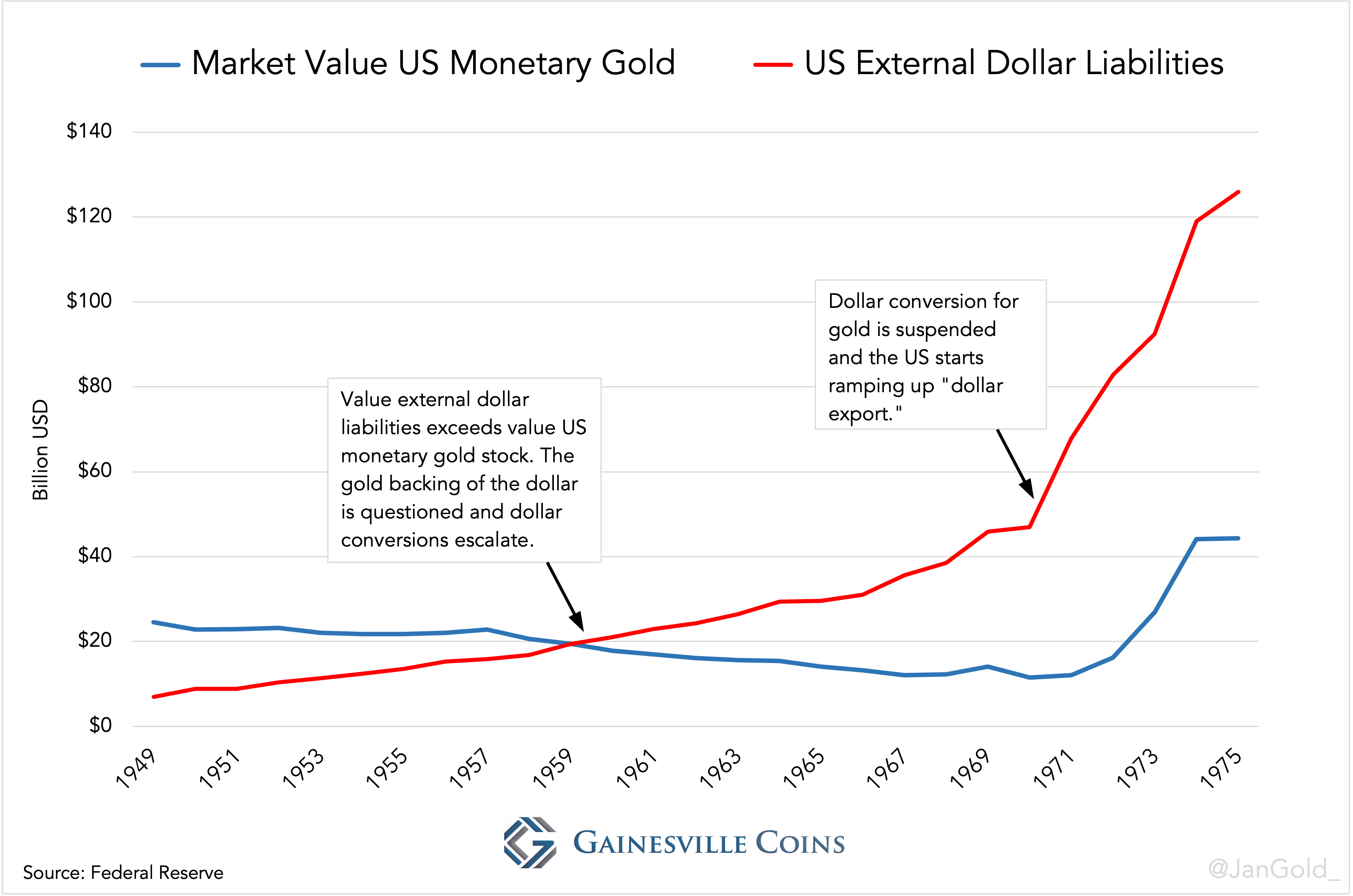

In the late 1950s the United States’ balance of payments deteriorated, resulting in a buildup of dollar balances held abroad, and, as central banks could convert dollars into gold, a decline of the US’s monetary gold stock. At first an increase in the supply of dollars abroad was welcomed because it inflated international liquidity beyond the growth of gold supply. Though, in 1960 the United States’ external dollar liabilities exceeded its monetary gold holdings, which prompted global concern. A run on the dollar could coerce a devaluation or default of the US.

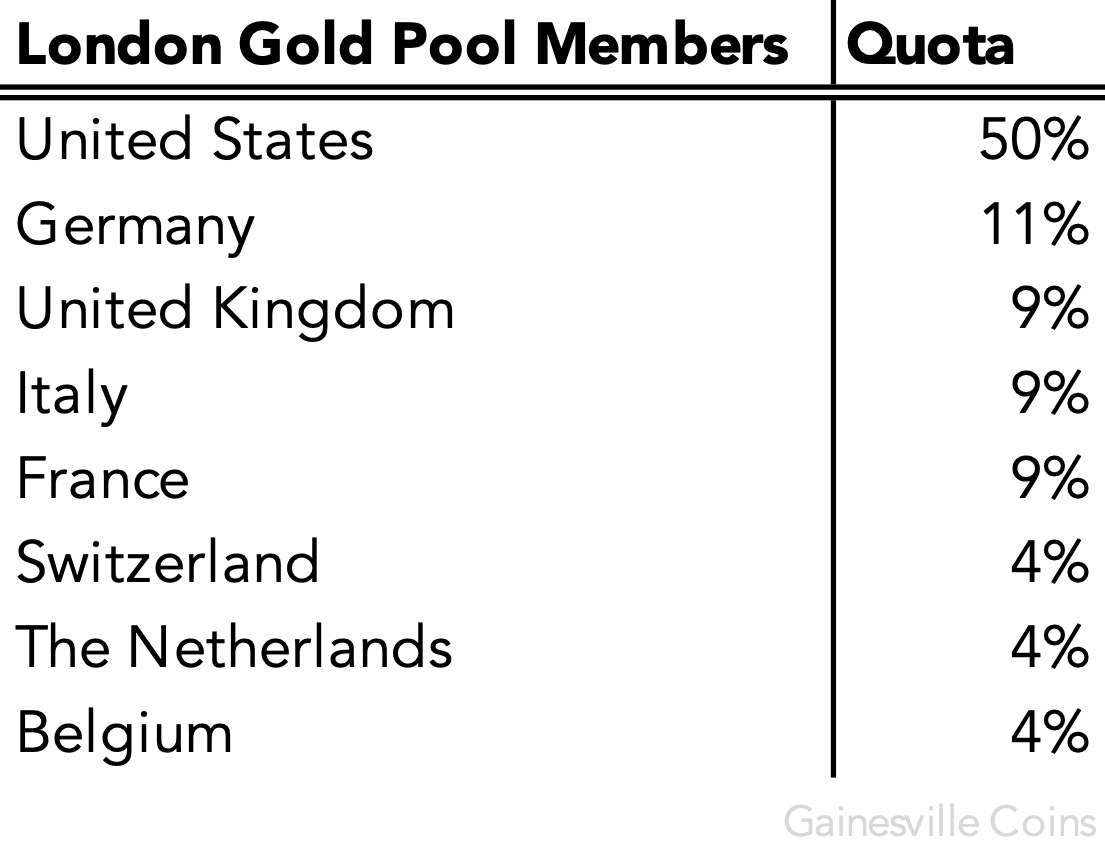

In November 1961, President of the Federal Reserve Bank of New York, Alfred Hayes, presented a plan at the Bank for International Settlements (BIS) in Bazel, Switzerland, to collectively defend the price of gold at $35 dollars an ounce in the free market (Bordo et al 2017). European central banks assented to form a Gold Pool with the US—buying and selling gold in the London Bullion Market to keep the free market price close to the official price—and protect the international monetary system from disintegrating. France accepted to join on the condition the US would restore its balance of payments deficit (Avaro 2022).

Although the new club started as a secretive syndicate, it didn’t take long before the Pool’s operations were leaked to the press to amplify its impact. On March 8, 1962, the Pool was first covered by Le Courrier de Genève (Bordo et al 2017, Naef 2022). Creating public awareness likely worked in its maiden years of existence when the Pool was a net buyer of gold. But as the US started printing more money to finance the war in Vietnam throughout the 1960s, downward pressure on the dollar mounted. The Pool was challenged in its bluff selling gold.

In February 1965, the President of France, Charles de Gaulle, gave a speech in which he conveyed his criticism of Bretton Woods and America’s “exorbitant privilege”: to the extent countries were willing to hold dollars in reserve, the US could print dollars out of thin air to pay for imports and make investments abroad. In reality, Bretton Woods was designed for the world to accumulate dollars. Additionally, the inflationary policies of the US in the late 1960s were exported abroad through its balance of payments deficit and fixed exchange rates, pushing foreign central banks to buy dollars with their printing presses (Dibooglu 1999, Bordo et al 2017).

According to De Gaulle, international settlement should be done in gold and the use of reserve currencies had to be limited. De Gaulle and his economic advisors foresaw a dollar crisis advancing. To protect itself from devaluation France ramped up dollar conversions into gold at the Fed, in part to supply the Pool.

Shortly after, Belgium and France expressed their doubts about the viability of the Pool at BIS meetings (Bordo et al 2017). European central banks didn’t want to defend the dollar-gold peg indefinitely for what was essentially a problem of the United States. France dropped out in June 1967 when the Pool’s resources needed to be increased (Avaro 2020).

In November 1967, Great Britain was forced to devalue pound sterling. If sterling could fail, so could the dollar, the market reckoned. Slowly but surely things started spiraling out of control and the Pool was confronted with significant losses. “The gold markets were faced with numerous bouts of speculative buying in late 1967 and early 1968,” the Federal Reserve Bank of Dallas remarks in its 1968 annual statement. From March 8 through 14, 1968, the Pool sold nearly 1,000 tonnes of gold. “US air force planes rushed more and more Fort Knox gold to London, and so much piled up in the Bank of England’s weighing room that the floor collapsed,” writes Timothy Green in The New World of Gold.

Belgium and Italy also became anxious to opt out as their gold reserves contracted (Green 1973 135). It became senseless to sell gold into a black hole. The next day, on March 15, 1968, the London Bullion Market was closed for two weeks at the behest of the US. Quickly the central bankers of the Pool flew to Washington for a conference.

A prominent person at that time was Jelle Zijlstra, President of the Dutch central bank and Chairman of the BIS from 1967 until 1981. Zijlstra writes the Europeans had a different interpretation than the US from the agreements reached in Washington (Zijlstra 1978 191):

The Washington conference of March 1968, … gave rise to many difficulties afterwards, because almost from the outset the decisions taken there were interpreted in two very different ways. Some countries were of the opinion that the only decision taken in Washington was to abolish the gold pool, to stop gold sales by central banks in the free market in order to keep the free market gold price close to the official price. The Americans took the position that it had also been decided that the central banks would never again buy gold on the free market, or in other words, that a first step had been taken towards the removal of gold from the international monetary system, the so-called demonetization of gold.

Read More @ GainesvilleCoins.com