by Pam Martens and Russ Martens, Wall St On Parade:

David Solomon, Chairman and CEO of Goldman Sachs, let it slip out at yesterday’s Senate Banking hearing what is really driving the mega banks’ backlash against federal banking regulators’ proposal to raise capital requirements at banks with more than $100 billion in total consolidated assets. (Community banks would not be impacted by the proposed capital increases.)

Solomon responded as follows to a question on the proposed new rules, attempting to justify how the trillions of dollars in derivatives his firm is holding inside its federally insured and taxpayer-backstopped commercial bank, Goldman Sachs Bank USA, is helping the country and that raising capital requirements on those trades would raise costs to consumers:

TRUTH LIVES on at https://sgtreport.tv/

“You can look at airlines hedging jet fuel; you wanna look at other derivatives, which obviously gets passed on to consumers; you can look at gas being hedged in utilities, which obviously gets passed on to consumers; and then you can look at other transactions. There’s a provision under the rule called SFT, which allows institutions like ours to borrow securities from pension plans and give them cash. That increases their returns and allows them to use their assets to increase their returns. Capital would increase by eight times for those types of transactions, which would make them unattractive and would therefore diminish the ability of pensions to access that tool to increase their returns.”

This one paragraph above goes to the heart of why these mega banks on Wall Street have launched one of the fiercest lobbying campaigns in their history – including attack ads on television – to stop these rules from taking effect. It’s all about derivatives, short sales, and dangerous trading activities taking place – not in the firm’s broker dealer or investment bank but in the federally-insured commercial banks they are allowed to own, which are backstopped by the American taxpayer.

Goldman’s Solomon makes it sound like his firm’s only involvement in derivatives is to help its business customers hedge legitimate risks, but Goldman itself is taking huge risks in derivatives for its own trading book and housing those derivatives in its federally-insured bank. As for Goldman paying pensions cash to borrow their securities, those securities are highly likely being used to loan out those securities to Goldman’s hedge fund clients in order for them to engage in shorting the market.

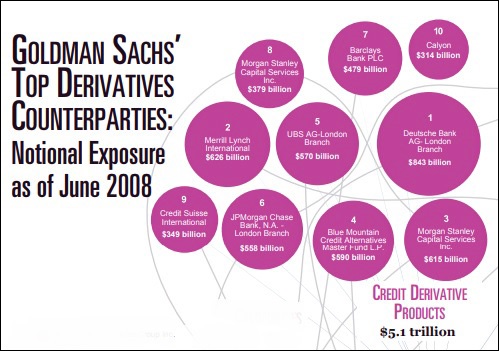

For the derivatives condition Goldman Sachs was in at the time of the 2008 financial crash, the chart below from the Financial Crisis Inquiry Commission puts to rest the idea that bank examiners or internal risk managers are capable of overseeing the safety and soundness of casino banks.

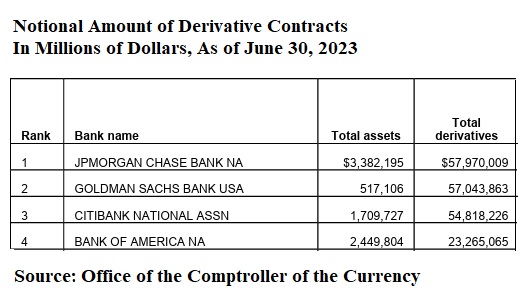

Consider what those bank examiners and internal risk officers have allowed to build up at the federally-insured Goldman Sachs Bank USA today. According to the Office of the Comptroller of the Currency (OCC), the regulator of national banks, as of June 30 of this year, Goldman Sachs Bank USA has $517 billion in assets and $57 trillion in notional (face amount) derivatives, with risk-based capital of just $55.9 billion. (See Table 16 in the OCC report.)

Per the chart below from the OCC, just four banks held $193 trillion in derivatives as of June 30, or 87 percent of the total derivatives held by all commercial banks in the United States. If there is any better definition of insane concentration of risk, we don’t know what it is.

That $57 trillion in notional derivatives at Goldman Sachs today is $4 trillion more than the $53 trillion it held in June of 2008 – when it and much of Wall Street blew up. According to a Fed audit released in July of 2011, from 2007 through at least July of 2010, Goldman Sachs received $814 billion in cumulative loans from the Fed, much of which were at below-market interest rates of less than 1 percent. In addition, it received an injection of $10 billion in capital from the taxpayer under the Troubled Asset Relief Program (TARP) – despite knowledge that it had engaged in multiple frauds in the leadup to the crisis. (See here and here.)

In short, these Wall Street mega banks want to completely erase the line between a deposit-taking federally-insured bank and the trading casinos they run on Wall Street. This was the status of things at the time of the 1929 stock market crash, which erased 90 percent of the value of the stock market over the ensuing three years. It also brought on the Great Depression, the largest economic downturn in U.S. history, and the closure of thousands of insolvent banks. Because there was no federal deposit insurance in 1929, millions of Americans lost all the money they had in their bank or got back pennies on the dollar.

Read More @ WallStOnParade.com