by Craig Hemke, Sprott Money:

It has been a grueling five-month downtrend for COMEX gold and silver prices, and the charts suggest that, once again, prices are at an inflection point and near a breakout. Can both metals rally and extend from here or is this just another lower high amidst the downtrend?

TRUTH LIVES on at https://sgtreport.tv/

The first thing to understand about this current bounce in price is that it is due, in part, to a safe-haven bid given the ongoing and worsening hostilities in the Middle East. Rallies in price based upon geopolitical stress are often short-lived and rarely do they have staying power. Understand this first and foremost before we proceed.

However, this current bounce in price is not entirely based upon geopolitics. There are two other important factors in play that are driving prices higher and, as such, give hope that the current downtrends may finally be broken.

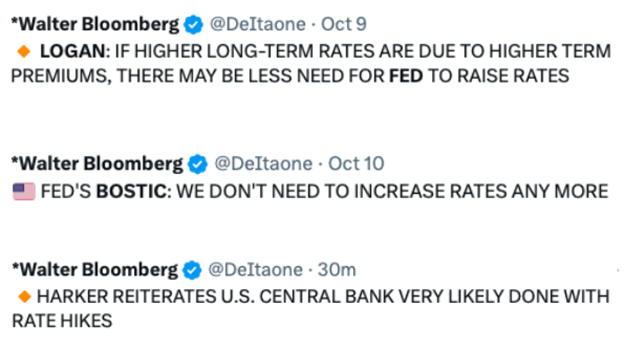

First, the past ten days have brought a change in perception regarding the future of fed funds rate hikes. Following the September FOMC meeting, it was generally accepted that the Fed was set to hike the fed funds rate one more time in 2023 before pausing and holding into 2024. This led to a sharp selloff in both COMEX metals as gold fell for nine consecutive days in late September, for a total loss of about $140. Over the same period, COMEX silver fell, too, for a loss of $2.80.

Last week, however, the tone of the “Fed speak” began to change due to geopolitics and a string of economic datapoints that indicated that the U.S. economy had continued to slow. As such, the fed funds futures market is beginning to predict that there will be no more rate hikes, and the timing of the first fed funds rate cut has been moved forward as well.

Between the geopolitics and the shift in tone from the Fed, there’s reason to believe that this current move higher is not just a bounce. Instead, it may be the trend change we’ve been waiting for since prices first began heading south back in May.

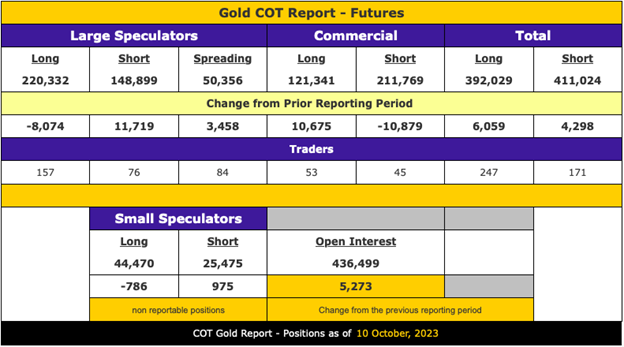

But there’s one more item that suggests the lows are in and that the trend toward higher prices has begun. If you’re a follower of the COMEX precious metals markets, you likely already know a thing or two about market positioning. Just watch the weekly Commitment of Traders (CoT) reports long enough and you’ll notice that price peaks often follow periods where the speculating hedge funds have moved heavily net long. Conversely, price lows often follow periods where these same funds reduce their net long positions or even move net short.

The most recent Commitment of Traders report was surveyed on Tuesday, October 10 and released last Friday, October 13. What did it reveal? Over the course of the reporting week, the Large Speculators (hedge and trading funds) in COMEX gold had reduced their net long position to just 71,433 contracts. At first glance, that may seem like a lot, but back in early May and before this current downtrend began, these same Large Speculators were net long 195,814 contracts. Doing the math, the downtrend in price has already reduced this Large Spec position by about 63%.

Additionally, at 71,433 contracts, the Large Speculators currently hold their smallest net long position since the price lows of December 2018 and November 2022. What price moves followed those net positioning lows? COMEX gold rallied nearly 40% in the first eight months of 2019 and 30% in the first five months of 2023.