by Jim Quinn, The Burning Platform:

So it begins. As we’ve seen in the Big Short movie/book, the timing of financial implosions is always difficult to predict, but the inevitable outcome of loaning money to people who can’t or won’t pay you back ALWAYS results in a financial crash/crisis. It has begun. First subprime auto loans. Next subprime credit card loans. Next subprime mortgage loans. Next prime auto loans. Next prime credit card borrowers. Next supposedly prime mortgage borrowers who weren’t really prime.

TRUTH LIVES on at https://sgtreport.tv/

Commercial property loans are already bad. They are just extending and pretending, until they can’t. The government is the biggest subprime borrower in the history of the world, as the national debt approaches $34 trillion, up about $1 trillion in a month. And that isn’t taking into account the $200 trillion of unfunded promises which will be defaulted upon, because of math. The shit is hitting the fan and you need to duck.

Subprime Auto Loan Delinquency Erupts, Reaching Highest Rate On Record

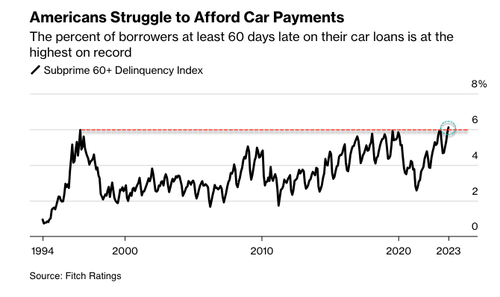

We have been dutifully tracking the auto sector, considered a leading economic indicator, to pinpoint the arrival of the crushing auto loan crisis and even the possibility of the onset of the next recession. In late January, we cited data from Fitch that revealed consumers are falling behind on auto payments – the most since the peak of the Great Financial Crisis. Fast forward nine months later, to September, that rate just hit the highest level in nearly three decades.

In what could be the beginning innings of the auto loan crisis, something we called a “perfect storm” earlier this year, Bloomberg cites new Fitch data:

The percent of subprime auto borrowers at least 60 days past due on their loans rose to 6.11% in September, the highest in data going back to 1994, according to Fitch Ratings.

“The subprime borrower is getting squeezed,” said Margaret Rowe, senior director with Fitch.

Rowe said, “They can often be a first line of where we start to see the negative effects of macroeconomic headwinds.”

What has been widely known is the consumer has been funding car purchases with even more debt to afford record-high prices, with many monthly payments exceeding $1,000. Factor in the Federal Reserve’s most aggressive interest rate hiking cycle in a generation, elevated inflation, and the restarting of the federal student loan payments, tens of millions of consumers are under immense pressure this fall.

An endless stream of retailers, such as Walmart, Nordstrom, Macy’s, and Kohl’s – all of whom have recently warned about a consumer slowdown. Banks have also raised concerns, such as Morgan Stanley’s Mike Wilson, who believes the consumer is ‘falling off a cliff.’ And the latest high-frequency data from Barclays shows card spending has taken another leg down.

Read More @ TheBurningPlatform.com