by Dr. Joseph Mercola, Mercola:

STORY AT-A-GLANCE

- In mid-July 2023, JP Morgan Chase Bank canceled all my business bank accounts, along with the personal accounts of our CEO, CFO and their respective spouses and children

- Over the past three-plus years, countless people and organizations have been cut off from online payment services and banking services for their views alone. What makes our current case unique is that Chase is expanding the punishment to key employees of my business and their families — people who literally have nothing do to with me

TRUTH LIVES on at https://sgtreport.tv/

- What we’re seeing is the weaponization of finance, where people whose views or actions go against the official narrative are cut off from basic financial services. This is the social credit system at work and, soon, it will be used against everyone

- The debanking of employees and their families is a social credit system tactic to make people start policing each other by punishing associations. This creates discord and distrust, and forces people to turn on each other for self-preservation

- May 2, 2023, Florida Gov. Ron DeSantis signed legislation that prohibits financial institutions from denying or canceling services based on political or religious beliefs. However, this law has never been invoked before, so there’s no procedure in place to enforce it. We’re hoping the attorney general will sort that out. Essentially, we’re the test case to determine whether the governor’s new law has teeth or not

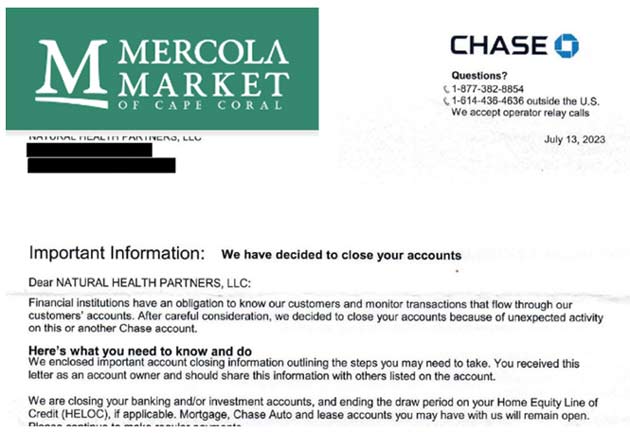

As I reported last week, in mid-July 2023, JP Morgan Chase Bank canceled all Mercola Market bank accounts, along with the personal accounts of our CEO, CFO and their respective spouses and children.1 All received identical letters in which no reason for the decision was given, other that there was “unexpected activity” on an unspecified account.

Cruel and Unusual

My CFO, Amalia Legaspi, whose Chase accounts — including a joint account with her husband — were closed along with mine, is now struggling to figure out how to pay for her husband’s health care in the Philippines.2

He’s bedridden with dementia and his pension and medical expenses rely on this account. It will be exceedingly challenging for her to correct this matter under the current circumstances as red tape prevents her from opening another bank account in his name.

I realize my opinions regarding COVID differ significantly from those of Chase CEO Jamie Dimon, but there is no reason to punish my employees and their families. What they’re doing is just inhumane and wrong on so many levels.

The Worldwide Weaponization of Finance

What we’re seeing is the weaponization of finance, where people whose views or actions go against the official narrative are cut off from basic financial services. This is the social credit system at work and, soon, it will be used against everyone.

Over the past three-plus years, countless people and organizations have been cut off from online payment services and banking services merely for their views.

In January 2022, natural health organizations, antiwar journalists, Christian organizations, anti-child-grooming organizations, nonprofits fighting vaccine mandates, organizations promoting early COVID treatments, alternative media and free speech unions had their Paypal accounts canceled without warning.

In February 2022, the Canadian government froze the bank accounts of more than 200 people for the crime of donating to anti-mandate protests,3,4 and the following month, Russian banks were excluded from the SWIFT system (the Society for Worldwide Interbank Financial Telecommunication). Russians living across the world were also debanked for nothing more than their names and national origin.5

Just last month, Nigel Farage, the British politician who started the Brexit movement, was also debanked for his political views. Initially, Coutts Bank (which is part of the NatWest Group) said his account was closed because his balance had fallen below the minimum required for eligibility, but subsequent revelations have shown this to be untrue, and NatWest CEO Alison Rose resigned once the lie became apparent.6