by Craig Hemke, Sprott Money:

We’re not quite through the first half of 2023, but just for fun, let’s take a stab at what we might expect to occur in the second half, at least as it pertains to gold and silver prices.

It’s early June, and the next FOMC meeting is one week away. Will the Fed hike the fed funds rate another 25 basis points or will they pause and take time to assess the economic damage that has already been done? We can’t know the answer to that question, but whether they do or whether they don’t, the forecast for the remainder of 2023 will remain the same.

TRUTH LIVES on at https://sgtreport.tv/

To that end, I suppose we should start with a recap of our annual forecast that was written and published back in early January. If you missed it or need a refresher, here’s a link:

The central premise of this year’s “macrocast” is that the year 2023 should play out in a manner similar to 2010 and 2019. Both of those years began like 2023 in that the same monetary policy of higher interest rates and quantitative tightening was being gleefully touted by Wall Street economists and financial media.

However, in both 2010 and 2019, a funny thing happened on the way to balance sheet and interest rate “normalization”. The U.S. economy began to falter, and as overall liquidity began to contract, the Fed was quick to flip course back to lower interest rates and/or quantitative easing. It was quite simple to deduce that when economic push came to shove, the Fed would err on the side of “keeping the plates spinning” at the sake of “credibility”.

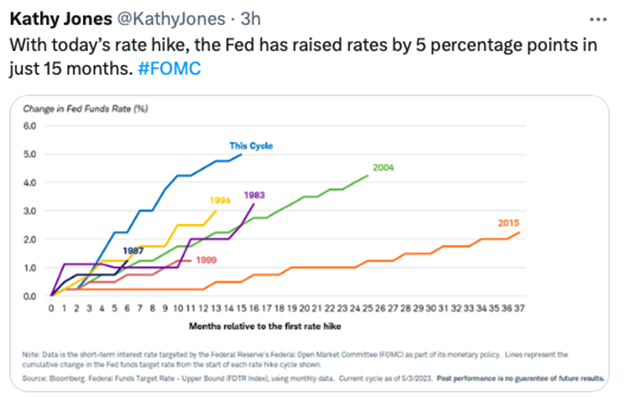

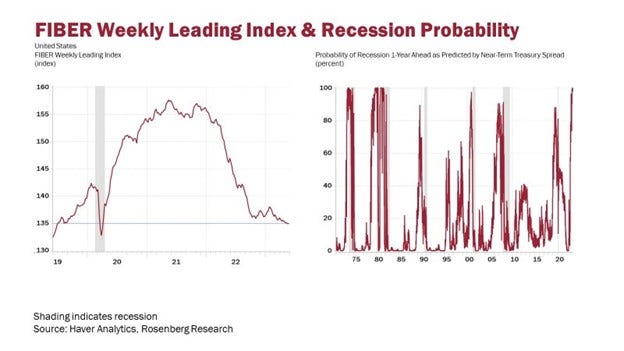

And now here we are in 2023. The year began with the same central bank rhetoric, but after 18 months of the most extreme pace of rate hikes the Fed has ever pursued, the U.S. economy is quite clearly teetering. Oh sure, you can take your statistical nonsense of the monthly jobs report and claim to see a “soft landing”. But, in doing so, you must choose to ignore all of the other datapoints that suggest recession is either imminent or already begun.

Next week brings the June FOMC meeting, Powell press conference, and latest Summary of Economic Projections. Will it also bring another 25 basis point fed funds rate hike? Maybe? Maybe not? Does it even matter? No.

With the U.S. economy demonstrably slowing, with financial stresses worsening in the banking sector, and with the pending election year of 2024, it is utterly predictable that the Fed will soon pause and then pivot to cutting rates before the year is out. On what type of schedule might all of this unfold? Well, first keep in mind that the average length of time historically between the last rate hike and the first rate cut is less than 90 days. Taking that into account, we get this:

- June 13-14 FOMC: 50/50 chance of one last rate hike

- July 25-26 FOMC: no rate hike

- August 26 Jackson Hole: Powell lays out new inflation target, suggests that the rate hike cycle is finished, with rate cuts now possible

- September 19-20 FOMC: your first fed funds rate cut

- December 12-13 FOMC: your second fed funds rate cut

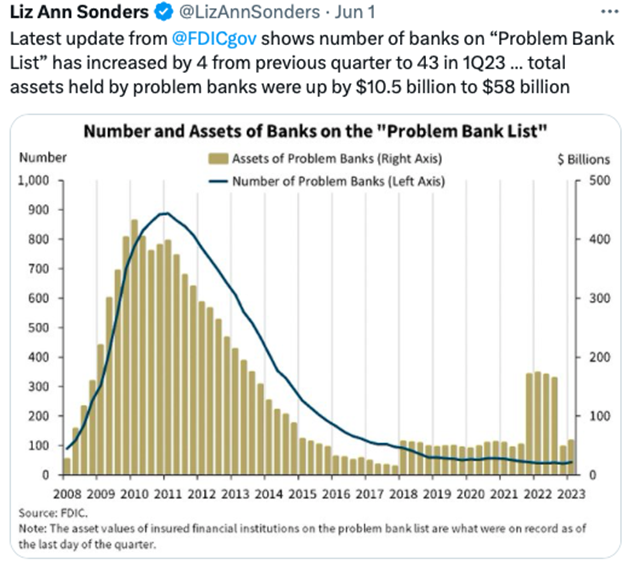

Now that’s just a guess based upon what we know as of today. What we can’t predict is war, famine, disease, or just plain old bank failures. By the way, did you know that the number of banks on the FDIC’s list of “problem banks” increased from 4 to 43 in just the first quarter of this year? You didn’t? You mean that didn’t get much press coverage when the report was issued last week? Hmmm, well, in case you missed it…

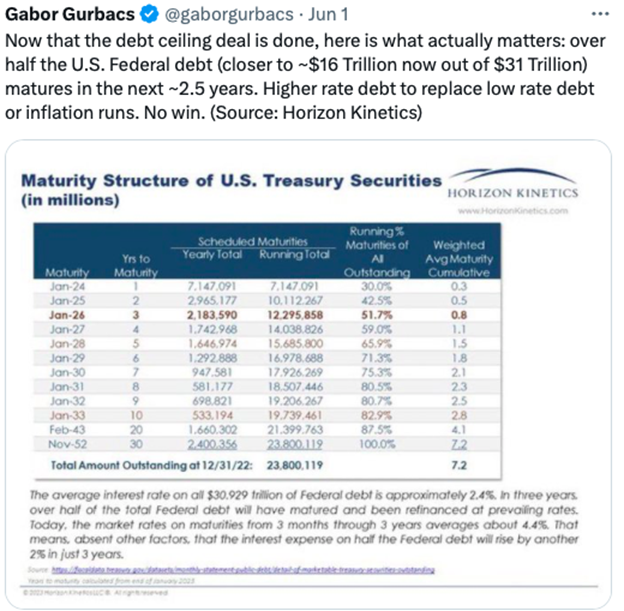

And one more thing about this so-called “responsible” Fed. What are they going to do when $24T of the total $32T national debt matures and needs to be refunded/reissued over the next three years? Are they just going to keep hiking rates to 6% and beyond, thereby forcing the interest cost of servicing that existing debt to soar toward $2T annually? Of course not. So again, interest rates will be coming down and lower rates will, eventually, be forced upon the treasury market through tactics like Yield Curve Control. Of that you can be certain.

Circling back to the beginning, what does all of this mean for gold and silver prices in the back half of 2023? We wrote in January that precious metal enthusiasts should expect to endure mostly sideways price action through the first half of the year, and that’s exactly what has transpired. As of today, COMEX gold is up about 8% YTD but COMEX silver is only up 2%. Reminders are posted below, however. Check the price action of COMEX gold in the first half of 2010, the first half of 2019, and the first half of 2023. Do these charts look somewhat familiar?