by Brian Shilhavy, Health Impact News:

It appears that the Biden Administration is abandoning their rhetoric that “the banking system is fine.”

CNN reported today that Treasury Secretary Janet Yellen met with CEOs of large banks yesterday and told them that “more bank mergers may be necessary.”

New York (CNN) — During Thursday’s meeting with the CEOs of large banks, Treasury Secretary Janet Yellen told executives that more bank mergers may be necessary as the industry continues to navigate through a crisis, two people familiar with the matter told CNN.

The comments from Yellen provide further evidence that Biden officials are starting to warm up to the idea of bank mergers despite concerns from progressives and the administration’s own scrutiny of corporate concentration. (Source.)

Her statements killed a stock rally this week that saw the stocks of regional banks increase 10%, in one of their best weeks since 2020.

TRUTH LIVES on at https://sgtreport.tv/

Not anymore.

As ZeroHedge News reported today, reports show that $billions of losses in deposits at U.S. banks have occurred in the past two weeks, with over $70 billion lost in large US Commercial Banks.

After yesterday’s continuing surge on flows INTO money market funds and increase in the use of The Fed’s bank bailout facilities, expectations were for more deposit outflows from US commercial banks (despite Western Alliance’s comments which sparked a melt-up in regional bank shares this week.

However, Treasury Secretary Yellen spoiled the party somewhat today by warning (reportedly) that the market should expect ‘more bank mergers’ (i.e. failures)…

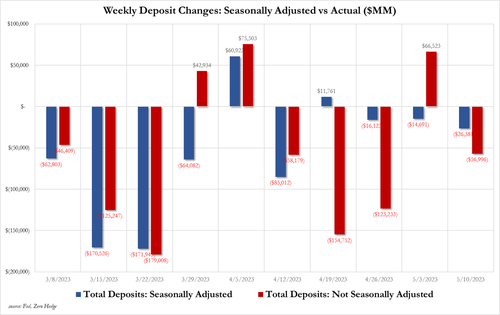

And so, according to the latest H8 report from The Fed, on a seasonally-adjusted basis, total US Commercial Bank deposits fell by $26.4 billion during the week ended 5/10 – the third straight week…

Source: Bloomberg

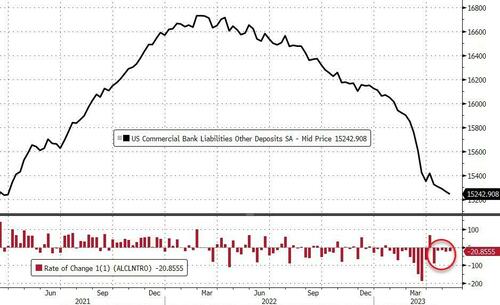

On a seasonally adjusted basis, US commercial bank deposits (ex-large time deposits) decreased $20.8bn last week (during the week-ending 5/10), for the fifth straight weekly outflow. That is the lowest since March 2021…

Source: Bloomberg

On a non-seasonally-adjusted basis, US commercial bank deposits (ex-large time deposits) dropped $50.26 billion (after jumping $63.8 billion) the prior week.

And judging by yesterday’s money market inflows, the deposit outflows continued this week (remember, deposit data is lagged a week to money market and Fed balance sheet data), despite reassurances from WAL…

Source: Bloomberg

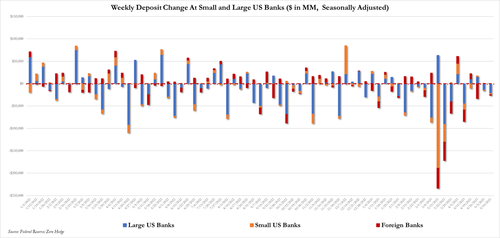

On a seasonally-adjusted basis (ex large time deposits), Large, Small, and Foreign banks all saw outflows last week. Small bank deposits are at their lowest since May 2021…

Source: Bloomberg

This is the 5th straight week of Small Bank outflows and Small Banks saw the largest outflows…

- Large Banks -$7.49 billion SA (-$36.5 billion NSA)

- Small Banks -$8.742 billion SA (-$12.5 billion NSA)

- Foreign Banks -$4.627 billion SA (-$1.2 billion NSA)

Source: Bloomberg

Including large time deposits, the breakdown is as follows:

- Large banks -$21.6BN

- Small banks -$2.7BN

- Foreign Banks -$2.1BN

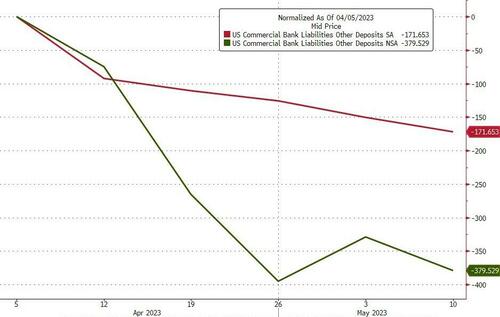

Finally, after adjusting for all the revisions (which are now an every week occurrence), what sticks out to us is that the last 5 weeks have seen $379 billion in NSA bank outflows, while SA the number is an outflow of only $171 billion.

Source: Bloomberg

So The Fed is claiming there are still over $200 billion in tax-payment related deposits expected to return to banks.

Source: Bloomberg

The Fed’s report showed residential real estate loans declined a seasonally adjusted $2.6 billion, while lending for commercial properties rose slightly. Consumer loans also ticked up from the prior week, while commercial and industrial loans fell $3.5 billion.

On the other side of the ledger, Commercial bank lending was little changed in the week ended May 10th, according to seasonally adjusted data. Large bank loans dropped $6.159 billion while Small Bank loans actually rose by $6.85 billion (despite significant deposit outflows)…

Read More @ HealthImpactNews.com