by Wolf Richter, Wolf Street:

In 2024, some banks will fail. In 2023, five banks failed. In 1989, over 500 banks failed. Since 1936, there were only 5 years without bank failures.

In 2024, some banks will fail. In 2023, five banks failed. In 1989, over 500 banks failed. Since 1936, there were only 5 years without bank failures.

The rate-cut-mania-inspired plunge in longer-term yields at the end of Q4, now partially reverse, had a salubrious effect on the balance sheets of commercial banks, according to the FDIC’s quarterly bank data released on Thursday.

TRUTH LIVES on at https://sgtreport.tv/

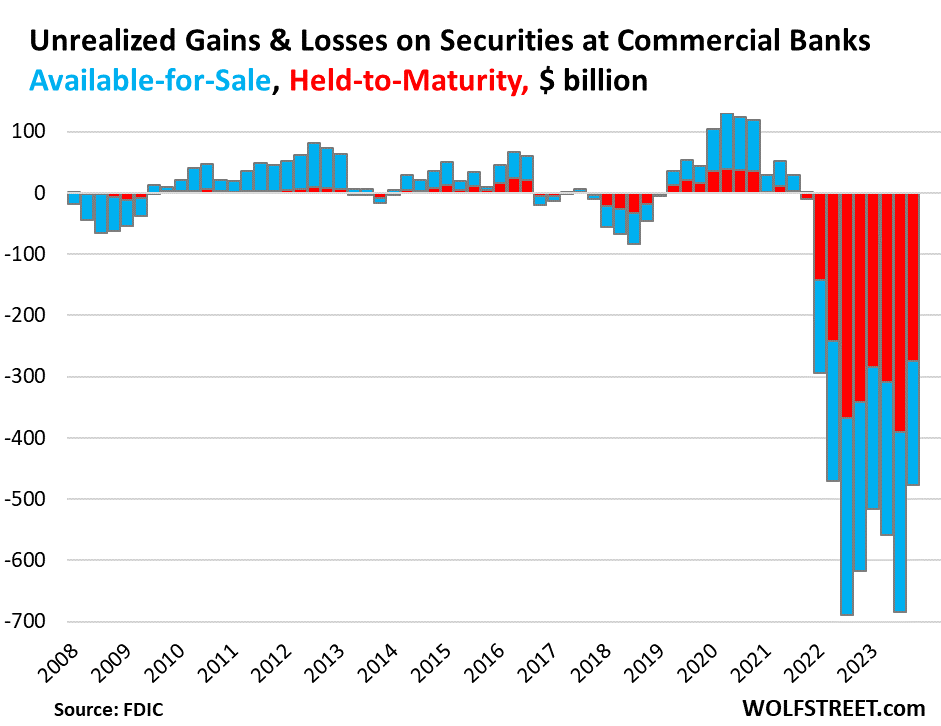

In Q4 2023, “unrealized losses” on securities fell by $206 billion (or by 30%) from the prior quarter, to a cumulative loss of $478 billion, or 8.8% of the $5.43 trillion in securities held by those banks. The securities are mostly Treasury securities and government-guaranteed MBS.

These unrealized losses were spread over the two accounting methods:

- HTM: Unrealized losses on the $2.50 trillion in held-to-maturity (HTM) securities fell by $116 billion from the prior quarter, to a cumulative loss of $274 billion (red in the chart below in total).

- AFS: Unrealized losses on the $2.93 trillion in available-for-sale (AFS) securities fell by $90 billion from the prior quarter to $204 billion (blue).

So as yields rose in 2022, the market prices of those securities fell, and record-breaking unrealized losses piled up, given the massive amounts of longer-term securities that banks had put on their balance sheet during the near-0% pandemic era.

At that time, the Fed printed trillions of dollars, part of which ended up as deposits in the banking system, and the banks, unhappy with T-bill yields of near 0%, plowed this cash into longer-term securities to get a yield that was more than 0%.

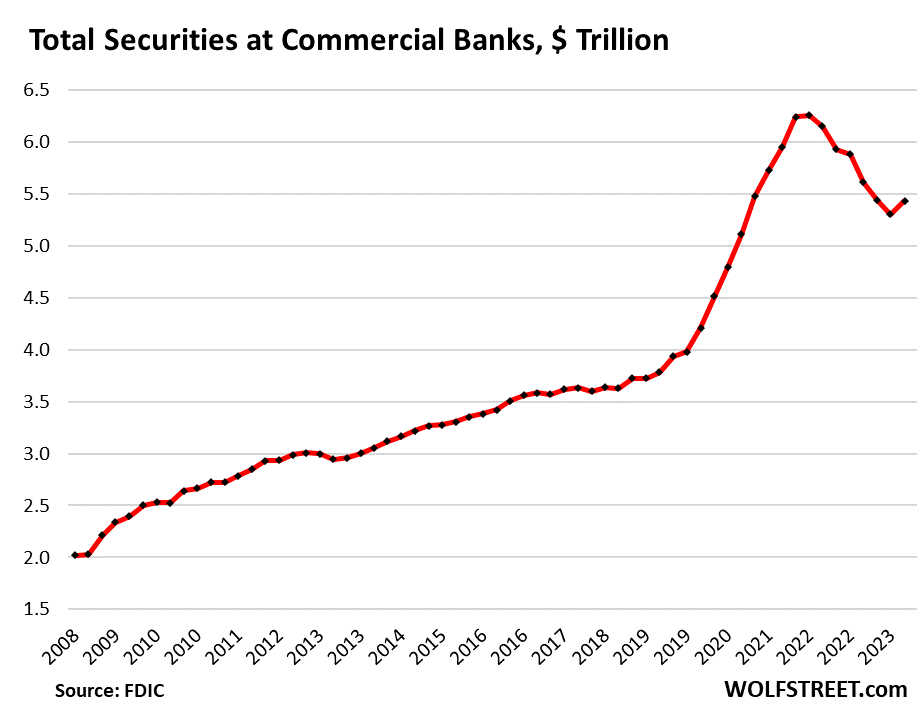

Total securities on bank balance sheets.

During the pandemic money-printing era, total securities held by banks soared by $2.5 trillion, or by 57%, to $6.2 trillion at the peak in Q1 2022.

By the end of 2023, the amount had dropped to $5.43 trillion, including the uptick in Q4. And the longer-term securities in this pile have lost a lot of market value. Several factors make up the decline, including:

- The portion of securities of the collapsed banks that the FDIC sold to non-banks are no longer part of it.

- Banks have written down AFS securities to market value.

- Some securities matured

- Banks may have sold some securities.

The $5.43 trillion in securities includes securities valued at market price and securities valued at purchase price.

Banks don’t have to mark these securities to market value, but can carry them at purchase price. The difference between market value and purchase price is the “unrealized gain or loss” that the bank must disclose in its quarterly financial filings.

In theory, “unrealized losses” on securities held by banks don’t matter because at maturity, whenever that may be, banks will be paid face value, and the unrealized loss diminishes as the security nears its maturity date, and goes to zero on the maturity date.