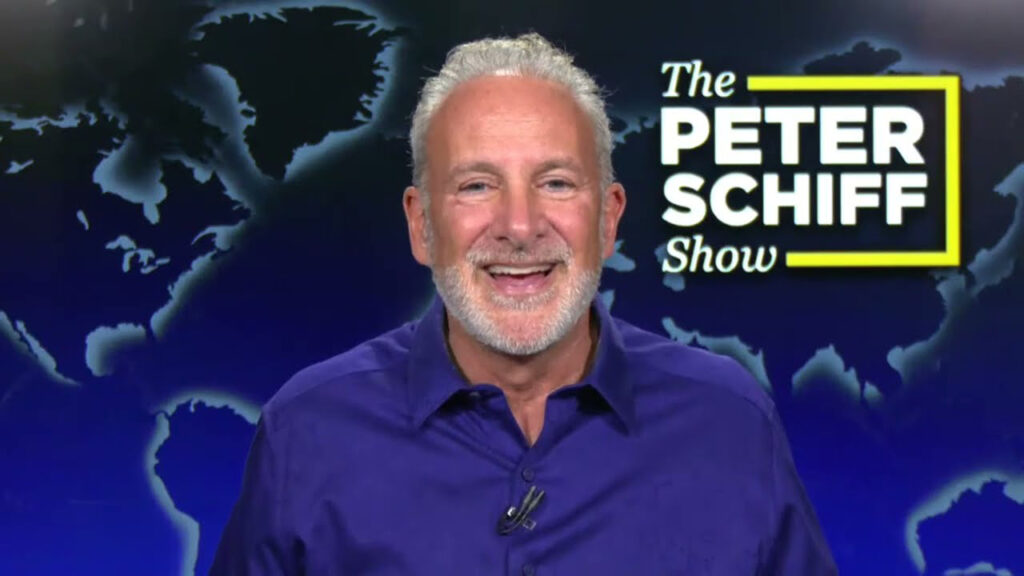

by Peter Schiff, Schiff Gold:

This week, Peter reacts to politicians’ sophomoric views on inflation and explains the recent surge in the price of gold. He also comments on the first day of Jerome Powell’s congressional testimony. Be sure to watch Peter’s special extra episode from earlier this week if you missed it.

Peter thinks the price of gold has finally broken free from resistance, and it’s going to keep rising. Because retail investors have been dumping gold recently, a retail sell-off is unlikely to bring gold below where it is now:

TRUTH LIVES on at https://sgtreport.tv/

“This rally is the first rally to new highs where the public is not participating. In fact, for weeks—actually months— leading up to the new high, the public was getting out of gold. … I think that’s a great contrarian indicator, and I think that’s a sign that this rally has legs, because normally the market peaks when you get a rush of buyers that come in. And now the market gets overbought, it gets saturated, and then there’s a correction.”

Even more promising for gold is the fact the central banks are increasing their purchases of the yellow metal, and they aren’t planning on selling it anytime soon:

“The central banks are the buyers, and they’ve got huge war chests of foreign currency reserves, plus they can print their own money and use that to buy gold. And I don’t think the central banks are that price sensitive. … They don’t want to run the price up, they want to buy it, but their goal is to have more gold, and their goal is not to sell any of this gold.”

If the retail sector stops selling and central banks keep buying gold, they’ll inevitably bid its price up even higher than it is today:

“The market is under supplied, and it’s about to run into a huge increase in demand. And what does that tell you? That means that the price of gold has a long way to go to catch up to clear that market. Gold is very undervalued right now, and it has been for some time, and that is the opportunity to buy it before it’s repriced to a realistic valuation.”

Pivoting to recent political news, Peter takes aim at Congresswoman Maxine Waters, who spuriously claims that housing prices cause inflation. Peter corrects her:

“Housing isn’t driving anything. Housing’s just gone along for the ride. The driver is Maxine Waters and her buddies in Congress. They’re driving the inflation bus, not housing. Housing’s just riding in the bus along with everything else. The driver of inflation is deficit spending and the money that the Federal Reserve prints to monetize that debt.”

Peter also responds to Congressman Brad Sherman, who mistakenly thinks the Fed’s inflation target of 2% should be revised upward. But, as Peter explains, when the 2% figure was decided on, it was supposed to be the upper limit of inflation in the United States: