by Richard (Rick) Mills, Silver Seek:

The world’s largest silver producer could mine all of its existing reserves within two years, throwing silver’s global supply-demand balance even further out of whack than it is currently.

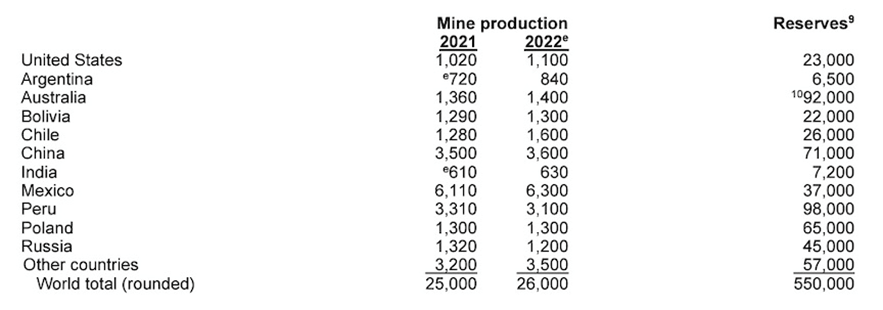

Mexico has regularly outputted 5,600 tons of white metal over the past 10 years, but has seen its reserves dwindle to just 37,000 tons. If mining continues at the current pace, Mexico’s silver reserves will be exhausted by the end of 2026, it was recently reported.

TRUTH LIVES on at https://sgtreport.tv/

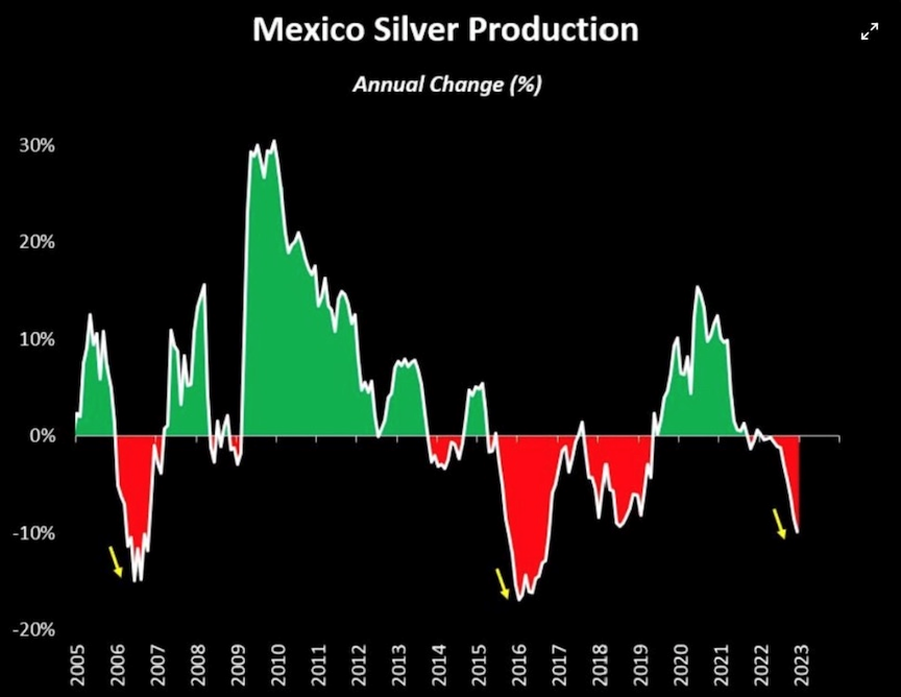

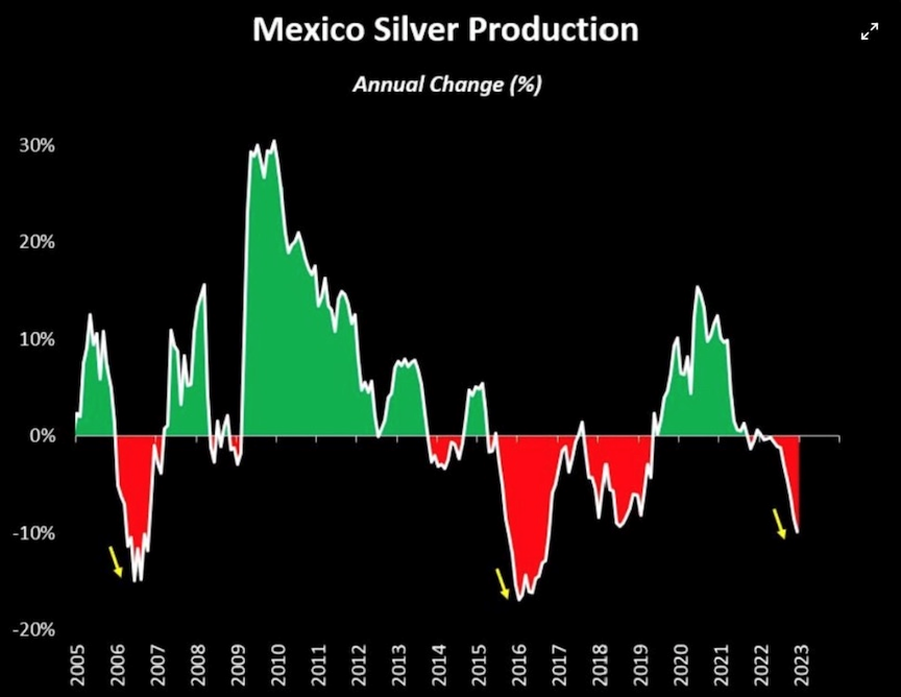

Silver production there is now declining double digits annually for the first time in almost a decade. This year, output is expected to fall by 16 million ounces because of the suspension of operations at Newmont’s Penasquito mine due to a strike. (The Silver Institute)

Source: Silver Academy

Source: Silver Academy

The country made headlines in 2022 when the government of President Andrés Manuel López Obrado nationalized the lithium industry.

According to Mining.com, The bill elevates lithium to the category of “strategic mineral”, declaring the exploration, exploitation, and use of lithium to be the exclusive right of the state. It also includes a clause allowing the state to take charge of “other minerals declared strategic” by Mexico…

Could silver be the next metal to be nationalized?

Since taking power in 2018, López Obrador has fought to reverse resource reforms under previous governments, which opened up the oil and electricity sectors to private investment. He has pushed a resource exploitation model that gives priority to state-controlled companies.

Last year, the Mexican government passed an overhaul of mining laws, including shorter concessions and tighter rules for permits. The reforms also reduced the length of mining concessions from 50 to 30 years. The earlier proposal was for 15 years.

Dan Dickson, the CEO of Endeavour Silver, a Canadian firm with two producing silver mines in Mexico, said the changes to concession terms would affect juniors’ ability to secure finance.

“We deplete our resources and need to make new discoveries to replace that supply. It will limit companies coming behind the operators to bring that additional supply on,” Dickson told the Financial Times.

The mining code changes also threaten to trigger a wave of litigation in Canada, where 70% of foreign mining companies operating in Mexico are based. Industry group Camimex has warned the legal reforms could jeopardize $9 billion of investment in the next two years.

According to the US Geological Survey, Mexico produced 6,300 tonnes of silver in 2022, against world number two China’s 3,600 tonnes, and third-place Peru’s 3,100t.

Source: USGS

Source: USGS

While Mexican production has nose-dived in the past, it’s never been in conjunction with China demand this large, Silver Academy notes:

Chinese demand is so intense because of the global bifurcation of trade; they are now buying raw ore, as well as concentrate directly from silver producing countries.(the same thing is happening to China’s copper — Rick)

This is in no small part because their own production is also drying up.

The website points out that Latin America is favoring labor and environmental activism, and recent trends in Peru, Chile and Panama that have shut down mines, including First Quantum Minerals’ massive Cobre Panama copper-gold-silver operation.