by Peter Schiff, Schiff Gold:

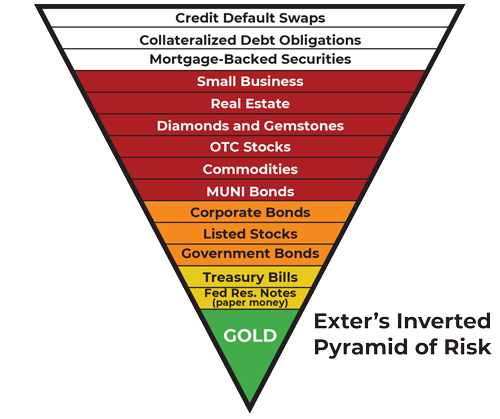

In the landscape of economic foresight, John Exter, a distinguished hard money advocate and former precious metals expert for The Fed, offers a model that resonates with the principles upheld here at SchiffGold. Developed in the 1970s, Exter’s Inverted Pyramid of Risk remains as relevant as ever, especially in assessing assets through the lens of counterparty risk. The pyramid serves as a guide to comprehend the risks facing America, particularly in anticipation of what may be the most severe credit crisis in the coming decade or two, centered around the USD crisis.

TRUTH LIVES on at https://sgtreport.tv/

We feature this in our “Why buy Gold” report under

the “Research and Analysis” section on SchiffGold.com

Exter’s Inverted Pyramid of Risk

Organized from the most illiquid and highest counterparty risk assets to the least risky and most liquid, the layers of the inverted pyramid provide a unique perspective that builds from the mindset of a counterparty-risk sensitive investor. A swift glance at the pyramid reveals that the removal of any assets on the lower end (the more narrow base), will lead to the downfall of everything associated with it on the higher end, akin to a collapsing Jenga tower.

- Derivatives and Unfunded Government Liabilities (White Top Layer):

- This top layer comprises assets marked by the utmost risk and volatility, encompassing derivatives such as options, CFDs, and futures. While these instruments arguably serve limited professional purposes like hedging and speculation, they are met with considerable skepticism. Any form of financial turbulence can not only wipe out a participant’s initial investment but also entail additional losses! Warren Buffett notably dubbed them ‘financial weapons of mass destruction.’ It’s prudent for most to never engage with derivative financial products, echoing the wisdom found in the proverb: “Can a man take fire to his chest and his clothes not be burned?’”

- Private Business Equity, Real Estate, and Non-Monetary Commodities (Red Layer): This layer includes genuinely productive assets and commodities for economic growth but given their relation to the credit markets they prove highly sensitive during a deflationary recession, as exemplified by the 2008 financial crisis. It emphasizes the vulnerability of these asset classes to the credit squeeze associated with what many refer to as the ‘business cycle,’ a phenomenon we contend is more influenced by central planning, specifically the ‘Fed cycle.’ Despite their inherent productivity, these assets remain susceptible to the capricious nature of centrally planned and interventionist policies and are some of the first to make headlines during a crisis.

- Blue Chip Stocks, Corporate Bonds, and Sovereign Government Bonds (Orange Layer): Positioned below are more conservative assets, appealing to long-term investors seeking yield beyond money market accounts and T-Bills. However, these assets are not immune to interest rate risks associated with Fed policy and are still susceptible to substantial losses during recession/depression.

- Federal Reserve Notes & Treasury Bills (Yellow Layer): Sought for stability, this is technically the first layer of what many call “risk-free” assets found in Federal Reserve notes and Treasuries. Even if one accepts this “risk-free” title (we do not), the solvency of the institutions holding these assets becomes a concern. ‘Great, I have cash holdings, but what if my bank ends up like Silicon Valley Bank?’ These are valid questions and will resurface during the next credit crisis coming as early as 2024.

- Physical Gold (Base Green Layer): At the foundational base of the pyramid, physical gold stands as the only liquid asset devoid of counterparty risks or credit risks! Aligned with the foundational principles of what money should be, gold’s immutability and resistance to defaults, bankruptcy, devaluation, or a plunge to zero make it unique as the last stand in financial collapse.

This model also unveils the flow of capital during economic phases.

In times of credit expansion, capital ascends the inverse pyramid into higher-risk, lower-liquidity assets. This occurs when investors see systemic economic safety and are comfortable taking on greater risks for higher returns. Note, that the broadening of the pyramid signifies the reusing of the same capital as collateral multiple times (e.g., fractional reserve banking, margin trading), contributing to an exponential amount of theoretical contracted capital found on the higher layers. This may sound astonishing, but the widely held belief is that the value of assets trading in the white layer derivative layer reaches into the quadrillions!