by Nick Giambruno, International Man:

Contrary to conventional wisdom, higher interest rates mean more inflation in the environment today.

That’s because the federal interest expense increases as interest rates rise.

As the federal interest expense rises, so does the budget deficit.

As the budget deficit increases, so does the currency debasement needed to finance it.

TRUTH LIVES on at https://sgtreport.tv/

Skyrocketing interest expense will have an enormous impact on the US budget.

Even according to the US government’s rosy projections, the interest expense on the federal debt will exceed $1 trillion for the first time in 2024… and it shows no sign of slowing down. On the contrary, it’s growing exponentially.

First, it’s essential to understand the basics of the US federal budget.

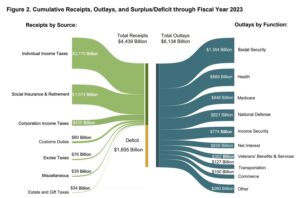

Let’s zoom out and look at the largest components of the US federal budget from the latest available data in the chart below. (Click image to enlarge.)

The biggest expenditures for the US government are so-called entitlements. It’s not likely any politician will cut these. On the contrary, I expect them to continue to grow.

With the most precarious geopolitical situation since World War 2, so-called “National Defense” seems unlikely to be cut. Instead, military spending is all but certain to increase.

Income Security is a catch-all category for different types of welfare. That’s unlikely to be cut too.

Unless it becomes politically acceptable to cut things like Social Security, military spending, and welfare, efforts to make a dent in expenditures won’t be meaningful.

Further, interest expense (Net Interest above) is set to explode higher.

The US government projects that the federal interest expense will exceed $1 trillion in 2024 for the first time. That means the interest expense will exceed defense and everything else in the budget except for Social Security, which it will also likely exceed soon.

As the cost of debt service is taking up a larger portion of the budget, there is less for other expenditures. That means the government has to borrow increasingly larger amounts to maintain basic functions.

However, it’s worse than issuing more debt to cover Social Security and the military.

The US government is now borrowing money to pay interest on the federal debt, which has a compounding effect as the federal debt and interest expense grow exponentially.

I suspect we are close to the inflection point where it gets out of control. 2024 could be the year that it becomes evident the US is trapped in a debt spiral.

Here’s the bottom line with the budget.

The most significant expenditures have nowhere to go but up.

But don’t count on increased revenue to offset these increases. Even if tax rates went to 100%, it would not be enough to stop the deficits—and the debt needed to finance them—from growing.

Read More @ InternationalMan.com