by Ronan Manly, BullionStar:

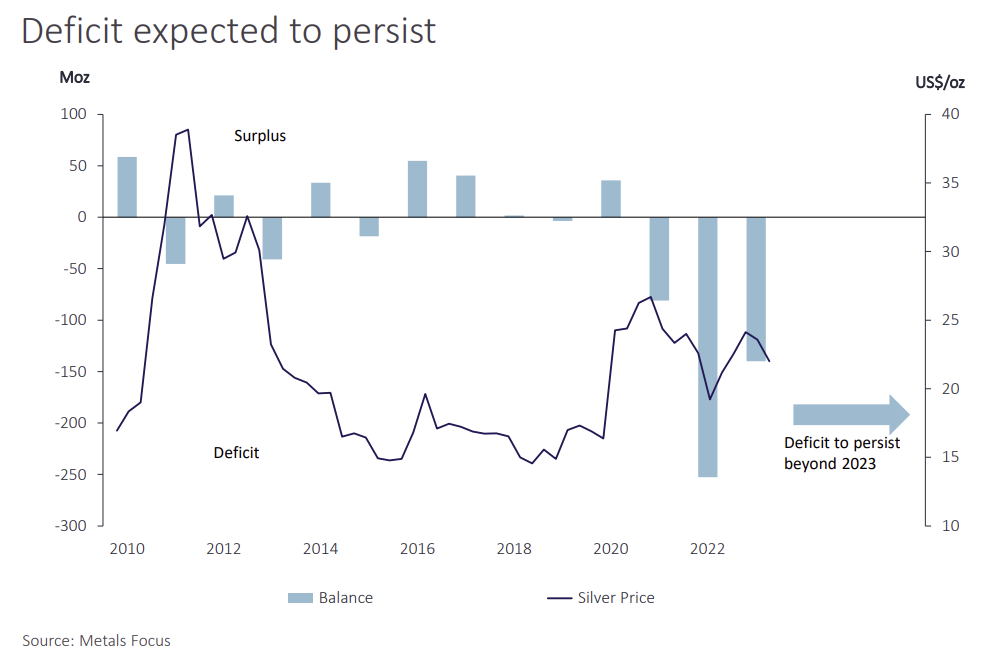

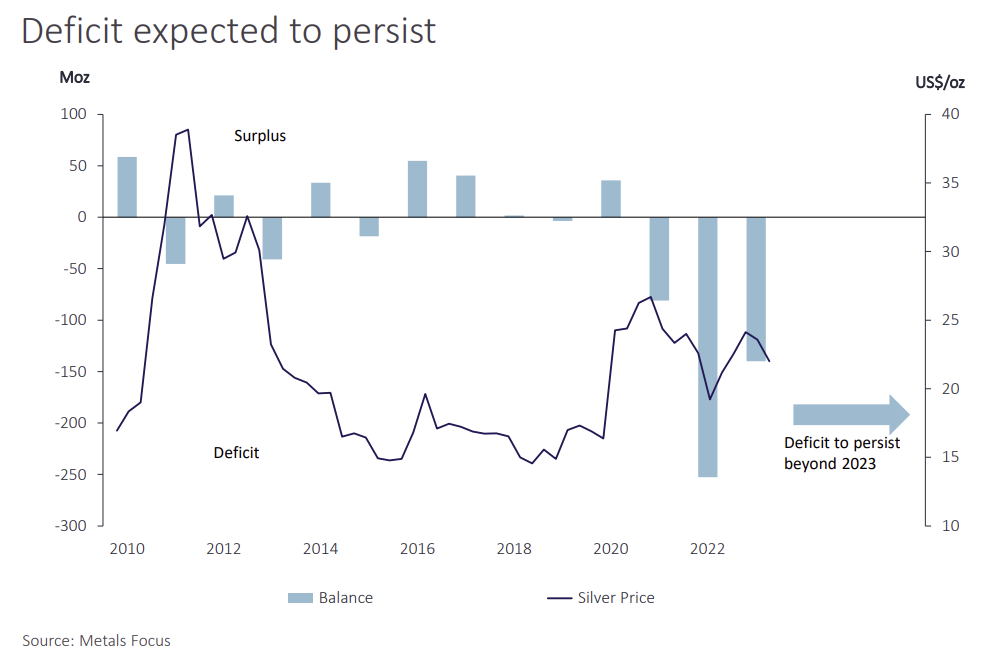

There has been a significant imbalance in the physical silver market for the last 3 years with annual silver demand exceeding annual silver supply.

This is a problem since when silver demand is greater than silver supply, the extra demand (deficit) must be met by eating into the world’s finite and limited above-ground silver stockpiles.

This silver deficit has been so persistent and systemic that it is being described by the Silver Institute as a ‘structural deficit’ i.e. a prolonged deficit that is due to underlying ‘structural’ factors (technological advances and a sharply growing industrial demand), in an environment where supply (mine production and recycling) is unable to adjust upwards to keep pace with demand.

TRUTH LIVES on at https://sgtreport.tv/

The Silver Institute is a Washington D.C. headquartered trade association that can be likened to the silver industry’s equivalent of the World Gold Council. The members of the Silver Institute are predominantly silver mining companies and refiners. The Silver Institute’s silver supply / demand data is collected and calculated by London based precious metals consultancy ‘Metals Focus’.

The Silver Institute / Metals Focus’ Supply – Demand model is basically as follows:

Total Annual Silver Supply = Silver from Mine Production + Silver Recycling

Total Annual Silver Demand = Investment Demand + Jewellery / Silverware Demand + All forms of Industrial Demand

Total annual silver supply is then compared to Total annual silver demand. Any difference is called the Market Balance, which is negative if Demand > Supply, and positive if Demand < Supply.

A better name for ‘Market Balance’ would be ‘Market Imbalance’. Likewise, a better way for the Silver Institute to define Supply – Demand equation would be:

Supply (Mine Supply + Recycling + Dishoarding of Existing Stockpiles) = Demand

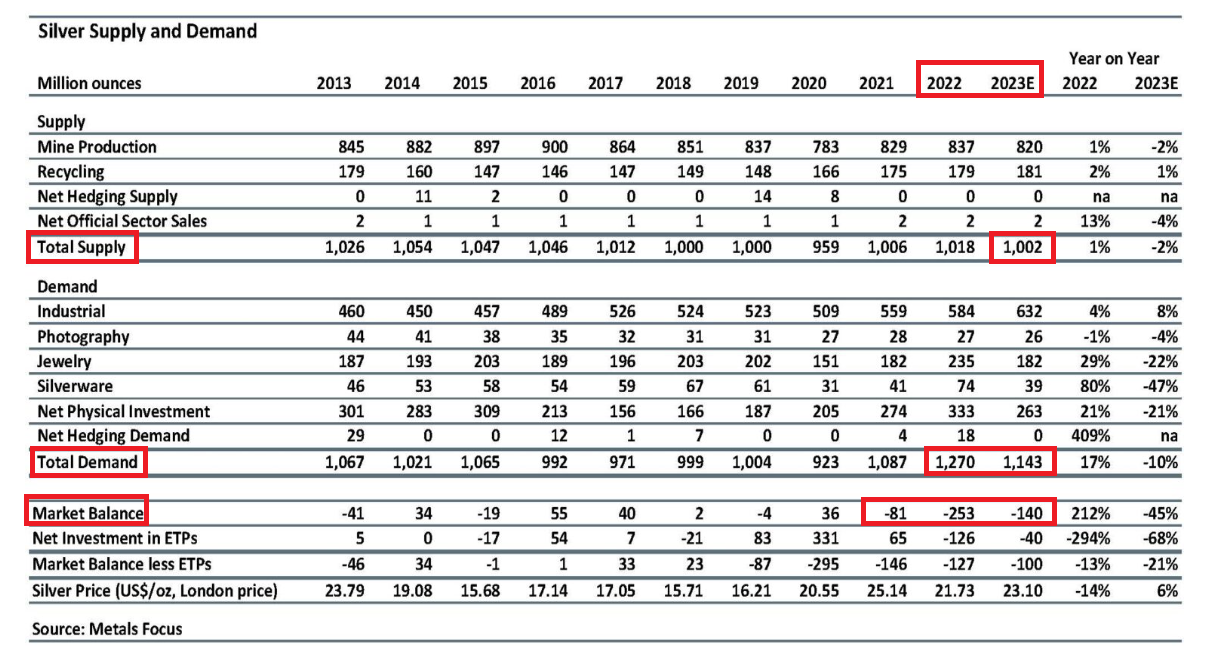

With the Silver Institute estimating that silver supply in 2023 was a total 1.003 billion ozs (31,197 tonnes), comprising 820 million ozs (25,505 tonnes) of mine supply and 183 million ozs (5,692 tonnes) of recycled supply, and with total demand estimated by the Silver Institute as being 1.143 billion ozs (35,551), the deficit (or market imbalance) is 140 million ozs (4354 tonnes) of silver in 2023.

This deficit follows the years 2021 and 2022 which had silver demand deficits of 81 million ozs, and 253 million ozs, respectively.

2023 is expected to be the second highest year for annual silver demand ever, after 2022 which saw the highest total demand on record of 1.27 billion ozs.

Therefore, over the 3 years of 2021, 2022 and 2023, the Silver Institute estimates that there has been a cumulative silver deficit of a massive 474 million ozs (14,743 tonnes).

The situation is made worse by the fact that not only is silver mining output not expanding to meet the higher demand. It’s actually falling. According to Metals Focus, in 2023, “global [silver] output is expected to decrease by 2% y/y to 820Moz due to lower production from Mexico, Peru and Argentina.”

Note that global silver output includes “primary silver production” where the primary metal extracted from ore deposits is silver, and “secondary production” where silver is extracted during the extraction and processing of other metals such as zinc, copper, and lead.

Although the Silver Institute’s annual World Silver Survey is published during April each year, this is followed up in November each year with a “World Silver Survey Interim Presentation” which includes updated data and commentary.

Importantly, in its 2023 interim update press release, published on 16 November 2023, The Silver Institute quotes Metals Focus (which actually gathers the data for the Silver Institute) saying that the structural silver deficit will continue into 2024 and beyond:

“Metals Focus believes the deficit will persist in the silver market for the foreseeable future.”

This silver deficit is primarily being driven by massive and growing industrial demand for silver.