by Brandon Smith, Alt Market:

Several years ago I predicted that the US would ultimately be confronted with the debilitating economic conundrum of stagflation, something which the nation had not seen since the 1970s. I suggested that stagflation would become a household word again and that the majority of American concerns would revolve around rising prices coupled with stagnant wages and falling production. In 2018 in my article ‘Stagflationary Crisis: USA’s Ongoing Collapse, Understanding The Cause’ I noted:

TRUTH LIVES on at https://sgtreport.tv/

“Years ago there was a rather idiotic battle between financial analysts over what the end result of the Fed’s massive stimulus measures would be. One side argued that deflation would be the outcome and that no amount of Fed printing would overtake the vast black hole of debt conjured by the derivatives implosion. The other side argued that the Fed would continue to print perpetually, resorting to QE4 or possibly “QE infinity” and negative interest rates as a means to stave off a market crash for decades (like Japan) while at the same time initiating a Weimar-style inflationary bonanza.

Both sides were wrong because they refused to acknowledge the third option – stagflation.”

The process of stagflation is difficult to track because there are multiple paths that it can take, many of them largely dependent on the whims of the central bank and its policy decisions. All we can really do is look back at the limited number of historic examples and guess at what will happen next. In the 1970s, stagflation nearly crushed the country with inflation rising by 7% to over 14% per year for a decade while the general public eventually faced high unemployment.

When I hear Zennials complain about being born into the “worst economy ever,” I have to laugh because they really have no clue. The 1970s was FAR worse in terms of erosion of buying power as well as overall poverty. If you look at film footage and photos of urban areas from LA to NY to Philadelphia during that time, many parts of these cities looked like bombed out war zones. The country was truly on the edge of disaster.

In the early 1980s, the Federal Reserve jacked interest rates up to over 20% – This stopped the inflation crisis but triggered a deflationary plunge that would sit like a giant boulder on the chest of the American consumer and small business owners for years to come. My own grandfather lost millions in his trucking and freight company during the rate spike; many people lost their businesses and homes.

In other words, as bad as the situation is now, we haven’t seen anything yet. Of course, we are quickly moving towards similar conditions and there is one thing we have today that the 1970s didn’t: A massive snowballing national debt.

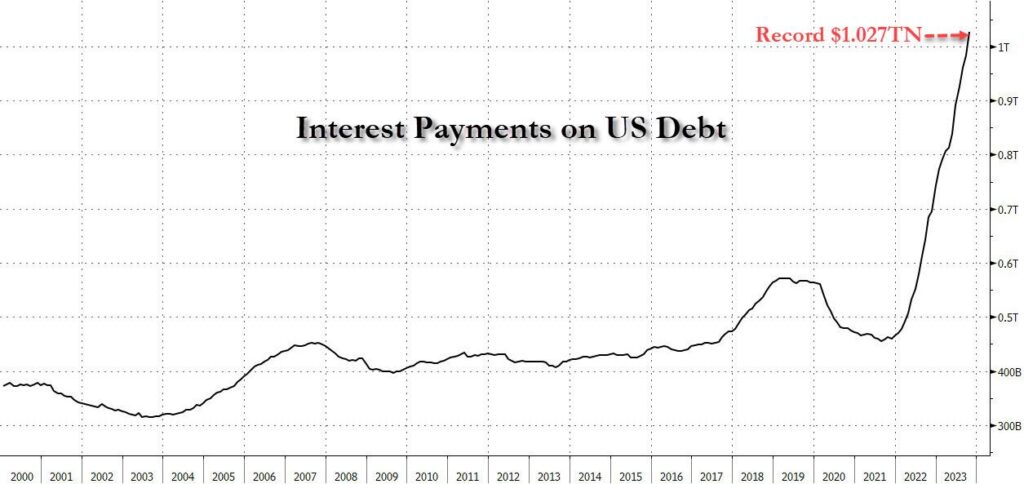

Currently, the US national debt is $33.8 trillion and has a 120% debt-to-GDP ratio. In a single month (October) the US added over $600 billion to the debt, and at the current pace the total official debt will hit over $41 trillion in one year. The speed of this accumulation is frightening. To put this in perspective, the Obama Administration and the Federal Reserve added around $9 trillion to the debt in 8 years during the corporate bailouts. Under Joe Biden, this is set to happen in a little over 1 year.

How is this happening?

As I have noted in the past, the US economy has stacked so much fiat and so much debt that any deviation in interest rates is going cause huge ripple effects. We don’t even need to hit the 20% interest rates of the early 1980s – A constant rate of near 6% is enough to cause debt to skyrocket. Then there is the problem of “compounding interest.” The US government is borrowing money to make interest payments, but it also borrows to roll over the principal payments, and it borrows still more to fund the general spending which is in excess of taxes collected (deficit spending).

At higher interest-rate levels, borrowing enters a destructive spiral. There’s interest payments on debt, which was itself borrowed to make interest payments on debt. To put it in simple terms, it’s a bit like a broke person taking on a stack of new credit cards to make the interest payments on a stack of old credit cards. It’s financial suicide.

Eventually the avalanche of debt will stall inflation but it will also pop multiple asset bubbles cross numerous market sectors and trigger a deflationary crisis. We are already seeing this trend with a crash in manufacturing as well as frozen wages. We are seeing it in the freight industry, with layoffs and bankruptcies piling up in a shocking downturn indicating impending recession. Not to mention US home sales have plunged to a 13 year low as prices continue to rise.

These are all red flags of an impending deflation event that WILL lead to large scale job losses, likely within the next year. It would seem the magic of covid stimulus measures is finally fading away and we are beginning to see the real economy underneath.

All the negative news has led to a spike in stock markets recently. Why? Because bad news is good news for equities. The expectation among investors is that the Fed is poised to cut rates or return swiftly to QE. This is not going to happen, at least not anytime soon. The Fed, I believe, wants a crash. After addicting markets to easy money for over a decade, the central bankers know EXACTLY what will happen as they continue to cut off the drug supply.