by Peter St. Onge, Activist Post:

Are we about to repeat the lost decade of the 1970s?

Today’s stagflationary economy — with high inflation and slow growth — will look familiar to anybody who lived through the 1970s.

Not only the stagflation, but the social unrest, decaying cities and political polarization all feel eerily familiar to those who thought gas lines, bell bottoms, and Captain and Tennille were all behind us.

For the past year my base case has been that we’re repeating the 1970s’ economy. The most salient feature of which was a double-peak stagflation that ultimately lasted roughly 8 years.

Perhaps this time paired with a 2008-style financial crisis that will ultimately convert into even more inflation.

TRUTH LIVES on at https://sgtreport.tv/

What Happened in the ’70s?

The story starts in the late 1960s, when the federal government went with “guns and butter.” Meaning enormous welfare spending on Lyndon B Johnson’s “great society” on top of the Vietnam war and the other myriad wars our military industrial complex demands.

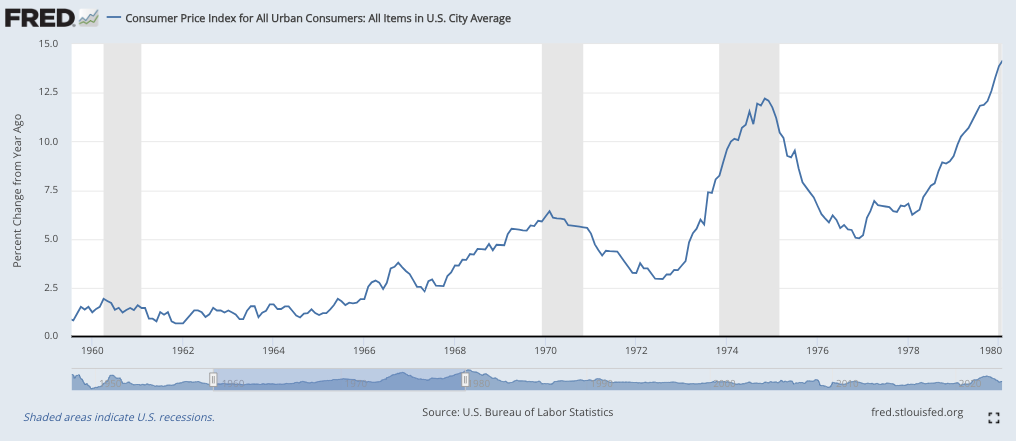

Guns and butter drove up inflation: It had averaged around 1% from 1952 to 1964, but started rising in 1965, hitting nearly 5% by 1968 and 6.5% by 1970.

At the time foreign countries could redeem their dollars for gold held by the US government. America’s inflation led these countries to fear the dollar would be worth less in future, so they began selling their dollars for gold. Most notably France, which sent a battleship to pick up 92% of the reserves they’d parked with the US in 1940 to pay for warplanes.

At this point Nixon could have tried to cut spending to reassure other countries — and reassure the American people — that the dollar was solid. Instead, of course, he “temporarily” suspended gold conversion. Which effectively killed the gold standard that had acted as that last constraint on US deficits and money printing.

As always when the government breaks something, 53 years later we’re still under that “temporary” suspension.

From Nixon to Stagflation

Once Nixon broke gold conversion, the gloves were off. Nixon’s Shock led to a decline in inflation for a single year, at which point it began a relentless march up, hitting 12% by 1974.

By the way, the Arab oil embargo, which is widely scapegoated for the 1970s’ inflation and was in response to US support for Israel, didn’t even start until inflation was already 8%. It certainly didn’t help quadrupling oil prices, but inflation was already soaring — oil just piled on.