by Alasdair Macleod, Schiff Gold:

The technical position for gold is looking very positive for higher prices. But technical analysis should be backed by fundamentals.

To a large extent, fundamentals are in the eye of the beholder, whose opinions in any situation can vary from positive to negative and everything in between. But even for the economic optimists, there are gathering clouds on the horizon likely to continue undermining the global economic outlook, the dollar, and all financial asset values. Fiat currencies are being downgraded relative to real money, which is gold.

TRUTH LIVES on at https://sgtreport.tv/

Current thinking is that inflation is a diminishing problem and that the interest rate spike is over. In this article, I point out where inflation expectations err and the mistake of believing that interest rate control is the solution.

It follows therefore that G7 debt traps are a more serious problem than generally realized. Furthermore, China and Russia are aware of the likely impact of current events on G7 currencies, and this is why they have accumulated hidden gold reserves.

In short, we face a transition between failing fiat and emerging gold-backed currencies, which might explain why gold’s technical position looks so positive.

If you are a chartist, you will judge the current market position for gold to look very bullish. The closely followed moving averages in the chart above are in a bullish sequence, both rising and the 55-day turning sharply higher. The current decline in the gold price should find strong support at its current level, which is between $1910—$1923. A follower of Elliot Wave Theory might say the most likely interpretation is there was a three-leg flat consolidation commencing in August 2020, completing in November 2022, lasting slightly more than 13 months which is a Fibonacci number. The subsequent move is the start of a new bull market.

Despite the backward-looking nature of technical analysis, the bullish argument is compelling, particularly in the context of heightened tensions in the Middle East and a looming global recession. The plain fact is that going into a recession we see G7 government finances (with the sole exception of Germany’s) already mired in debt traps, likely to lead to a series of funding crises. These funding crises inevitably drive up bond yields and divert investment capital from private sector actors to government debt, worsening the economic outlook. And since government revenue depends on profitable economic activity, the funding squeeze ends up undermining government finances.

It is a situation that echoes the 1970s when currency instability led to gold rising from the previously established Bretton Woods level of $35 to $850 on 21 January 1980. At the same time, the Federal Funds Effective Rate rose from a low of 3.3% in February 1972 to a high of 13.8% when gold peaked, going on to over 19% the following year. Today, the idea that both gold and interest rates can rise together is dismissed by the banking and investment establishment. Yet, since August 2020 the Fed Funds Effective Rate has risen from the zero bound to 5.33% currently and gold priced in dollars is roughly unchanged — hardly the negative correlation upheld by the establishment.

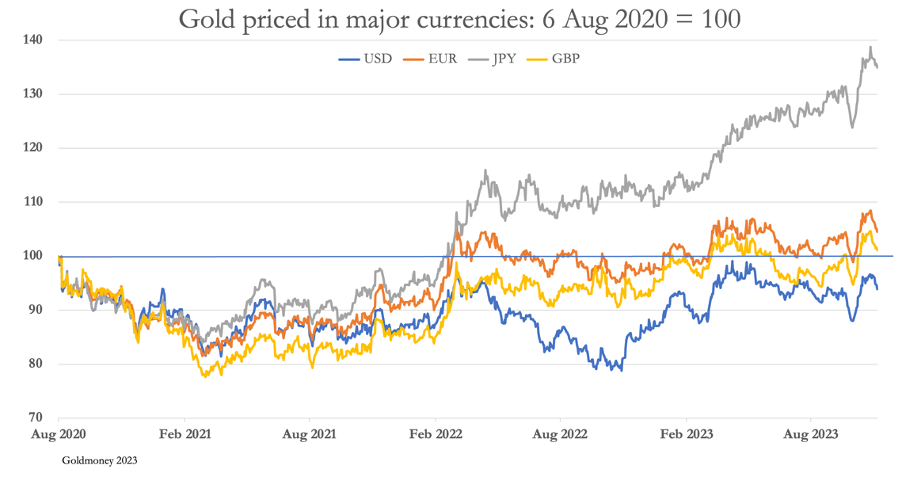

Due to the dollar’s relative strength, priced in other currencies, gold is now higher than it was when it first peaked on 6 August 2020, illustrated in the chart below.

In the case of Japan’s yen, it is 35% higher, 4% higher in euros, and 1% higher in sterling while in dollars it is 6% lower. The yen has been particularly weak, due to the Bank of Japan’s monetary policy keeping its deposit rate negative.

With it being widely recognized that the global economy faces an economic downturn, there is also a misconception about the consequences for consumer prices. It is assumed that a recession reduces demand leading to a glut of goods and therefore lower prices. That being the case, they say that with their improving purchasing power currencies might be expected to strengthen against gold. This misconception dates back to the early 1930s when goods were effectively priced in gold because the dollar was tied to it at $20.67 to the ounce. The fact that the dollar was devalued 40% by President Roosevelt in 1934 confirms that the monetary strength was in gold, not the dollar currency. And in the 1970s when the dollar and all other currencies were detached from gold, recessions were accompanied by escalating rates of consumer price inflation.