by Peter Schiff, Schiff Gold:

The technical analysis last month highlighted the mixed environment at the time:

The indicators are once again giving some mixed signals. The price action is definitely needing further consolidation. However, other indicators suggest a market that is just getting started. … Either way, downside does seem limited at this point, especially considering all the bad news has been priced in.

TRUTH LIVES on at https://sgtreport.tv/

The pullback from recent highs is still a healthy correction after the price action got a bit ahead of itself. “Limited downside” means that $1880 could be tested in the worst case, but should hold. The price could certainly turn around before then though. The current pullback is laying the groundwork for a strong and healthy up-leg that should finally take Gold to a new all-time high.

Resistance and Support

Gold

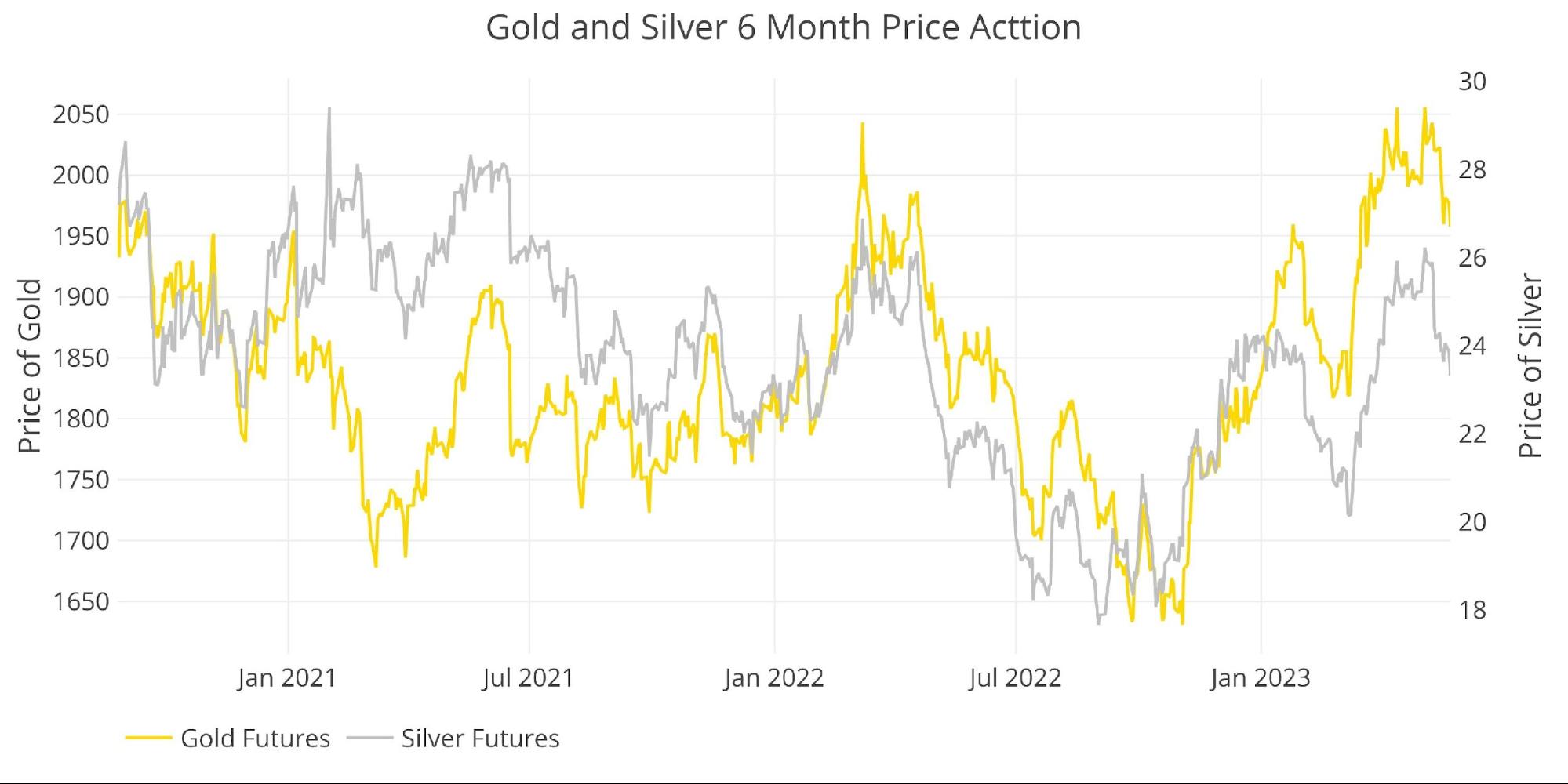

Once the possibility of new all-time highs faded, the metal-faced a stiff pullback. In the end, this will only make the burst through that much stronger though. For now, the shorts are attacking $1950 with a lot of confidence. There does not seem to be any immediate catalyst to push gold higher so the path of least resistance is still down.

Outlook: Short-term bearish

Silver

Silver has really struggled to hold onto $25 and $26. It saw a major pullback last week that preceded the move in gold. It’s now consolidating. The fact it held in well once gold started to fall and didn’t see further weakness is a good sign. That said, it still needs to get back into the $26 range to regain its bullish momentum.

Outlook: Neutral

Figure: 1 Gold and Silver Price Action

Daily Moving Averages (DMA)

Gold

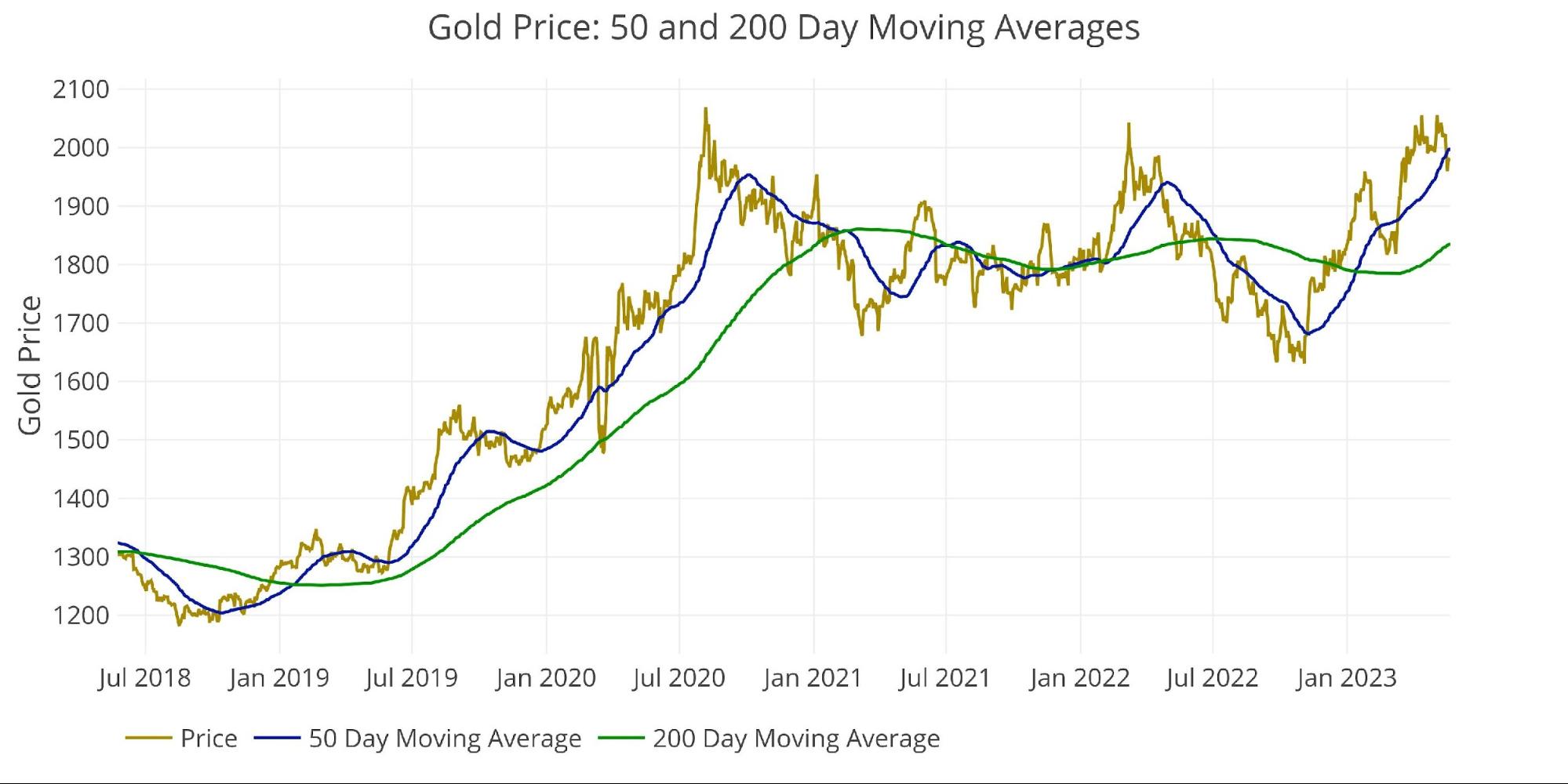

Gold has fallen below the 50 DMA, but this isn’t enough of a consolidation. Because of the rapid advance, the 200 DMA remains well below both the current price and the 50 DMA. While the market is in a bullish posture, the gap suggests more correction or consolidation is needed.

Outlook: Short-term neutral/bearish, medium-term very bullish

Figure: 2 Gold 50/200 DMA

Silver

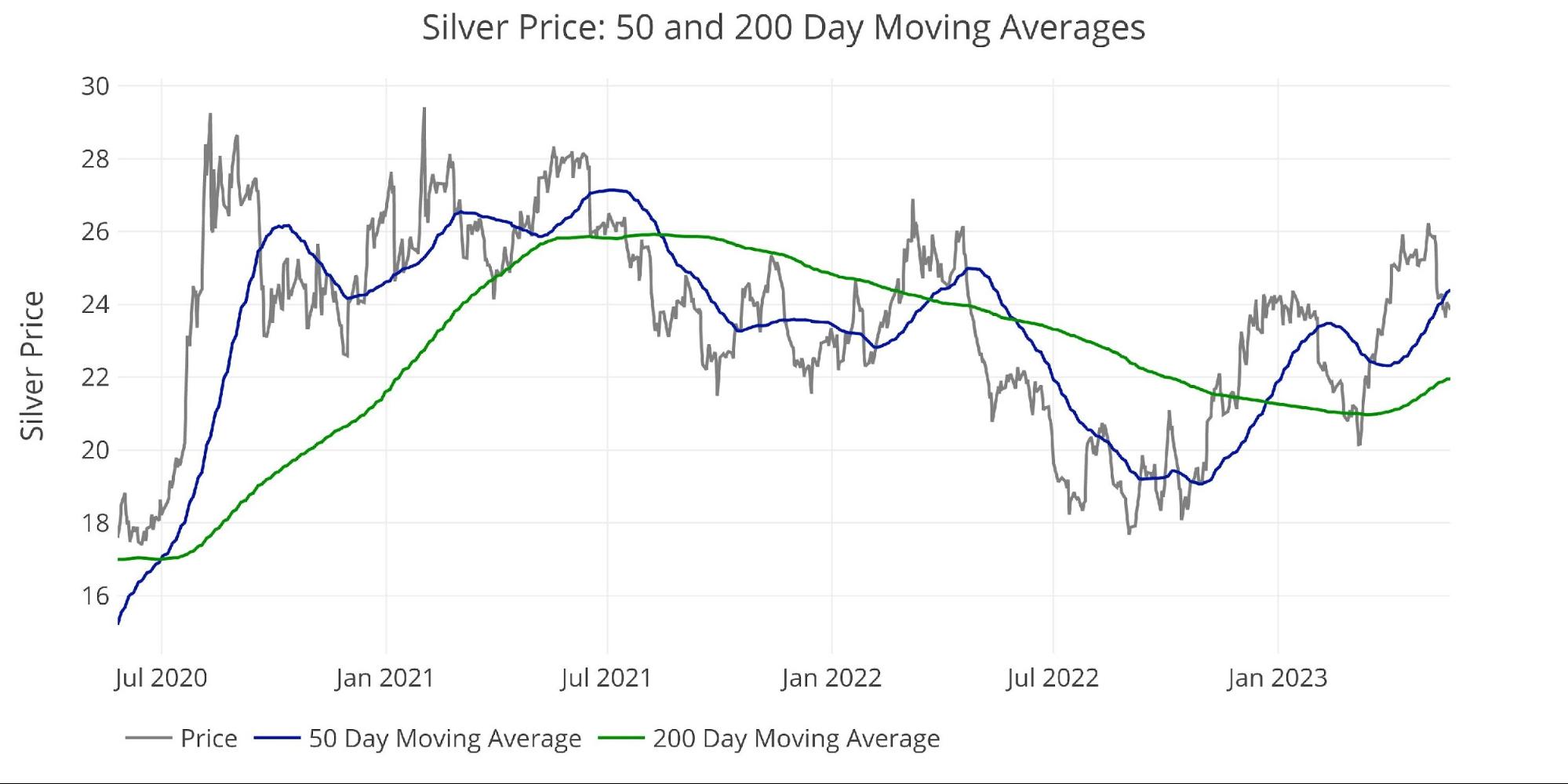

Same update as gold with one addition, the silver 50 DMA has not gotten so far out in front of the 200 SMA since 2020. This called for a needed and healthy correction.

Outlook: Short-term neutral/bearish, medium-term very bullish

Figure: 3 Silver 50/200 DMA

Comex Open Interest

Gold

The latest action shows that the price rose before the spec traders got behind the move. They climbed on board late in the move but could not get gold to new all-time highs. They then rushed for the exit which really pummeled the price. Open interest could definitely fall further, but it’s closer to a bottom than a top. Either way, this chart is not as bullish as last month when the entire move seemed to be independent of the futures market.