by Pam Martens and Russ Martens, Wall St On Parade:

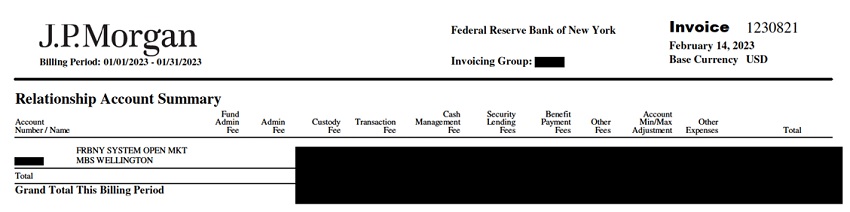

The New York Fed, which has bank examiners engaged in supervising JPMorgan Chase, has also repeatedly provided bailout funds to JPMorgan Chase; was supervising JPMorgan Chase when it lost $6.2 billion of deposits from its federally-insured bank by gambling in derivatives on its London trading desk; allowed JPMorgan Chase’s Chairman and CEO, Jamie Dimon, to previously sit on the New York Fed’s Board of Directors, even as he faced the $6.2 billion derivatives trading scandal; and the New York Fed has exclusively used JPMorgan Chase to hold, as custodian, more than $2.3 trillion of the Federal Reserve’s Mortgage-Backed Securities (MBS) for the past 15-1/2 years – despite JPMorgan Chase admitting to five felony counts brought by the criminal division of the U.S. Department of Justice during that time.