by Mish Shedlock, Mish Talk:

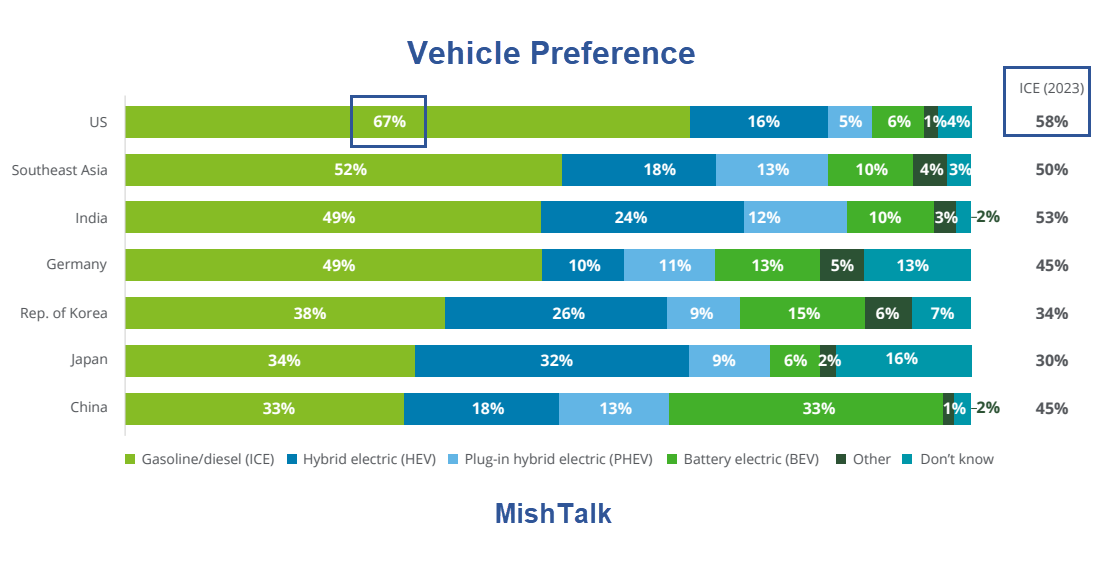

Demand for EVs is crashing in the US. Only six percent want an EV for their next vehicle but 67 percent want an ICE up from 58 percent last year.

Demand for EVs is crashing in the US. Only six percent want an EV for their next vehicle but 67 percent want an ICE up from 58 percent last year.

2024 Global Automotive Consumer Study

Please consider the Deloitte 2024 Global Automotive Consumer Study

TRUTH LIVES on at https://sgtreport.tv/

Four Key Trends

- Slowing EV momentum may be putting current decarbonization timelines in jeopardy.

- A significant number of consumers may be thinking about switching vehicle brands.

- Interest in connectivity features may not fully translate into revenue and profit.

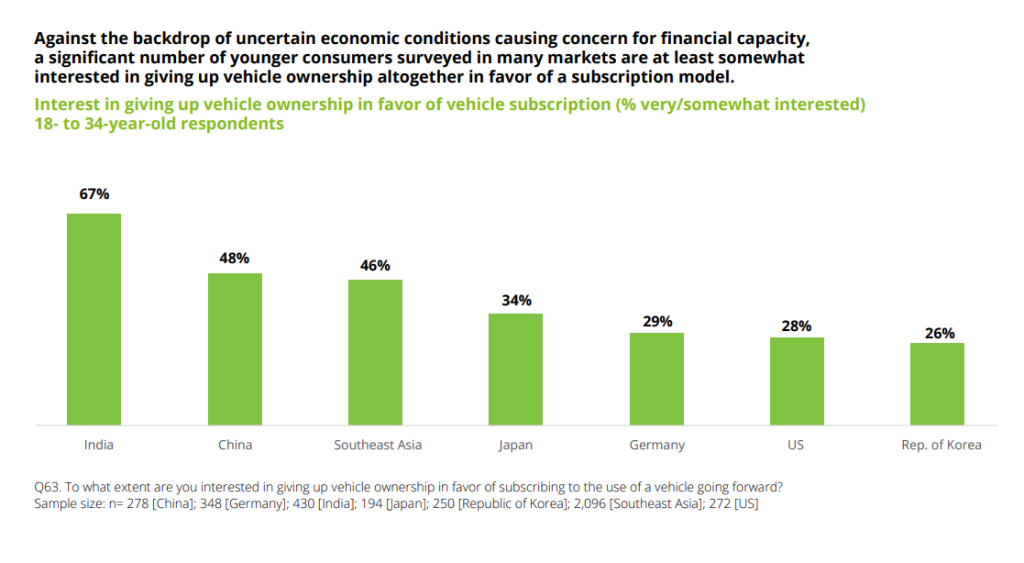

- Younger consumers are interested in vehicle subscriptions, as a growing number of them question if they need to own a vehicle going forward.

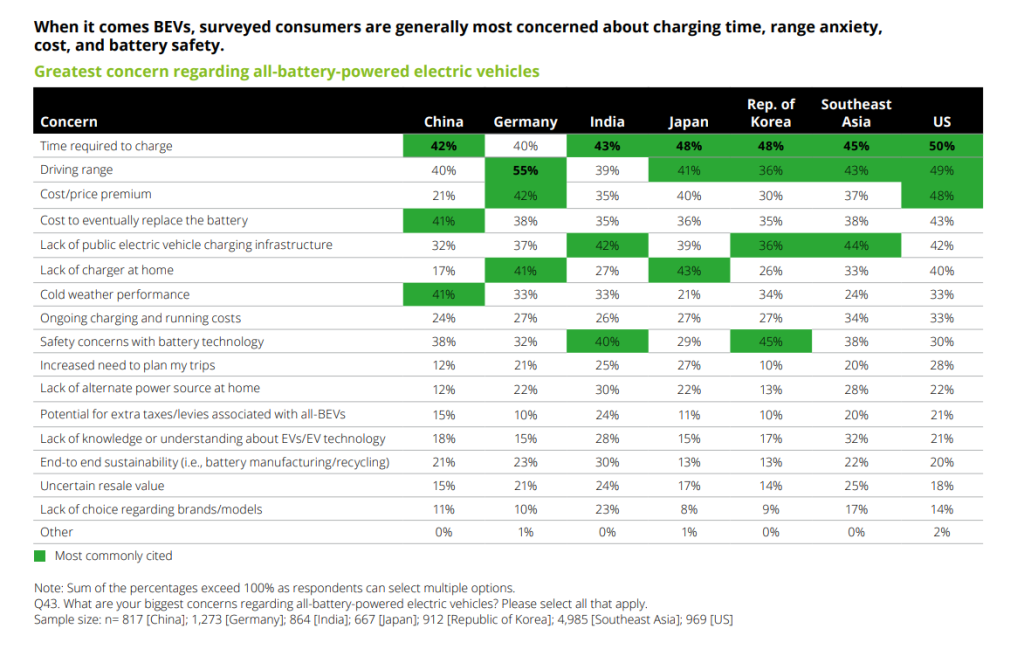

BEV Charging Time and Anxiety Range

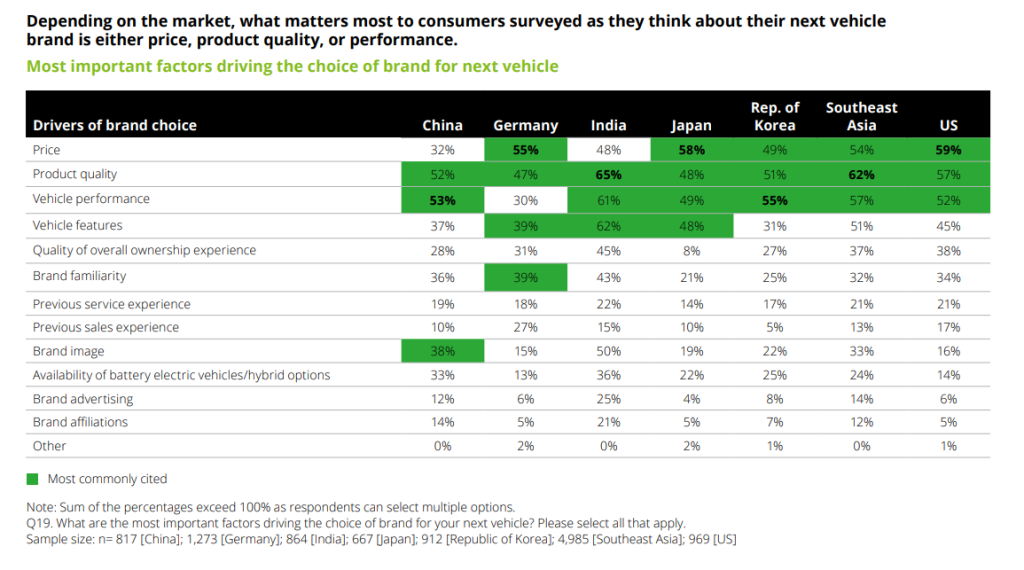

Price a Top Concern in the US

Subscription Model

Losing Bets

The Wall Street Journal comments on Hertz, Tesla and the Perils of CEO Groupthink

Hertz announced to much fanfare on Oct. 25, 2021, that it planned to buy 100,000 Teslas. “Electric vehicles are now mainstream, and we’ve only just begun to see rising global demand and interest,” then-CEO Mark Fields said. The share prices of both companies popped, and Tesla’s market capitalization surged past $1 trillion, exceeding the valuations of nearly all traditional automakers combined

Over the next year, Hertz announced plans to buy up to 65,000 Polestars and 175,000 electric vehicles from General Motors. Hertz featured Tom Brady in ads renting an EV. “Knowing Hertz is leading the way with their electric fleet speaks to how the world is changing and the way companies are approaching being environmentally and socially conscious,” the legendary quarterback proclaimed.

The market has changed. Electric-vehicle euphoria has crashed into reality, and Hertz’s bet has gone south.

Readers might have heard that lower maintenance costs are a major electric-vehicle advantage. As Hertz discovered, the opposite it true. Even minor accidents can require batteries to be replaced, which can cost $20,000. Many EV parts aren’t readily available, so cars have to sit in the shop for weeks.

The bigger problem is that Americans don’t want to plan trips around the locations of electric-vehicle charging stations—often to discover later that the chargers are broken. Nor do they want to download multiple apps to charge at different stations, or worry about their battery range degrading in cold temperatures.

Traditional automakers had committed to spend tens of billions of dollars on EVs. Startups such as Lucid, Nikola, Lordstown and Rivian debuted on public stock exchanges with fantastic market valuations despite having produced few if any cars. Rivian in early November 2021 boasted a $153 billion market cap. It’s now worth $17.3 billion.

As demand for electric vehicles stalled, the buzz wore off. The auto industry and investors are now suffering from a horrible hangover.

The EV reversal illustrates the perils of groupthink, which has infected the C-suite and Wall Street just as it has college campuses. Ideological conformity has fueled the ESG (environmental, social and governance) and DEI (diversity, equity and inclusion) movements in corporate America, which have proved costly and distracting.

Eight Inconvenient EV Truths

- EVs are more expensive

- EVs are inconvenient for anyone who needs a public charger

- EVs are inconvenient for anyone who drives long distances

- Insurance costs are higher

- Maintenance costs are higher

- Repairs take longer and parts are in short supply

- Minor accidents can be very costly requiring a new battery

- Consumers don’t want the damn things and rightfully so

Those are the inconvenient facts.

In addition, people have legitimate concerns over many things including fires, battery recycling, minerals and mining, and whether EVs do anything positive for the environment at all.

To repeat, most consumers (94 percent) don’t want the damn things and rightfully so.