from ZeroHedge:

Update (1700ET): Forgive our furrowed brow and generally government-data-questioning nature, BUT… One rather notable thing though which throws all of this ‘transparency’ into doubt…

According to the prior week’s data, Small Banks saw a tiny $1.1 billion outflow (NSA), which prompted much rejoicing early on Monday when markets opened.

That tiny outflow was revised to a massive $47.5 billion outflow according to this week’s data!

TRUTH LIVES on at https://sgtreport.tv/

So just how much will this last week’s data be revised next week?

* * *

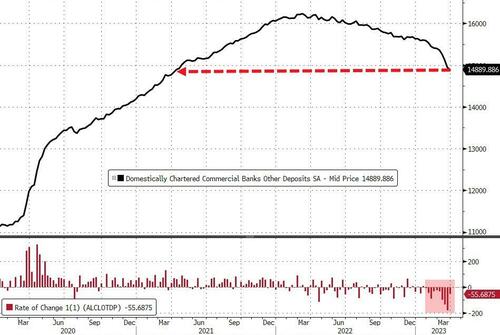

US commercial bank deposits (ex-large time deposits) fell for the 10th straight week (to the week-ending 3/29), down $55 billion to their aggregate lowest since April 2021…

Source: Bloomberg

Rather oddly, on a non-seasonally-adjusted basis, total US commercial bank deposits (ex-large time deposits) ROSE $54 billion last week…

Source: Bloomberg

On the bright side, the pace of outflows has slowed to $55.7 billion (from around $180 billion the previous two weeks), but the outflows look set to continue as Money Market fund inflows kept rising this week (a week ahead of the deposit data)…

Source: Bloomberg

Both large and small banks saw outflows once again, with large banks seeing $48 billion in outflows (to the lowest since March 2021) and small banks seeing a modest $7.2 billion in outflows (to the lowest since June 2021)…

Source: Bloomberg

On a seasonally-adjusted basis, Small banks saw around $275 billion in outflows in March (which included the week running up to SVB’s collapse) while large banks have seen $195 billion in outflows during that same period.

Last week saw outflows (SA) from large, small, and foreign banks

- Large banks: -$39.9BN for week ended March 29, vs -$89.8BN last week

- Small banks: -$44.8BN for week ended March 29, vs +$5.8BN last week

- Foreign banks: -$26.4BN for week ended March 29, vs -$41.7BN last week