by Geoffrey Grinder, Now The End Begins:

The historical roots of the 15-minute city are connected deeply with the current moment—one we will be living with for a long time to come, says the World Economic Forum

The historical roots of the 15-minute city are connected deeply with the current moment—one we will be living with for a long time to come, says the World Economic Forum

The World Economic Forum has been quietly working on something called the ’15-Minute-City’, a plan, or shall we say scheme, that recently has advanced from the planning stage to the prototype stage, and this should concern you if you value your individual liberty and freedom. We have told you repeatedly, and so say we again now, there are more lockdowns coming only the reasons for them will change. COVID was a trial balloon to see if people would consent to being locked down, and guess what, they did. No stopping it now. 2023 is gonna be a crazy year.

GOLD CLOSED UP $8.35 TO $1819.50//SILVER ALSO HAD A STELLAR DAY UP $0.63 TO $24.03//PLATINUM CONTINUES TO GAIN ON PALLADIUM: PLATINUM UP $41.85 TO $1057.20 AND PALLADIUM IS UP ONLY $21.90 TO $1810.65//COVID UPDATES RE CHINA//COVID UPDATES: DR PAUL ALEXANDER/VACCINE IMPACT//SLAY NEWS/CHINESE OUTLOOK FOR INCOME AND EMPLOYMENT SOUR//UKRAINE VS RUSSIA: UKRAINE’S LVIV, KIEV AND KHARKOV PUMMELED AS THESE CITIES ARE IN TOTAL DARKNESS//PEPE ESCOBAR: A MUST READ///IN BRAZIL LULA TO BE INAUGURATED ON SUNDAY: EXPECT FIREWORKS (RIOTING)//CONTINUAL USA JOBLESS CLAIMS RISE//ELON MUSK ANNOUNCES NEW SCIENTIFIC DEBATE ON TWITTER AND THAT WILL EXPOSE THE COVID /VACCINE CRIMES//SOUTHWEST AIRLINES CONTINUES IN CHAOS!! WITH MORE CANCELLATIONS

GOLD CLOSED UP $8.35 TO $1819.50//SILVER ALSO HAD A STELLAR DAY UP $0.63 TO $24.03//PLATINUM CONTINUES TO GAIN ON PALLADIUM: PLATINUM UP $41.85 TO $1057.20 AND PALLADIUM IS UP ONLY $21.90 TO $1810.65//COVID UPDATES RE CHINA//COVID UPDATES: DR PAUL ALEXANDER/VACCINE IMPACT//SLAY NEWS/CHINESE OUTLOOK FOR INCOME AND EMPLOYMENT SOUR//UKRAINE VS RUSSIA: UKRAINE’S LVIV, KIEV AND KHARKOV PUMMELED AS THESE CITIES ARE IN TOTAL DARKNESS//PEPE ESCOBAR: A MUST READ///IN BRAZIL LULA TO BE INAUGURATED ON SUNDAY: EXPECT FIREWORKS (RIOTING)//CONTINUAL USA JOBLESS CLAIMS RISE//ELON MUSK ANNOUNCES NEW SCIENTIFIC DEBATE ON TWITTER AND THAT WILL EXPOSE THE COVID /VACCINE CRIMES//SOUTHWEST AIRLINES CONTINUES IN CHAOS!! WITH MORE CANCELLATIONS

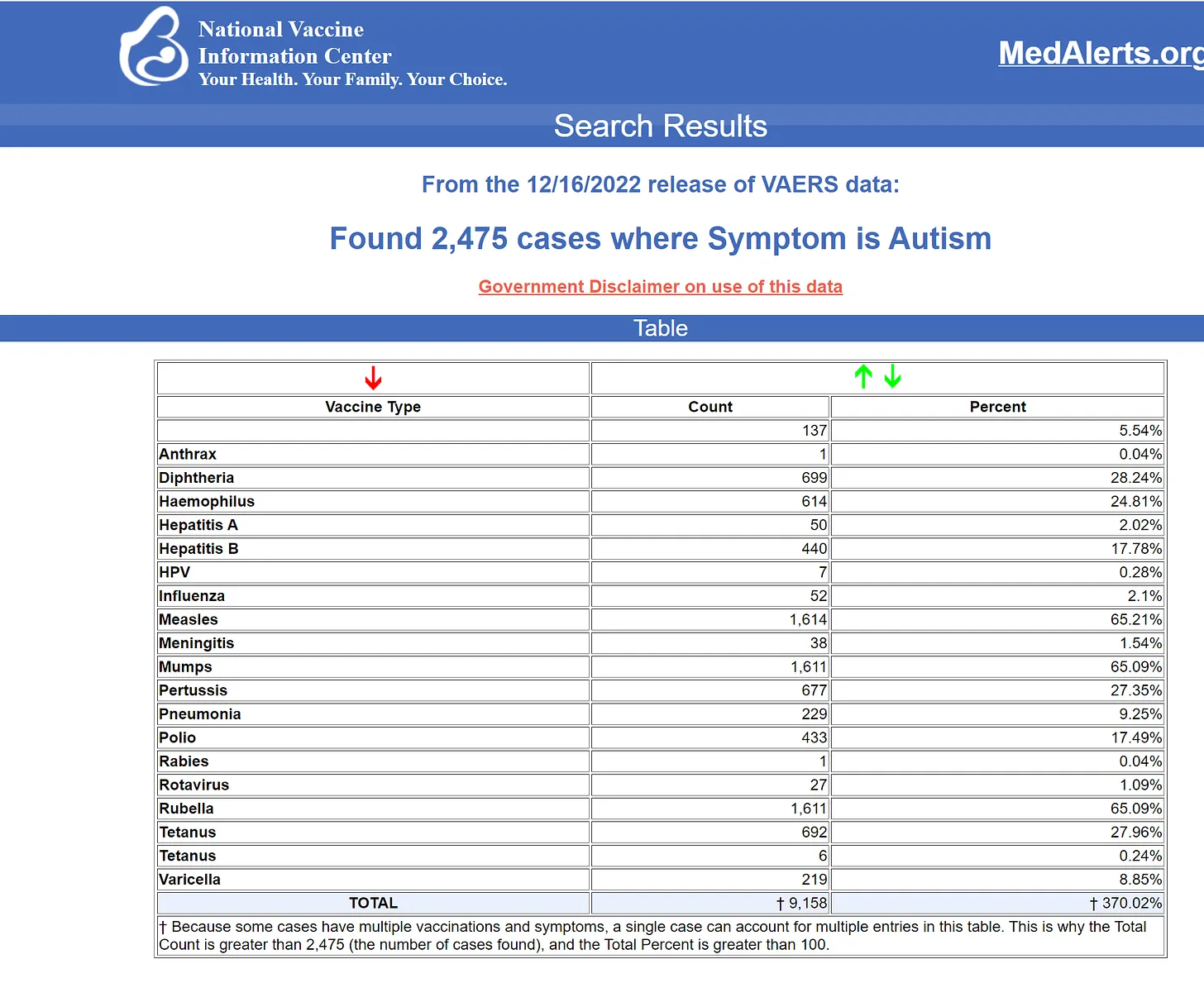

I was watching a Susan Oliver video claiming it’s just coincidence. So I decided to take a look for myself. It seems clear from the source data that she’s giving you false information.

I was watching a Susan Oliver video claiming it’s just coincidence. So I decided to take a look for myself. It seems clear from the source data that she’s giving you false information.