by Peter Schiff, Schiff Gold:

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

TRUTH LIVES on at https://sgtreport.tv/

Gold

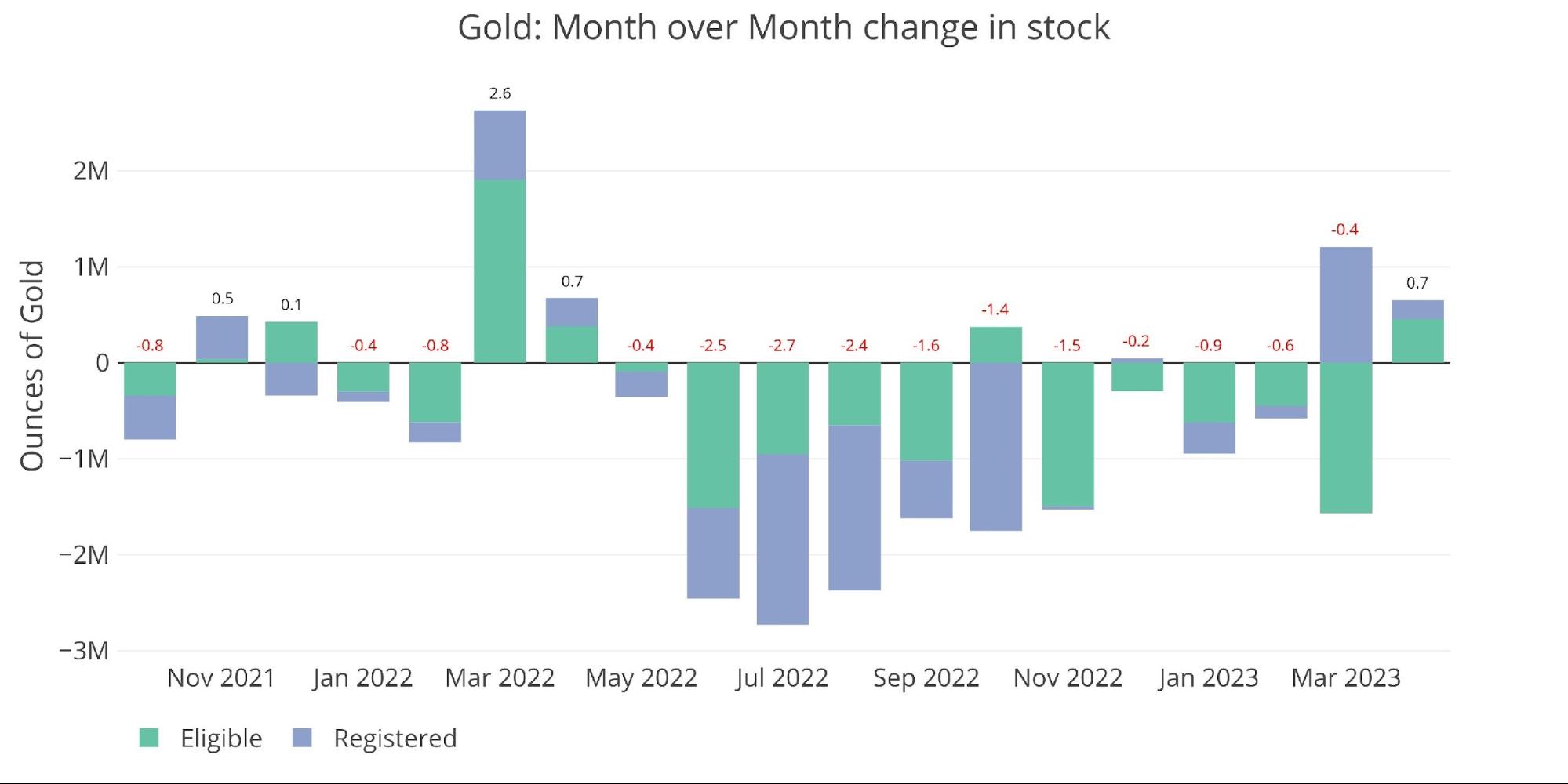

After 11 months of consistent net outflows, gold has finally seen some modest inflows of 700k ounces in April. At the moment, it’s hard to know exactly why the restock has happened beyond identifying the inflows as coming from JP Morgan and Manfra. It’s quite possible that actual supplies got low enough that they had no other choice but to scrounge up what gold they could.

Figure: 1 Recent Monthly Stock Change

The daily activity has been fairly muted except for two large moves of 643k ounces and 578k ounces from Eligible to Registered. I have had a theory for some time that the metal in Registered is not really available for delivery and that the 11M ounces are mainly for optics.

The theory originated by looking at the pre-Covid data when Registered was a mere fraction of total inventory (Figure 6). When Covid happened there were concerns about meeting all delivery demands and so the major vaults shuffled some metal around and poof, all of a sudden Registered was a massive amount of total inventory.

This doesn’t just happen overnight though. You don’t go from 1.5M ounces to 17M ounces because you found a little extra metal in a vault somewhere. That is going from $3B to $34B. My argument is that this was an optics move. Paper contract holders finally got nervous (rightfully so) about whether they could actually turn their paper into gold and delivery volume started to increase. The Comex decided to change some rules and inflate the amount of gold available. But in terms of actual physical metal, nothing really changed.

As mentioned, the recent inflows combined with the move from Eligible into Registered supports that theory. Why would they move 1.3M ounces of gold from Eligible into Registered just as the April delivery month got started even though there were already 11M ounces in Registered? Simply because there isn’t actually 11M ounces of available gold in Registered.

The main driver was JP Morgan. They moved exactly 578,718 ounces on each of the two days (3/24 and 3/31) from Eligible to Registered. This brought their total Eligible down to 577,966 ounces, with Registered increasing to 3.6M ounces. So yes, JP took from their lower Eligible stockpile and moved it to their Registered bucket so that it was available for delivery just in time for the April contract delivery period. If JP Morgan needs to defend gold again, it would completely wipe out their Eligible metal.

The April gold contract ended with 21k contracts open at First position which means the 2.5M ounces JP originally had in Registered was more than enough to cover the entire delivery volume of April if JP Morgan decided to meet 100% of delivery demands. Clearly, not all of the 2.5M in JP Morgan Registered is actually available.