by Matthew Piepenburg, Gold Switzerland:

As we warned throughout 2022, the Fed’s overly rapid and overly steep rate hikes would only “work” until things began breaking, and, well…things have clearly begun to break, including the petrodollar.

Even prior to the recent headlines regarding US regional banks, “credit event” stressors were already tipping like dominoes around the world, from the 2019 repo crisis and the 2020 bond spiral to the 2022 gilt implosion.

TRUTH LIVES on at https://sgtreport.tv/

Then came SVB et al in 2023, and, of course, the forewarned disaster at Credit Suisse…

But as we also warned literally from day 1 of the sanctions against Putin, the oh-so-critical petrodollar would be among the next dominoes to tip, and tipping is precisely what we see.

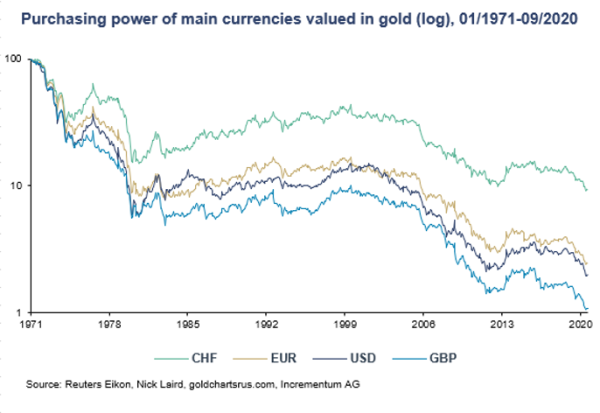

As argued below, petrodollar shifts are yet another headwind for USTs and USDs, but an obvious tailwind for gold.

But before we dig into this historical tipping point, it’s important to see the forensic cause of all that is breaking…

The Bond Market, Of Course…

We can’t repeat this point enough: The bond market is the thing.

And toward this end, the signs of generational and global shifts in global trade, currency settlements and political instability is directly tied to broken sovereign credits reeling under the pressure of artificial rate hikes.

Less Credit, Less Growth, More Volatility

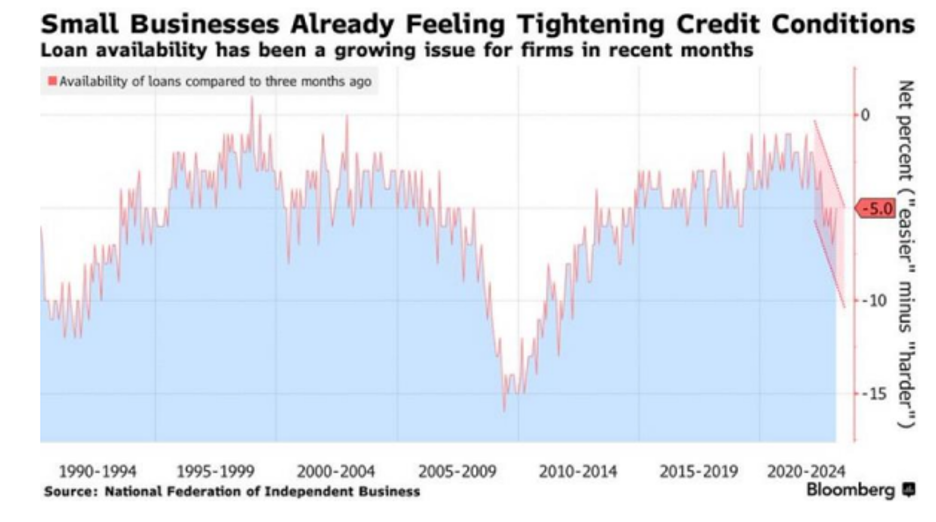

In the wake of recent bank failures and now carefully muted headlines, credit is tightening behind the curtains, and that’s a bad sign.

Even the safer companies in the US with “investment grade” credit status aren’t issuing bonds into a credit market that has seen volatility on the short end of the UST market which looks more like a crypto-coin trade than a “risk-free-return” UST.

The recent gyrations in the 2-year UST and futures market surpassed vol levels seen in 1987, 9-11, or even the GFC of 2008, but I’m betting those details didn’t make the headlines of the financial media with much attention to detail…

As the WSJ recently noted, however, March issuance of bonds by even the highest rated companies came in at just under $60B, significantly below the five-year average of $180B for the same month.

And as for the junkier companies and their junkier bonds, well…their luck, as well the demand for their IOUs, has all but dried up.

March saw US zombie/junk borrowers (who live off “extend-and-pretend” low rates and yield-desperate investors [suckers]) issuing only $5B in bonds, compared to a five-year average of over $24B for the same month.

Hmmm.

Uh-oh?

Stated simply, easy, cheap and freely available credit, which has been the fun but toxic wind beneath the otherwise broken wings of the so-called post-08 “recovery” (bubble), is ending/breaking, which means hope for any vestige of US economic growth is now all but an open joke.

Small banks, which will be falling off the vine one by one in the coming months as depositors openly move toward the larger banks and money markets, means that credit, and hence hope, for small businesses in the US will be harder to get than an honest voice in Congress.

Needless to say, none of these open signals of tightening credit bode well for Main Street in particular or economic growth in general.

The Fed’s Generational Sucker-Punch

The Fed may have given the top 10% of the US 90% of all the bubble wealth which came from their post-08 rate repression…

Read More @ GoldSwitzerland.com