from ZeroHedge:

After repeated laments by the likes of Bill Ackman, who most recently said that “I continue to believe that the best course of action is a temporary @FDICgov deposit guarantee until an updated insurance regime is introduced” (and who just flip-flopped on his “Fed must hike with shock and awe“ call from 2022 and is now urging for a Fed hiking pause), and following a Bloomberg weekend report that US mid-sized banks demanded a two-year total deposit insurance scheme from the FDIC, and warned if it doesn’t arrive, there may lots more shotgun weddings (or shotguns), moments ago Bloomberg reported that “US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.” Guess our March 12 tweet was ahead of its time yet again.

TRUTH LIVES on at https://sgtreport.tv/

FDIC unveils new sign pic.twitter.com/PbYESPaji5

— zerohedge (@zerohedge) March 12, 2023

The BBG report explains that “Treasury Department staff are reviewing whether federal regulators have enough emergency authority to temporarily insure deposits greater than the current $250,000 cap on most accounts” without formal consent from a deeply divided Congress, and goes on to note that “authorities don’t yet view such a move as necessary, especially after regulators took steps this month to help banks keep up with any demands for withdrawals” which is an important caveat, and is the same one that hawks are using to justify why a Fed pause would be self-defeating (“why is the Fed blowing up their last bit of inflation-fighting credibility; what do they know that we don’t): the same question can be applied to the Treasury: “what does the Treasury know that we don’t.”

Most likely nothing – after all bank crises are non-linear, but as Bloomberg notes, “still, they are developing a strategy out of due diligence in case the situation worsens.”

“We will use the tools we have to support community banks,” White House spokesman Michael Kikukawa said, without directly addressing whether the measure is being studied. “Since our administration and the regulators took decisive action last weekend, we have seen deposits stabilize at regional banks throughout the country and, in some cases, outflows have modestly reversed.”

Still, the report notes, the behind-the-scenes deliberations show there are concerns in Washington’s corridors of power as midsize banks call for broader government intervention after three lenders collapsed this month when uninsured depositors pulled their money, and as a fourth firm strives to avoid a similar fate. Shares of that one, First Republic Bank, tumbled an additional 47% on Monday as industry leaders tried to find a way to bolster the company’s finances.

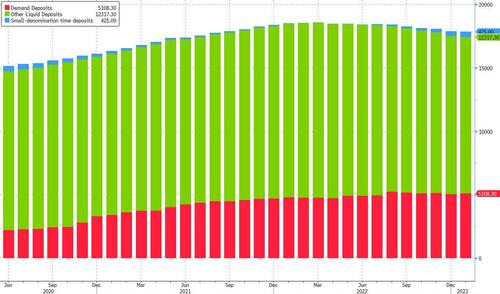

Ok, that’s the theory. What about the practice? After all, as regular readers know there are $18 trillion in total deposits, all of which will have to be insured…

… and just $125 billion in the FDIC’s Deposit Insurance Fund, which makes an outright guarantee of all deposits just a small mathematical impossibility.