by Michael Maharrey, Schiff Gold:

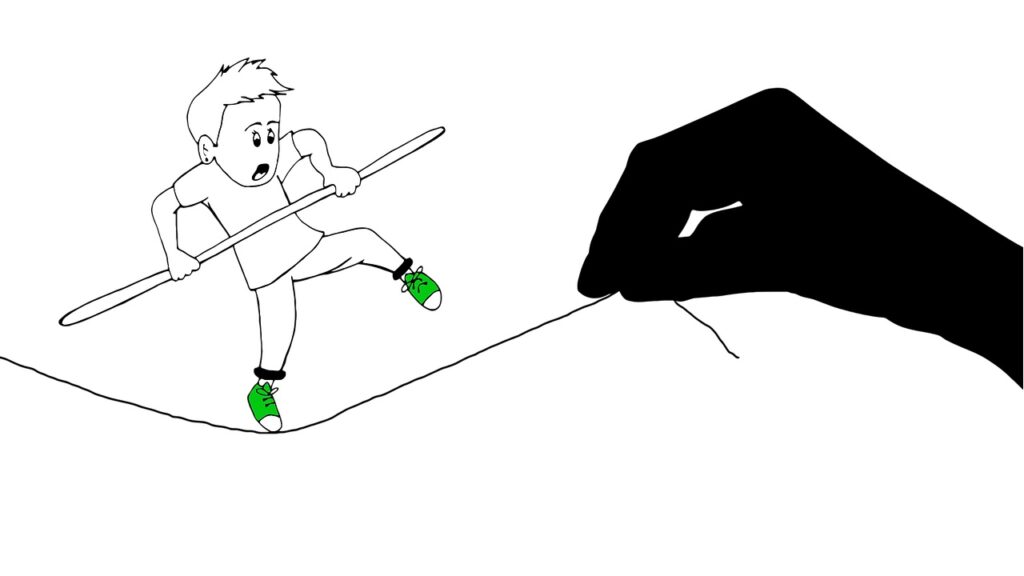

The Federal Reserve is trying to walk a tightrope — in a hurricane.

After rate hikes resulted in the collapse of Silicon Valley Bank and Signature Bank, the Federal Reserve and the US Treasury stepped in with a bailout. With that hole in the dam seemingly plugged for the time being, the Fed pushed forward and raised interest rates by another 25 basis points at its March meeting.

TRUTH LIVES on at https://sgtreport.tv/

In effect, the bank bailout ended the inflation fight while allowing the Fed to continue the pretense of an inflation fight for a little while longer.

THE RATE HIKE

At its March meeting, the FOMC raised interest rates by another quarter percent. That brings the target range for the Fed funds rate to between 4.75 and 5%. It was the ninth consecutive rate increase.

The official FOMC statement asserted that the “US banking system is sound and resilient.”

It also noted that inflation “remains elevated.”

CPI came in at 6% in February. Although the CPI has ticked down in recent months, it remains closer to the 2022 highs than it does the 2% Fed target.

The FOMC statement indicated that “the Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.”

But it removed language from the statement saying the committee expects “ongoing increases” and replaced it with a line saying the committee “will closely monitor incoming information and assess the implications for monetary policy.”

This was widely viewed as a doveish indication that the Fed might be close to the end of rate hikes.

But the statement emphasized that “the Committee is strongly committed to returning inflation to its 2 percent objective.”

During the post-meeting press conference, Powell indicated that the banking crisis may actually help the Fed beat down inflation by tightening lending conditions.

Or maybe not.

It’s possible that these events will turn out to be very modest effects on the economy, in which case inflation will continue to be strong, in which case, you know, the path might look different. It’s also possible that this potential tightening will contribute significant tightening in credit conditions over time. And in principle, that means that monetary policy may have less work to do. We simply don’t know.”

The 25 basis point rate hike was widely anticipated. With price inflation still running far above the target, the Fed couldn’t plausibly pivot and end rate hikes. But make no mistake, the inflation fight ended the moment the central bank created the bank bailout program.

SOMETHING BROKE

The collapse of SVB and Signature Bank were the first things to break as a result of Fed tightening.

They won’t be the last.

As I’ve been saying for months, this was inevitable. This bubble economy is built on artificially low interest rates and money creation. The Fed took some of that away when it started tightening monetary policy. In effect, the central bank has dug the foundation out from under the economy and the financial system. You can’t undermine a foundation without eventually causing the entire building to collapse.

During his post-FOMC meeting press conference, Powell tried the paint the collapse of SVB and Signature Bank as “an outlier.”

“These are not weaknesses that are at all broadly through the banking system,” Powell claimed.

This is simply false.

In fact, the collapse of SVB and Signature Bank was the tip of the iceberg. According to a Washington Post report, hundreds of banks are at risk because the Fed rate hikes have decimated the value of bonds held by these banks.