by Peter Schiff, Schiff Gold:

Given the potential impacts of the ongoing banking crisis, I will start this article with the conclusion.

The current banking crisis could not have come at a worse time for the Comex system. Inventories have seen massive depletion over the last 2+ years as investors have slowly been pulling physical out of the vaults. I have previously called this a run on the vault but labeled it as a stealthy one. As though certain investors did not want to raise the alarm, but slowly take possession while inventory was still available.

TRUTH LIVES on at https://sgtreport.tv/

Now that confidence in the banking system has been put to the test, people will look to alternative means to store their wealth and get their money out of the financial system. The easiest and safest way to do this would be to own physical precious metals, as people have done for thousands of years.

It is likely that demand for physical metal could increase significantly in the months ahead. The futures market is already showing a massive move in the price of gold, which is knocking on the door of $2,000. It’s only a matter of time before this moves into the physical market. When it does, the Comex vault run will pick up steam.

Investors looked at SVB and saw that it was undercapitalized and people could only get 80-90 cents on the dollar. If investors were to do the same due diligence on the Comex they would find an even worse fractional reserve system in the metals market. The recent discovery by the LME that some of their inventory was stones rather than nickel should only serve as another wake-up call that the supply of physical metal is extremely tight. If everyone rushes for physical at the same time, there won’t be nearly enough to satisfy demand at current prices (silver has 15 paper ounces per 1 physical ounce!).

We could be only months away from seeing a break in the Comex system. SchiffGold will be working all weekend to take orders. Best to get physical locked in at current prices while you still can.

Current Trends

This analysis focuses on gold and silver within the Comex/CME futures exchange. See the article What is the Comex? for more detail. The charts and tables below specifically analyze the physical stock/inventory data at the Comex to show the physical movement of metal into and out of Comex vaults.

Registered = Warrant assigned and can be used for Comex delivery, Eligible = No warrant attached – owner has not made it available for delivery.

Gold

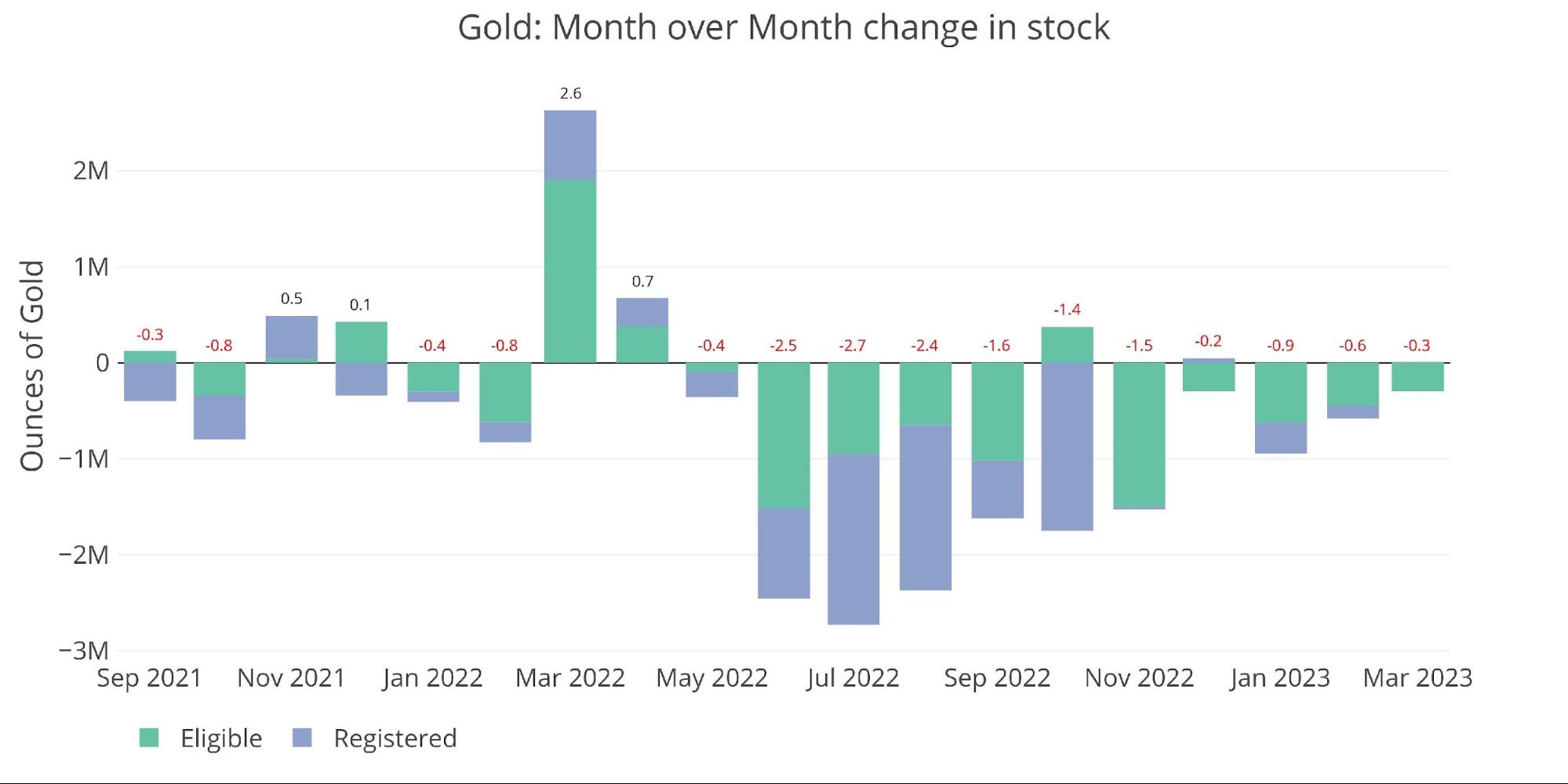

Gold is now in its 11th straight month of net outflows, seeing 285k ounces leave the vault so far in March. The exodus of metal has slowed since last year when some months saw almost 3M ounces leave Comex vaults.

Figure: 1 Recent Monthly Stock Change

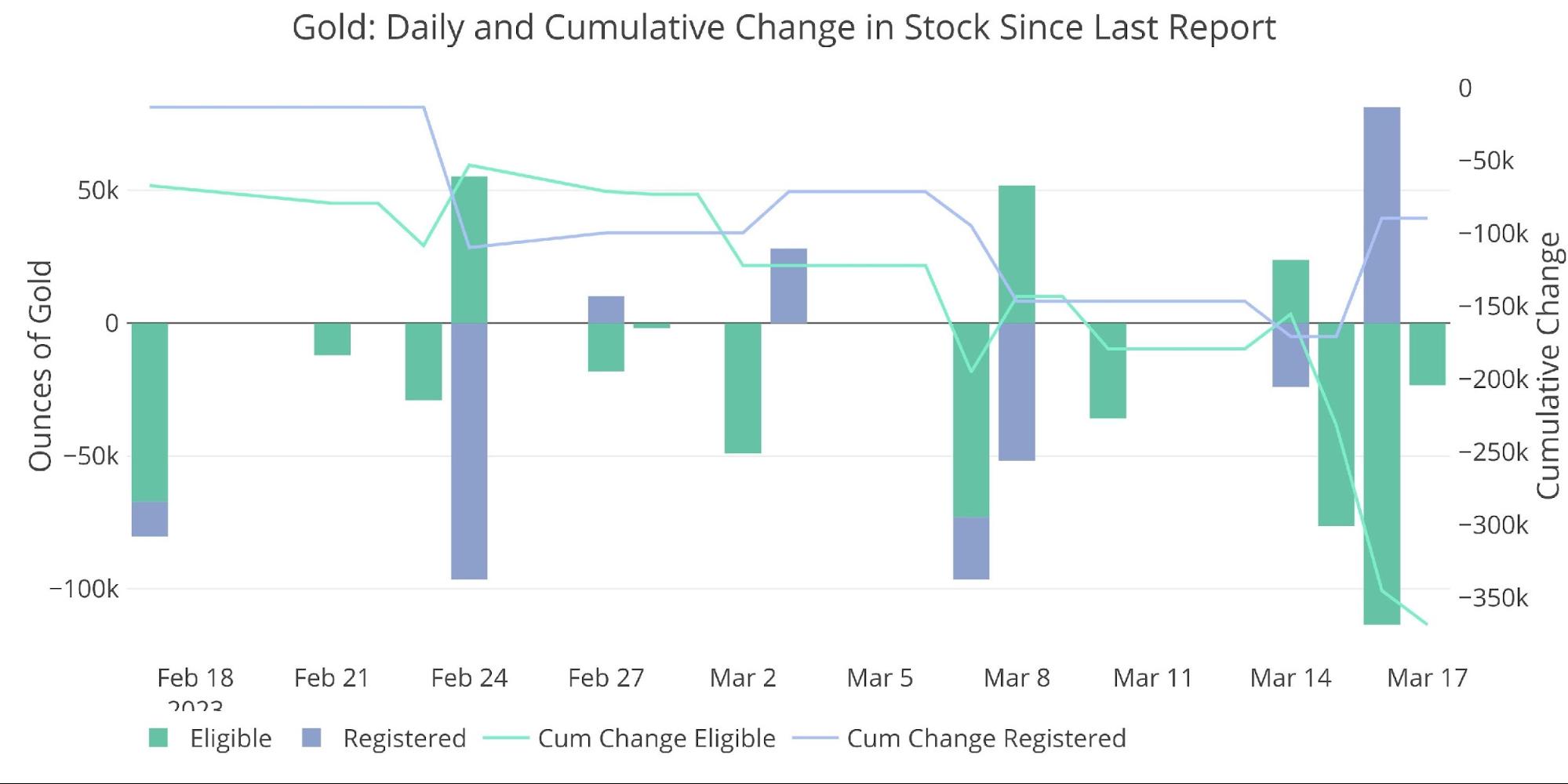

As mentioned above, this could change quickly and may already be changing! As the chart below shows, this latest week was the busiest week of outflows in the last month. Given the price of gold finished the week at $1993, the ongoing banking crisis, and general fear in the market… it seems likely that demand for physical could be ready to soar. That could drive larger outflows from Comex vaults in the near future.

Figure: 2 Recent Monthly Stock Change

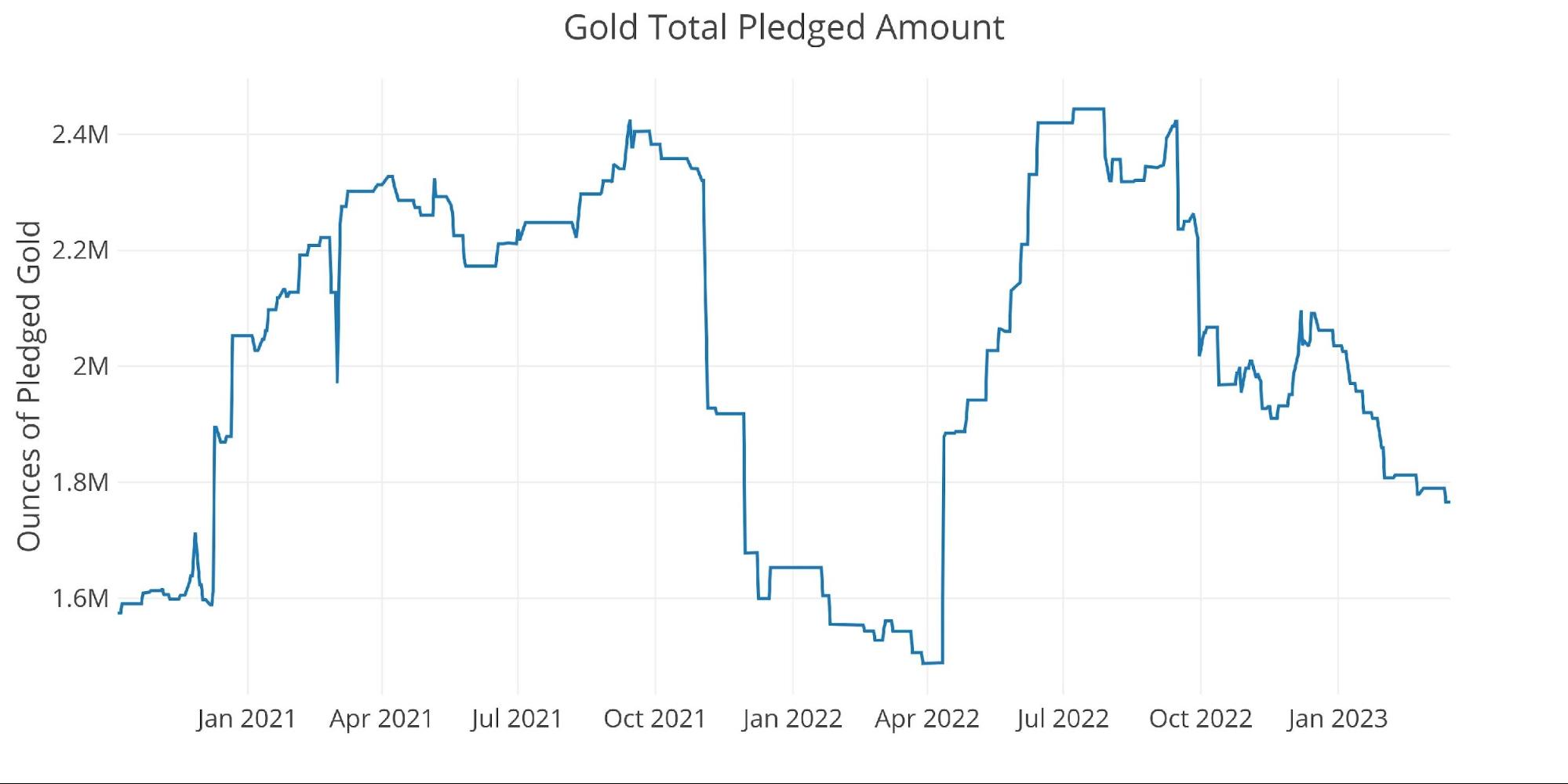

Pledged gold continues to decline, but similar to the inventory at large, the drop has been slowing.

Figure: 3 Gold Pledged Holdings

Silver

Outflows in silver continue at a strong pace, seeing 3.5M ounces in outflows MTD. Registered is actually seeing inflows for the second month in a row, most likely because inventory of Registered had reached dangerously low levels. As mentioned previously, the real floor is not actually zero but somewhere higher. This is for optics to keep confidence in the fractional reserve silver trade.