by Chris Menahan, Information Liberation:

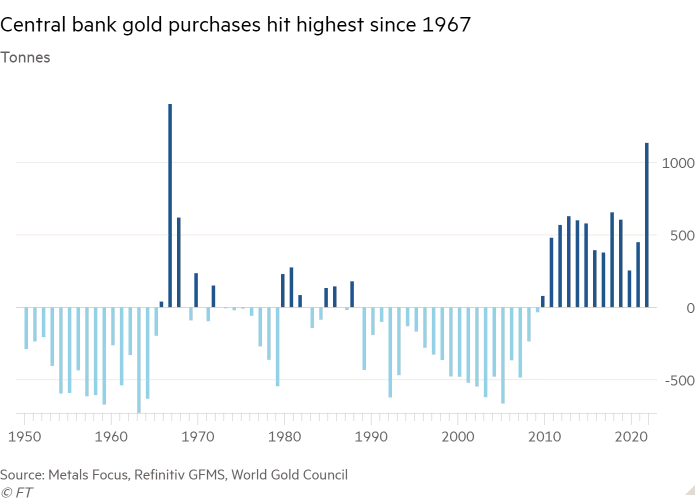

Did you know that central banks bought more gold last year than any year in the past 55 years—since 1967?

Though most don’t realize it, 1967 was a significant year in financial history, mainly due to the events at the London Gold Pool.

The London Gold Pool was an agreement among central banks of the United States and Western European countries to stabilize the price of gold. The goal was to maintain the price of gold at $35 per ounce by collectively buying or selling gold as needed.

TRUTH LIVES on at https://sgtreport.tv/

However, in 1967 the London Gold Pool collapsed due to a shortage of gold and increased demand for the metal. That’s because European central banks bought massive amounts of gold as they began to doubt the US government’s promise to back the dollar to gold at $35/ounce. The buying depleted the London Gold Pool’s reserves and pushed the price of gold higher.

In short, 1967 was the beginning of the end of the Bretton Woods international monetary system that had been in place since the end of World War 2. It ultimately led to severing the US dollar’s last link to gold in 1971. The dollar has been unbacked fiat confetti ever since—though the petrodollar system and coercion have propped it up.

The point is large global gold flows can be a sign that a paradigm shift in the international monetary system is imminent.

Central banks are the biggest players in the gold market. And now that we have just experienced the largest year for central bank gold purchases since 1967, it’s clear to me something big is coming soon.

And those are just the official numbers that governments report. The actual gold purchases could be much higher because governments are often opaque about their gold holdings, which they consider a crucial part of their economic security.

Today, I think we are on the cusp of a radical change in the international monetary system with profound implications. Yet, few are aware of what is happening and its enormous significance.

I suspect most people will be taken by surprise—and it won’t be a pleasant one. They’ll be the ones holding the bag for a failing monetary system.

But it doesn’t have to be a disaster for everyone…

Those who get positioned properly ahead of this paradigm shift could make fortunes.

The Real Reason for China’s Massive Gold Stash

According to the Financial Times, the big buyers of gold in 2022 were China and Middle East oil producers. That’s not a coincidence, as these countries will be at the center of the changes to the international monetary system.

It’s no secret that China has been stashing away as much gold as possible for many years.

China is the world’s largest producer and buyer of gold. Most of that gold finds its way into the Chinese government’s treasury.

Nobody knows the exact amount of gold China has, but most observers believe it is many multiples of what the government declares.

Today it’s clear why China has had an insatiable demand for gold.

Beijing has been waiting for the right moment to pull the rug from beneath the US dollar. And now is that moment…

The key to understanding it all is Chinese President Xi’s recent historic visit to Saudi Arabia and other Gulf Cooperation Council (GCC) states to launch, in his words, “a new paradigm of all-dimensional energy cooperation.”

The GCC includes Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, and the United Arab Emirates. These countries account for more than 25% of the world’s oil exports, with Saudi Arabia alone contributing around 17%. In addition, more than 25% of China’s oil imports come from Saudi Arabia.

China is the GCC’s largest trading partner.

The meetings reflect a natural—and growing—trade relationship between China, the world’s largest oil importer, and the GCC, the world’s largest oil exporters.

During Xi’s visit, he made the following crucial remarks (emphasis mine):

“China will continue to import large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, strengthen cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.”

After years of preparation, the Shanghai International Energy Exchange (INE) launched a crude oil futures contract denominated in Chinese yuan in March 2018. It’s the first oil futures contract to be traded in China. The contract is based on Brent crude oil, the global benchmark for oil prices, and is settled in cash.

Since then, any oil producer can sell its oil for something besides US dollars… in this case, the Chinese yuan.

The INE yuan oil futures contract provides a new pricing benchmark for the global oil market, which the US dollar has traditionally dominated. By trading in yuan, the contract is expected to increase the use of the Chinese currency in global trade and reduce the reliance on the US dollar.

Read More @ InformationLiberation.com