from ZeroHedge:

For much of the day, anyone doing analysis on the now-liquidated Silicon Valley Bank was confined to using stale financial data as of Dec. 31… we certainly were when analyzing the impact of SVB’s contagion (see here) as excerpted below:

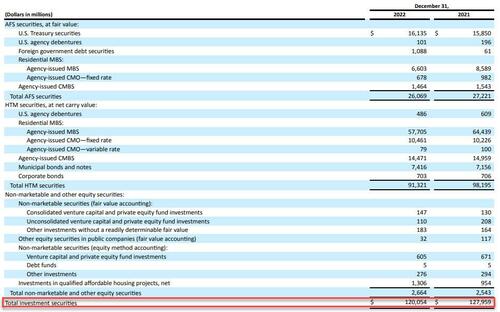

For those who slept through yesterday, here is what you missed and why the US banking system is suffering its worst crisis since 2020. Silicon Valley Bank, aka SIVB, the 18th largest bank in the US with $212 billion in assets of which $120 billion are securities (of which most or $57.7BN are Held to Maturity (HTM) Mortgage Backed Securities and another $10.5BN are CMO, while $26BN are Available for Sale, more on that later )…

TRUTH LIVES on at https://sgtreport.tv/

… funded by over $173 billion in deposits (of which $151.5 billion are uninsured), has long been viewed as the bank at the heart of the US startup industry due to its singular focus on venture-capital firms. In many ways it echoes the issues we saw at Silvergate, which banked crypto firms almost exclusively.

The big question, of course, is what happened in the past 24 hours to not only snuff the bank’s proposed equity offering, but to push the bank into insolvency.

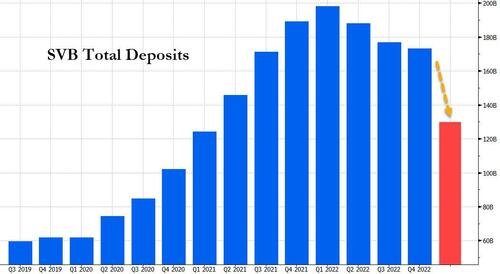

So how many deposits were pulled from SIVB in the past 24 hours. Everyone going off the Dec 31 number

— zerohedge (@zerohedge) March 10, 2023

We got the answer just a few moments after that tweet, when the California Department of Financial Protection and Innovation reported that shortly after the Bank announced a loss of approximately $1.8 billion from a sale of investments and was conducting a capital raise (which we now know failed), and despite the bank being in sound financial condition prior to March 9, 2023, “investors and depositors reacted by initiating withdrawals of $42 billion in deposits from the Bank on March 9, 2023, causing a run on the Bank.”

As a result of this furious drain, as of the close of business on Thursday, March 9, “the bank had a negative cash balance of approximately $958 million.”

At this point, despite attempts from the Bank, with the assistance of regulators, “to transfer collateral from various sources, the Bank did not meet its cash letter with the Federal Reserve. The precipitous deposit withdrawal has caused the Bank to be incapable of paying its obligations as they come due, and the bank is now insolvent.”

Some context: as a reminder, SIVB had $173 billion in deposits as of Dec 31., which means that in just a few hours a historic bank run drained a quarter of the bank’s funding!

But not everyone got out in time obviously, there is a long line of depositors who are over the $250,000 FDIC insured limit (in fact only somewhere between 3 and 7% of total deposits are insured). The following list, while incomplete, is approximately sorted by size of exposure: