by Richard (Rick) Mills, Gold Seek:

Gold is back in favor this week as a banking crisis that started with the failure of Silicon Valley Bank (SVB), had investors flocking to safe-haven assets including the US dollar, Treasuries and bullion.

Spot gold Wednesday hit an intra-day high of $1,933/oz, as European bank stocks fell. Credit Suisse shares came under intense selling pressure, after its largest investor said it could not provide the Swiss bank with more financial assistance. However, they surged on Thursday after the country’s central bank agreed to lend it up to $54 billion, following the collapse of three US banks — SVB, Silvergate and Signature Bank.

TRUTH LIVES on at https://sgtreport.tv/

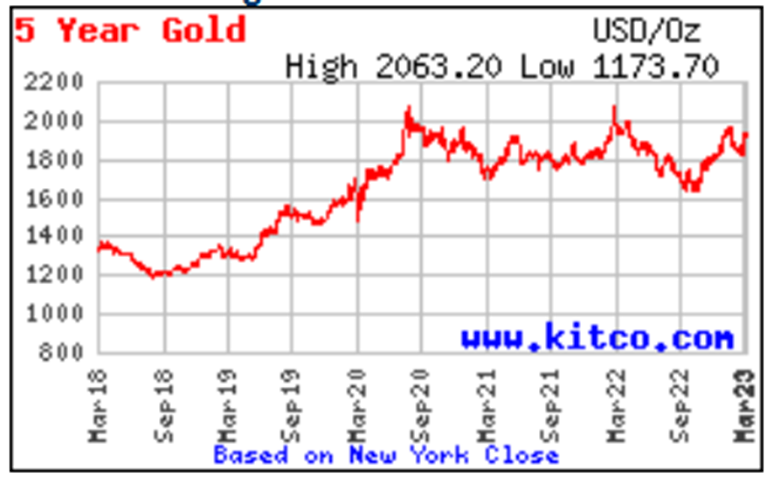

Source: Kitco

Source: Kitco

But the real driver of gold prices currently is the Federal Reserve’s decision-making over how much it will continue to raise interest rates, pause them or even lower them as the central bank pores over economic data and weighs the banking crisis ahead of its regular policy meeting next week.

Members of the Federal Open Market Committee will decide on March 22 whether to hike the federal funds rate by 25 or 50 basis points, or leave it at between 4.5 and 4.75%.

Officials have raised rates at each of their last eight policy meetings spanning 12 months, as they try to lower inflation to their 2% target. However, the bank collapses and resulting market turbulence have added a complicating factor for the Fed as it debates its next move on inflation. (Wall Street Journal, March 15, 2023)

Here we look at what it all means for precious metals going forward.

Banks bailed out

Silicon Valley Bank and Signature Bank are among the largest banks in the United States, valued at $209 billion and $110.4 billion, respectively. (JP Morgan Chase, Bank of America and Citibank are the three largest, valued at between $1.7 and $3.2 trillion).

When Silicon Valley Bank collapsed last Friday, it became the second-largest bank failure in US history, behind number one Washington Mutual Bank in September, 2008.

How did it go down?

As the bank grew to be the 16th largest in America, SVB invested their funds in long-term bonds when rates were near zero.

This may have seemed like a good idea at the time, but when interest rates rose, those long-term bond prices fell, cratering their investments.

On Wednesday, SVB announced that it suffered a $1.8 billion after-tax loss and urgently needed to raise more capital to address depositor concerns.

The market reacted sharply and SVB lost over 160 billion dollars in value in 24 hours.

What happened next is familiar to most Americans, especially those who protested against the bank bailouts during the financial crisis.

So the Federal Deposit Insurance Corporation took over SVB on Friday to get depositors access to their money by Monday, and because the bank’s troubles posed a major risk to the financial system…

Before the FDIC stepped in, depositors could only access up to $250,000…

The Federal Reserve, the Treasury Department and the FDIC said regulators took the unusual step of guaranteeing the deposits because SVB presented a major risk for the U.S. economy.

Signature Bank in New York was also closed on Sunday after its customers began withdrawing cash too quickly. State regulators said they took over the bank to stabilize financial systems. Federal regulators said depositors from both banks will get their money.

Wall Street then ordered several regional banks to cease trading Monday, as their shares plummeted. Shares of First Republic Bank, for example, were stopped after falling 65%.

The Economist notes that rising interest rates have left banks exposed.

The crux of the issue is what happens when a bank is forced to sell bonds, and previously unrecognized losses become real.

As mentioned, at SVB, when interest rates were low and asset prices high, the California bank loaded up on long-term bonds. When the Fed raised interest rates at the fastest pace in four decades, bond prices plunged and the bank was left with huge losses.

Unrecognized losses across America’s banking system totaled $620 billion at the end of 2022. Post-financial crisis regulations sought to limit credit risk by ensuring that banks hold assets that can easily be sold. None fits the bill better than US government bonds.

But as The Economist explains:

Many years of low inflation and interest rates meant that few considered how the banks would suffer if the world changed and longer-term bonds fell in value. This vulnerability only worsened during the pandemic, as deposits flooded into banks and the Fed’s stimulus pumped cash into the system. Many banks used the deposits to buy long-term bonds and government-guaranteed mortgage-backed securities.

[Note this is exactly what happened in 2008. After introducing quantitative easing, the Fed expected the smaller banks to lend more to individuals and businesses to kickstart the economy. Instead, they bought bonds and MBS’s, inflating their profits and handing out obscene CEO bonuses — Rick]

You might think that unrealized losses don’t matter. One problem is that the bank has bought the bond with someone else’s money, usually a deposit. Holding a bond to maturity requires matching it with deposits and as rates rise, competition for deposits increases. At the largest banks, like JPMorgan Chase or Bank of America, customers are sticky so rising rates tend to boost their earnings, thanks to floating-rate loans. By contrast, the roughly 4,700 small and mid-sized banks with total assets of $10.5trn have to pay depositors more to stop them taking out their money. That squeezes their margins — which helps explain why some banks’ stock prices have plunged.

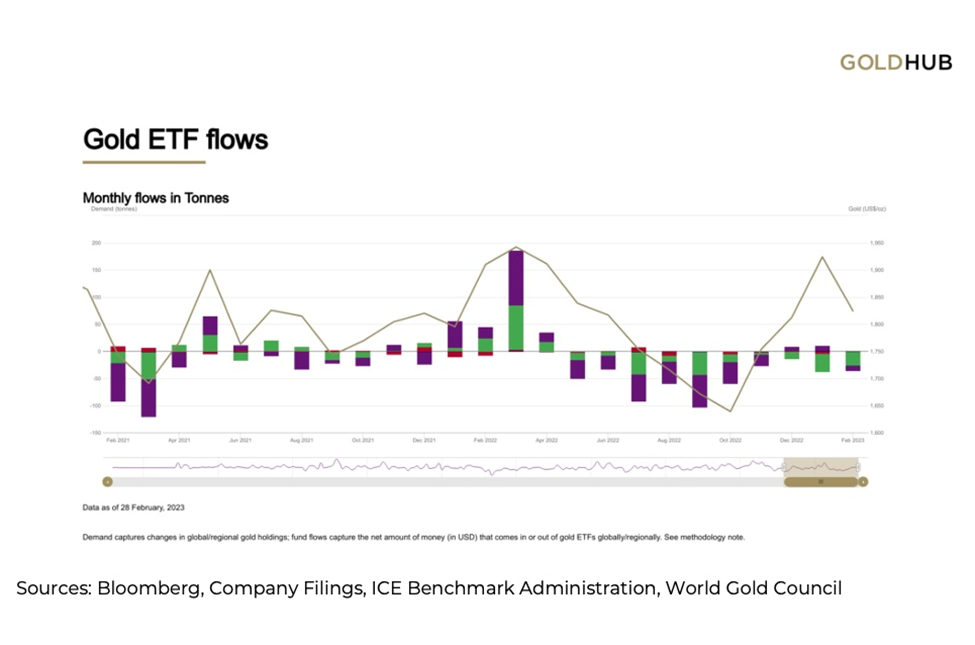

Gold ETF selling

Despite gold rising to within $100 of an all-time high of $2,034 set in the fall of 2020, some investors are dumping the yellow metal.

A stronger dollar and rising bond yields (remember, gold pays neither a dividend not a yield, making the opportunity cost of holding gold higher during periods of high interest rates) led to a 5% decline in the gold price in February.

Last month, many investors of gold-backed ETFs decided to liquidate. According to the World Gold Council, gold ETFs lost $1.7 billion in February, marking a 10-month losing streak, the longest since January 2014.

Gold ETF assets under management (AUM) declined by 1% to $200 billion, WGC data showed. In tonnage terms, February’s decline saw global ETF holdings fall by 34 tonnes to 3,412t.

European funds drove outflows as the region’s central banks continued to deliver outsized rate hikes, while North American gold ETFs lost just over half a billion dollars, the first monthly outflow in 2023 after two consecutive months of inflows, the WGS said.

However as we observed in a previous article, the gold price continues to stay lofty, despite a high US dollar and elevated government bond yields (the latter saw some volatility this week and last). The dollar and gold normally move in opposite directions.