by Peter Schiff, Schiff Gold:

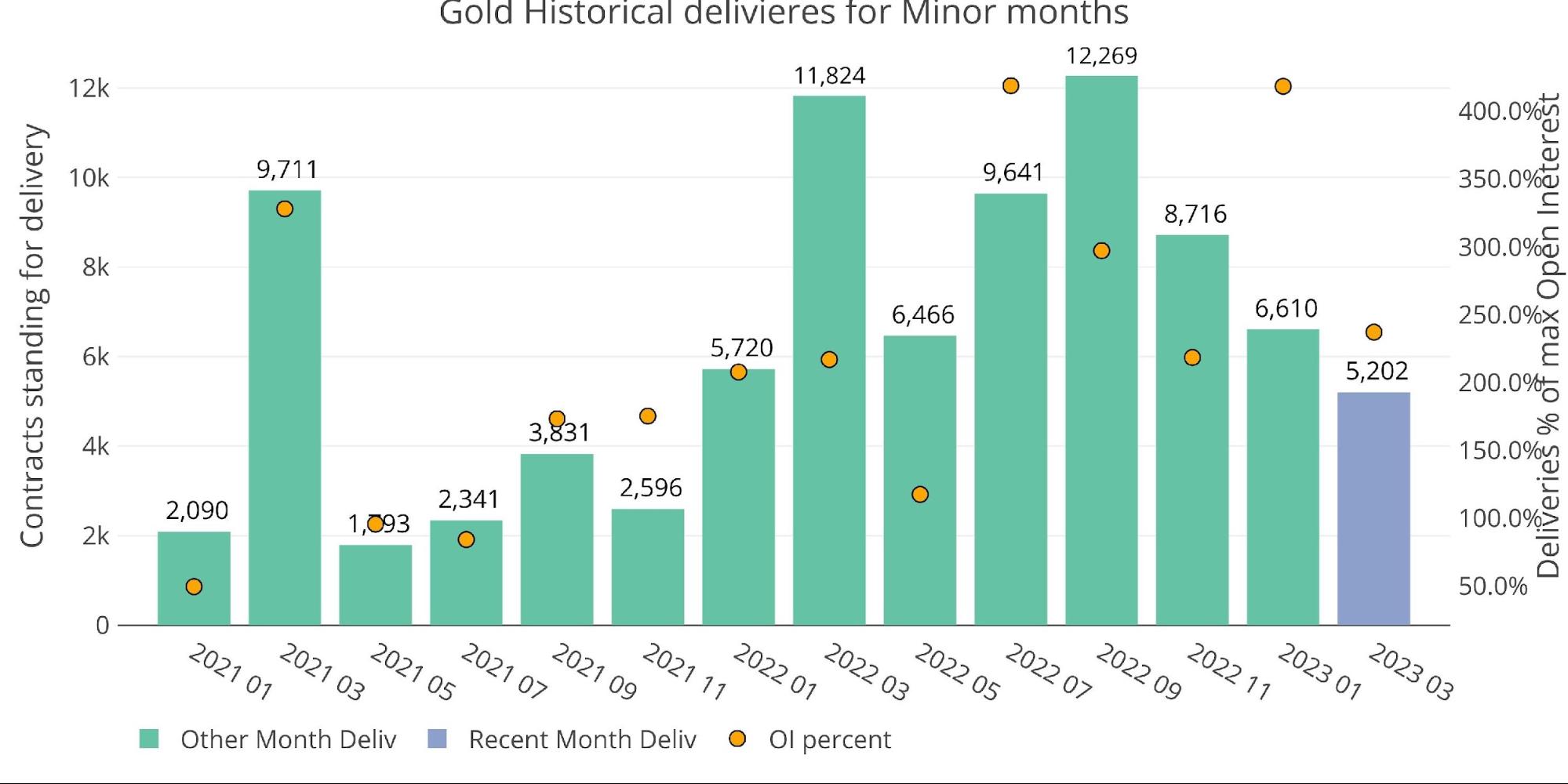

Gold is wrapping up March, which is a minor delivery month. While it was a decent delivery month, it was the smallest minor month since November 2021.

Gold is wrapping up March, which is a minor delivery month. While it was a decent delivery month, it was the smallest minor month since November 2021.

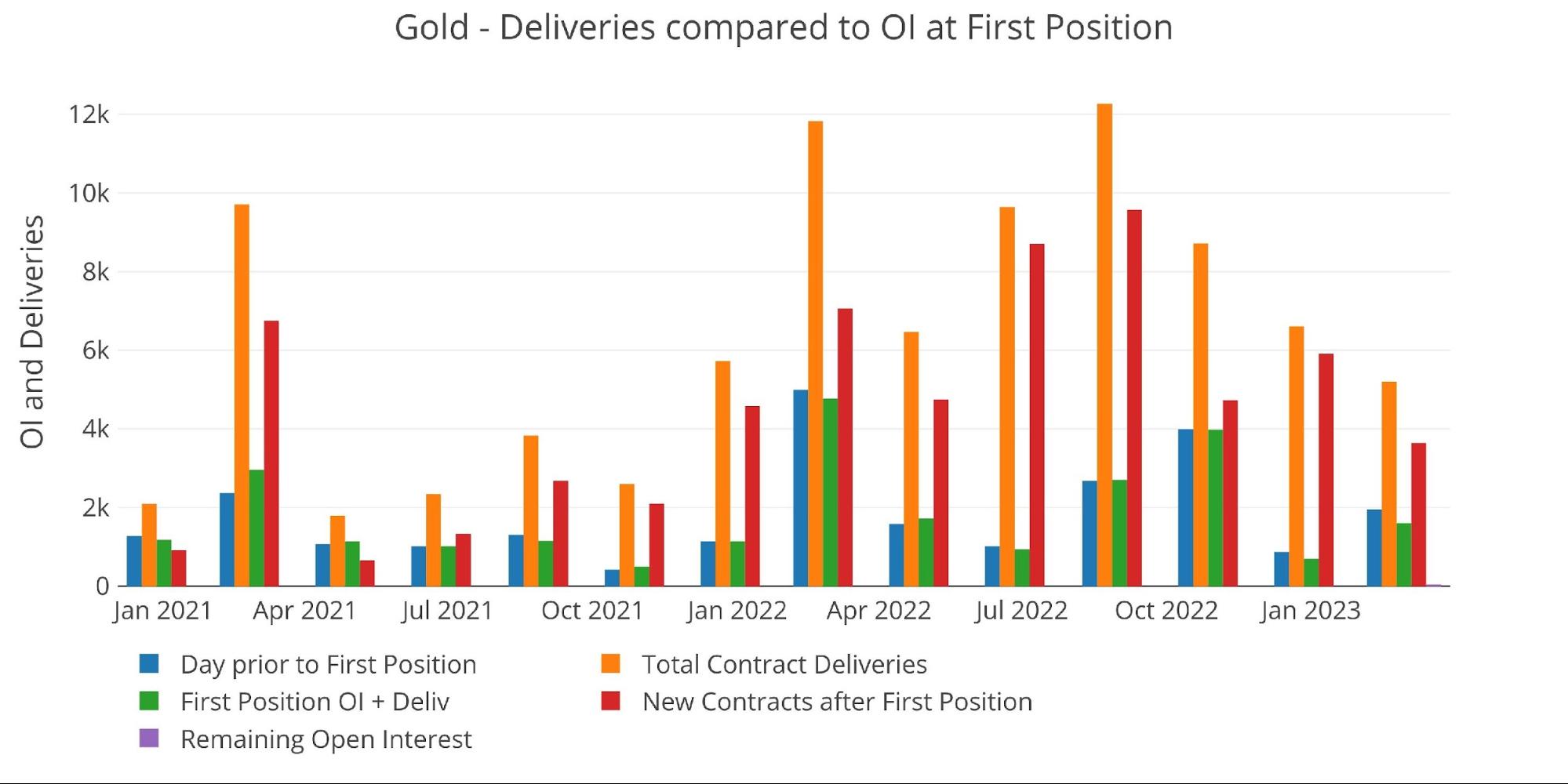

Lower delivery volume has been driven by two factors. First, it had low open interest into the close (green bar) and second, the net new contracts were a bit weaker than previous months (red bar). That said, it should still be noted that 5,202 contracts is still a strong delivery for a minor month historically speaking.

TRUTH LIVES on at https://sgtreport.tv/

Figure: 2 24-month delivery and first notice

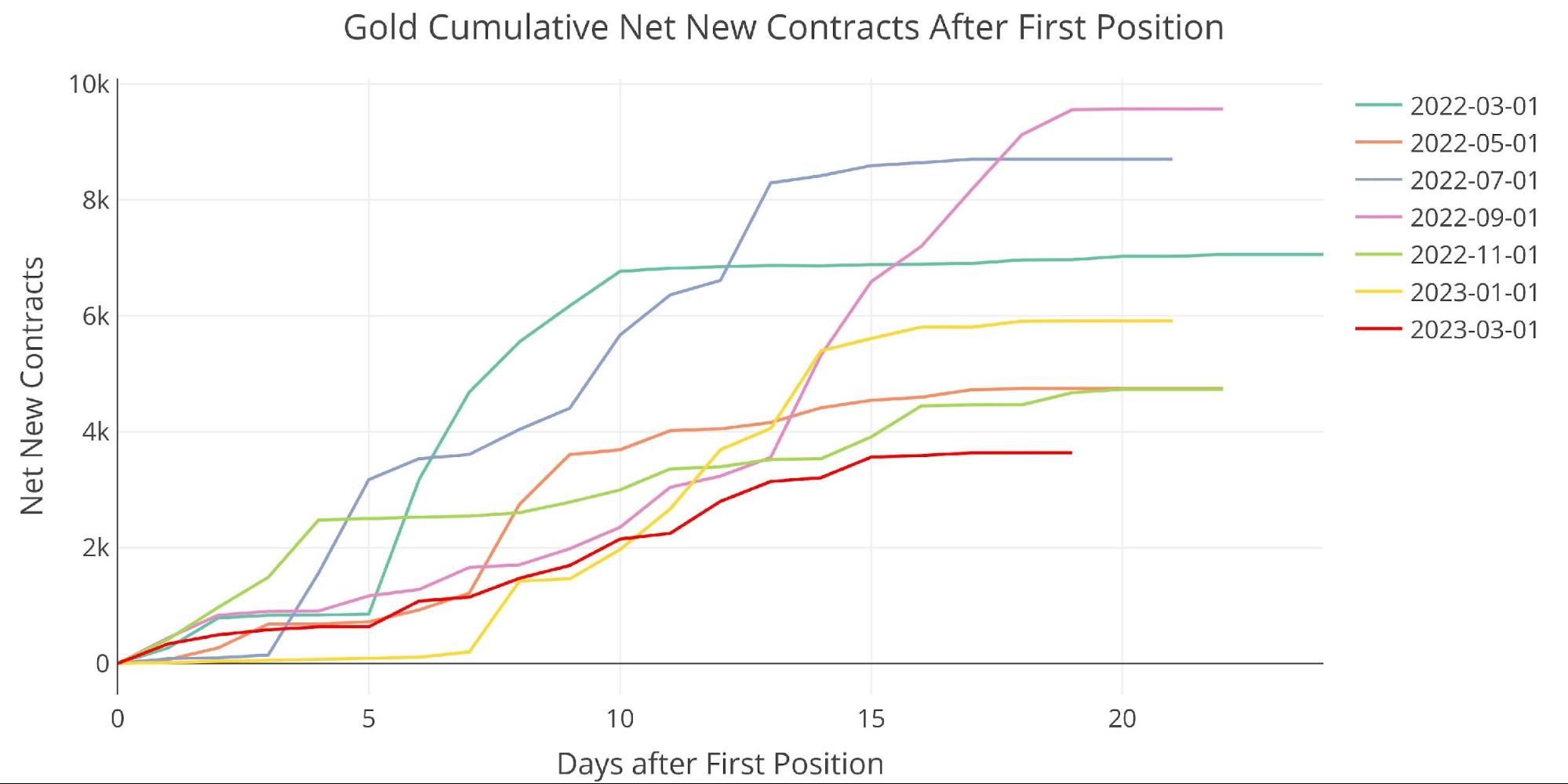

Taking one last look at the net new contracts shows that volume did not respond at all to the banking crisis that has been unfolding the last two weeks as net new contracts slowed and then stopped.

Figure: 3 Cumulative Net New Contracts

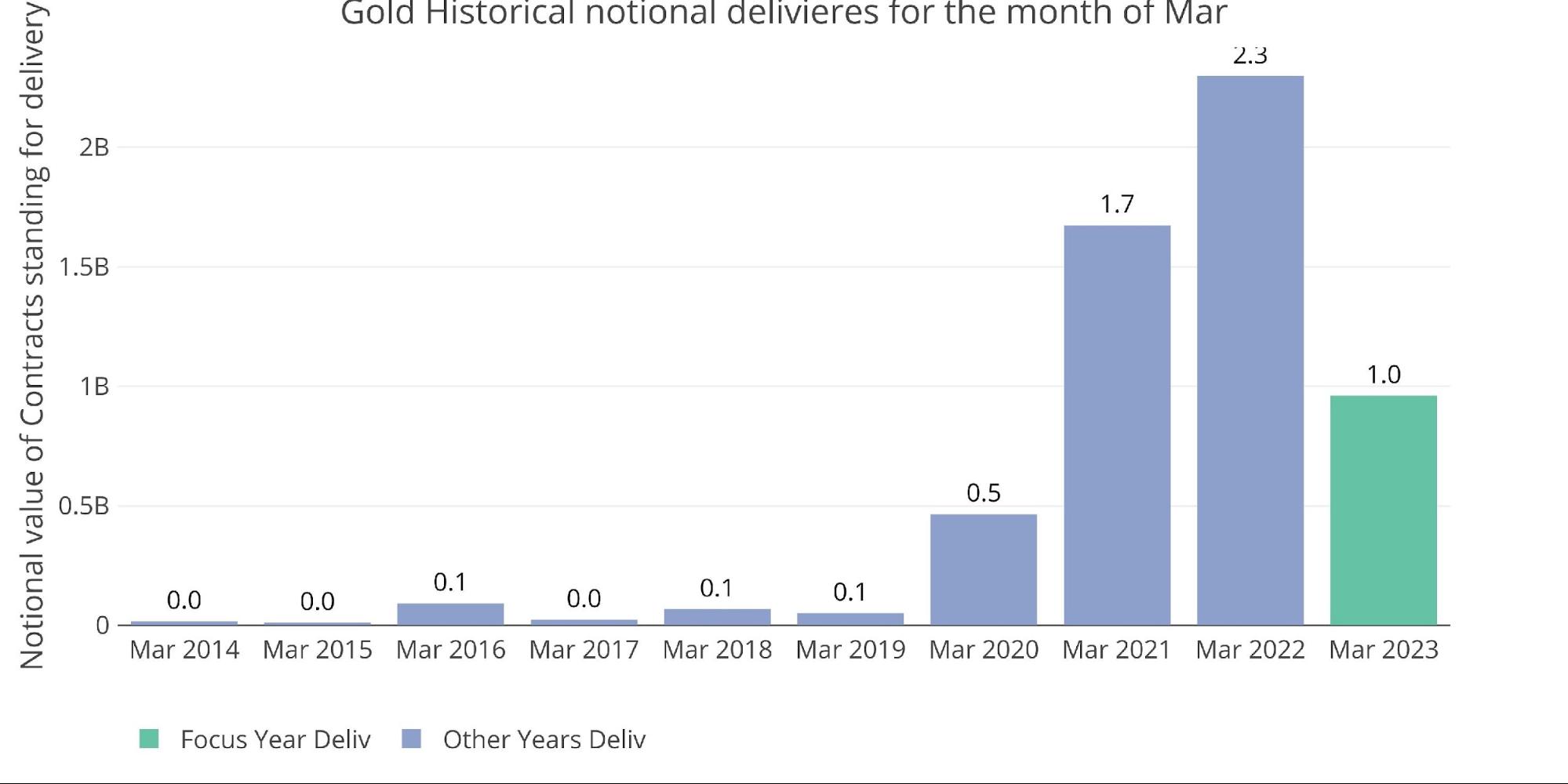

As mentioned previously, from a historical basis, this was a relatively strong March. It is just less than what has been seen in 2021 and 2022. Please note, amounts below are notional dollar amounts.

Figure: 4 Notional Deliveries

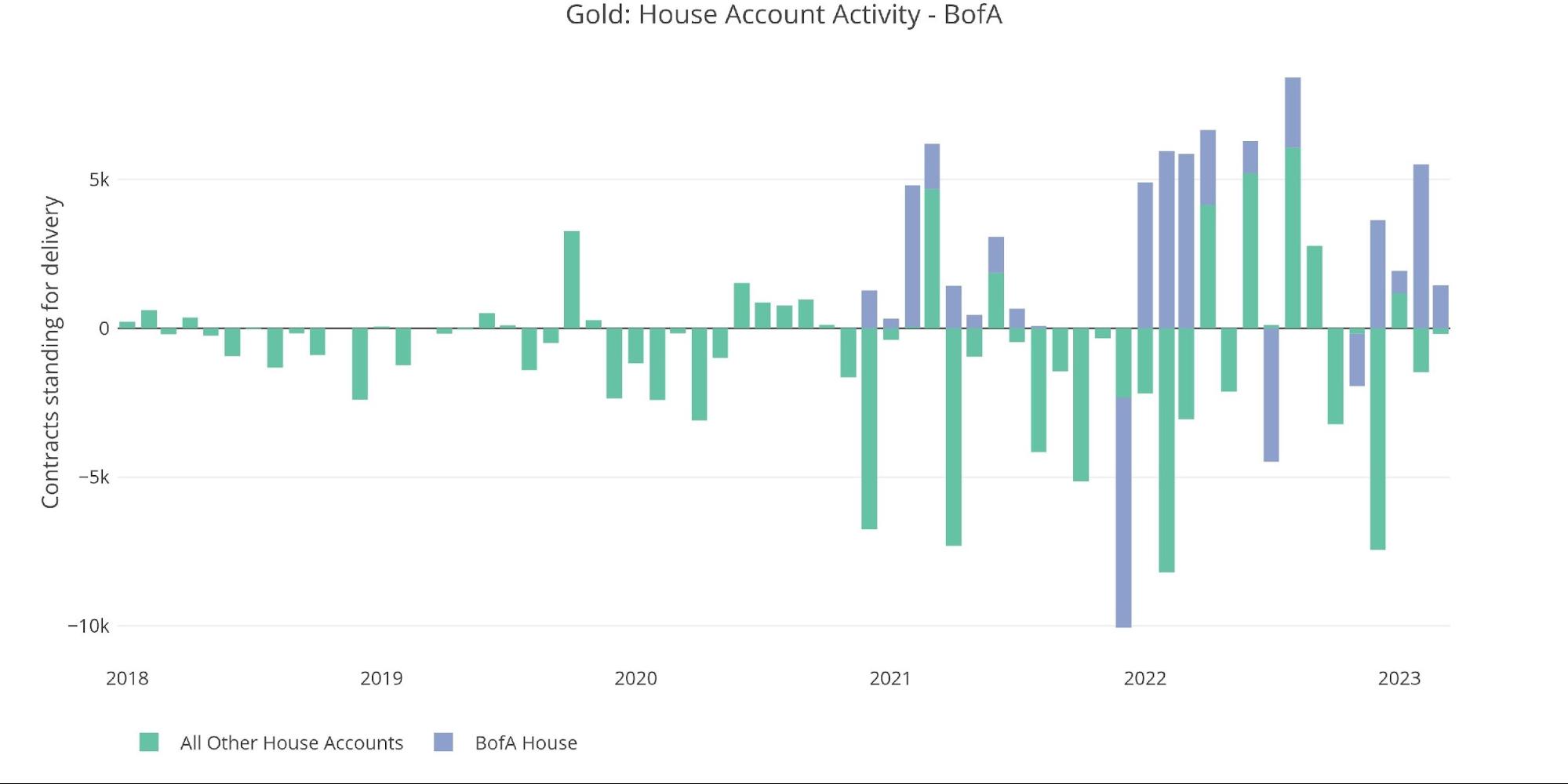

The house accounts were fairly quiet, with only BofA coming in to scoop up some contracts. BofA is most likely taking the opportunity to build up stock it can dump once delivery demand spikes back up.

Figure: 5 House Account Activity

The strangest activity occurred in the actual physical vaults. It seems that in preparation for the upcoming delivery month of April (a major month), JP Morgan has pre-emptively bolstered its Registered position. JP Morgan moved a whopping 578k ounces (~$1.15B) from Eligible to Registered. As discussed previously, this could be a move to improve the optics and try to demonstrate that supply is available to meet delivery demand as the next major month looms for gold.