by Peter Schiff, Schiff Gold:

After charting its biggest increase since 2007 in the third quarter, household debt surged again in Q4 as Americans try to borrow their way out of the squeeze soaring price inflation has put on their wallets.

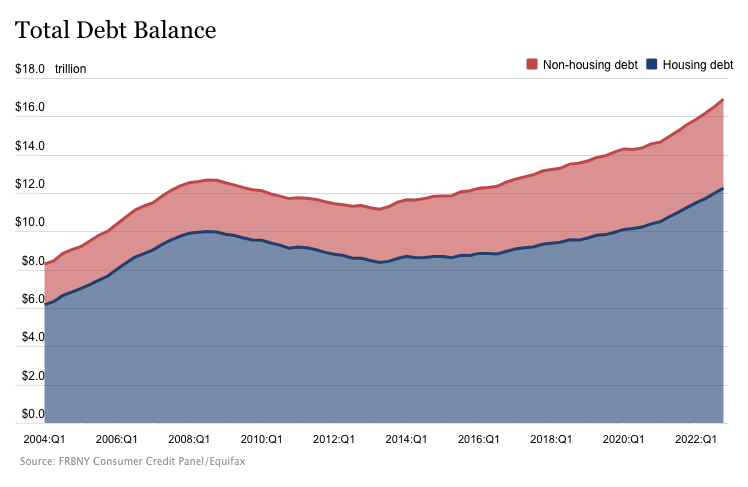

Total household debt rose by $394 billion in the last quarter of 2022, according to the latest New York Fed Household Debt and Credit report. It was the biggest quarter-on-quarter rise in two decades.

TRUTH LIVES on at https://sgtreport.tv/

Total household debt increased by 8.5% in 2022 and now stands at a record $16.9 trillion. That’s $2.75 trillion higher than it was pre-pandemic.

Mortgage balances grew by $254 billion in Q4. Americans now owe $11.92 trillion in mortgage debt. Mortgage balance grew by nearly $1 trillion in 2022.

It appears that people are tapping into home equity in order to make ends meet as prices continue to rise. Balances on home equity lines of credit (HELOC) increased by $14 billion. It was the third consecutive quarterly increase and the largest increase in more than a decade.

Americans have turned to credit cards to pay the bills in this inflationary environment. Credit card balances increased by another $61 billion in Q4. That nearly doubled the $38 billion increase in credit card debt during the third quarter of ’22. In total, Americans owed $986 billion on their credit cards as of the end of 2022, surpassing the pre-pandemic high of $927 billion.

Other balances, including retail cards and other consumer loans, increased by $16 billion. When you factor in other credit accounts, the total revolving credit debt spikes to nearly $1.2 trillion.

Meanwhile, the average annual percentage rates (APR) currently stand at 19.91%, with many credit cards charging over 20%. That means minimum payments are increasing, and it will cost consumers more to pay off those balances.

Most mainstream reporting attributed this surge in debt to the strong labor market. According to this narrative, with a robust job market, consumers have the confidence to buy on credit. But in a recent podcast, Peter Schiff said the surge in credit card debt really evidences the fact that we don’t have a strong labor market.

If the labor market was really so strong, people’s paychecks would be high enough that they wouldn’t need to use credit to buy the things that they needed. They could actually afford to buy stuff without going deeper into debt, especially since interest rates are rising so much. You would think consumers would be reluctant to take on more debt in a rising rate environment. The only reason they’re doing it is because they really have no choice.”

Other debt categories also charted increases in Q4.

Auto loan balances grew by $28 billion to $1.55 trillion. According to the New York Fed, this was consistent with the upward trajectory seen since 2011.

Student loan balances now stand at $1.60 trillion, up by $21 billion from the previous quarter.

As debt rises, along with interest rates, Americans appear to be having a harder time keeping up with their payments. The share of current debt becoming delinquent increased again in the fourth quarter for nearly all debt types, according to the New York Fed report. This follows two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.4 percentage points, respectively.